Merchant cash advances offer fast access to capital, but the cost can be significant. With high APRs, steep fees, and daily payment withdrawals that disrupt cash flow, many business owners struggle to keep up. Some small business operators even fall into repayment cycles that drain working capital and restrict financial flexibility. These challenges can make it difficult to manage day-to-day expenses, let alone invest in growth.

While MCAs can be helpful in emergencies, the repayment terms often place long-term strain on a business. For small business owners looking to protect margins and sustain momentum, it's worth exploring safer, more cost-effective alternatives to merchant cash advance solutions.

This article outlines five funding options that offer better terms, more manageable repayment structures, and the potential to strengthen cash flow without compromising stability. Whether you're navigating a temporary dip in revenue or planning for expansion, understanding your business financing options can lead to smarter, more sustainable decisions.

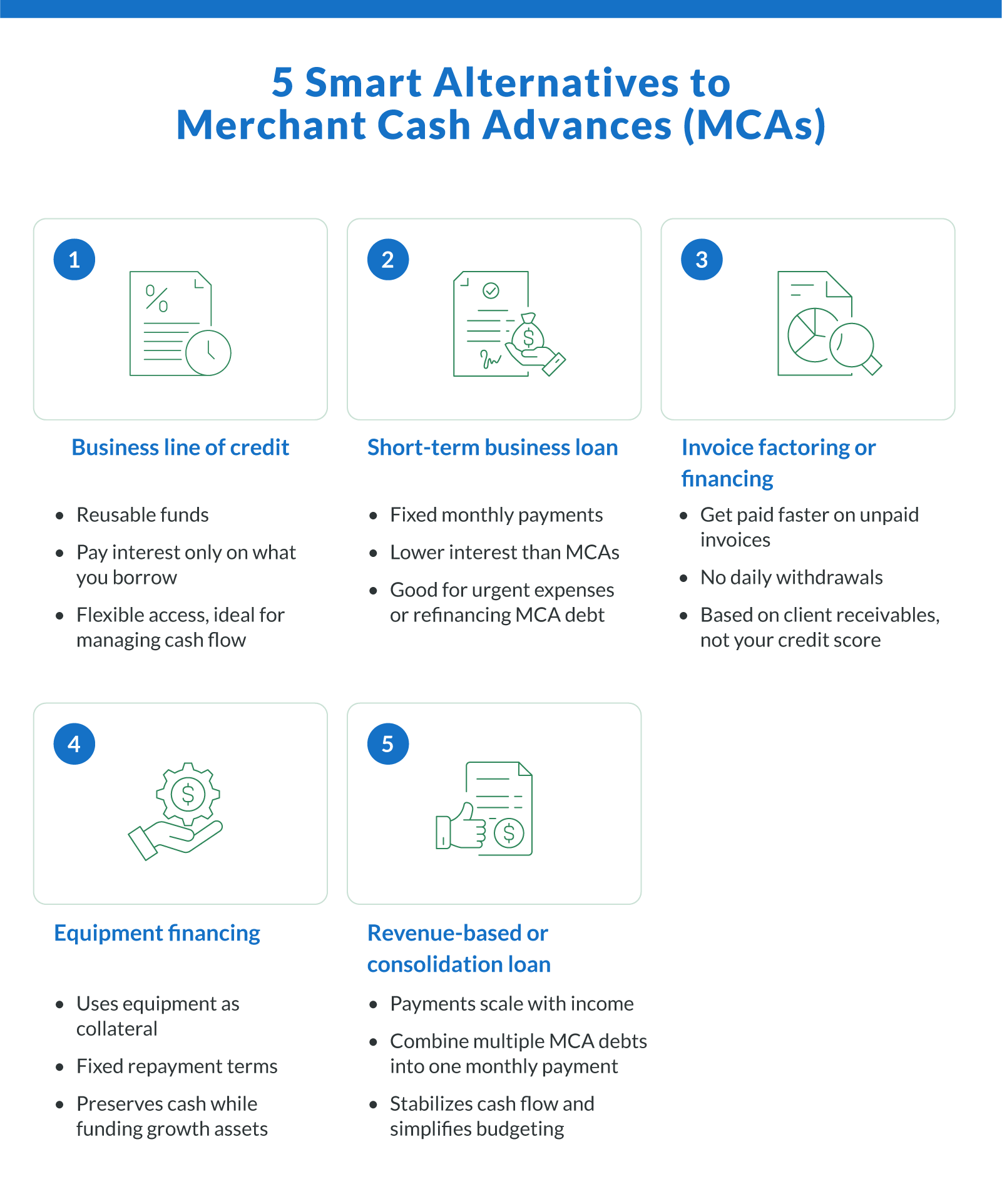

Business Line of Credit

A business line of credit is a revolving funding option that gives entrepreneurs reusable access to working capital, making it ideal for managing short-term expenses like payroll, inventory restocks, or marketing campaigns. Unlike a merchant cash advance, which can result in daily deductions that can quickly erode your cash flow, a business line of credit offers flexible repayment and lower interest rates. You only pay interest on what you borrow, making it a smart choice for preserving liquidity.

Here's why many business owners prefer this option:

Only pay interest on the amount borrowed. Helps preserve cash flow and control costs.

Flexible repayment terms. Borrow and repay as needed, without the rigid daily deductions of MCAs.

Quick approval and funding. Traditional banks and online lenders often approve within days.

Higher limits and better terms for qualified borrowers. A strong credit history can improve access to capital.

For example, a boutique retailer stuck in a cycle of MCA repayments switches to a business line of credit. The move allows them to draw funds as needed and repay on a schedule that is aligned with seasonal revenue, giving them more control over cash flow and long-term planning.

Whether you're stabilizing operations or preparing for growth, this funding option delivers flexibility and peace of mind.

Short-Term Business Loan

Short-term business loans provide a lump sum of capital with a fixed repayment schedule, making them a practical solution for small business owners seeking predictable costs and clear timelines. These term loans typically offer lower interest rates than merchant cash advances and avoid the uncertainty of daily withdrawals, which can strain cash flow.

Here's why short-term loans are a strong option:

Fixed repayment schedules. Clear end dates and consistent monthly payments simplify budgeting.

Lower interest rates. More affordable than the high APRs associated with MCAs.

Refinance opportunities. Help replace expensive MCA debt with more manageable terms.

Credit-building potential. Consistent repayments can improve your business credit profile.

Up-front funding. Receive a lump sum to handle urgent needs like repairs, payroll, or inventory.

The approval process varies by lender. Traditional loans from banks may take longer and require more documentation, while alternative lenders often deliver quick cash with fewer requirements.

For example, a local food truck owner may use a short-term business loan to replace worn equipment after a sudden breakdown. The fixed payments help them stay on budget and free up resources for seasonal marketing.

Invoice Factoring or Invoice Financing

Invoice factoring and invoice financing are alternative financing methods that convert your outstanding invoices into quick access to cash. With invoice factoring, the factoring company collects payment directly from your clients. Invoice financing, on the other hand, involves you maintaining client relationships and handling collections yourself. Businesses can access up to 90% of their receivables without waiting for clients to pay, which is ideal for keeping operations running when cash flow is tight.

Here's how these options work and why they help:

Unlock working capital tied up in unpaid invoices. Get fast access to cash without taking on traditional debt.

No reliance on personal credit. Approval is based on receivables, not your credit history.

No daily withdrawals. Unlike MCAs, these solutions don't disrupt your cash flow.

Predictable costs. Factor rates, or discount fees, vary based on industry, client payment behavior, and bank statements.

These financing options are best for B2B businesses with slow-paying clients but consistent receivables.

For example, a logistics firm may use invoice factoring to manage fuel and labor costs during peak season. The advance helps them keep trucks on the road while waiting for client payments to clear.

For many, this approach bridges the gap between sales and collections, maintaining steady operations and healthy cash flow.

Equipment Financing

Equipment financing allows businesses to purchase or upgrade machinery, vehicles, or tools without depleting working capital. Unlike a merchant cash advance, which involves daily payments and no asset backing, equipment financing uses the equipment itself as collateral.

Here's why equipment financing can be a smart investment strategy:

Uses equipment as collateral. Reduces lender risk and leads to lower interest rates.

Fixed repayment terms. Predictable monthly payments help manage cash flow.

Preserves working capital. Enables you to invest in growth without draining reserves.

Tax benefits. Qualifying equipment may be eligible for deductions under Section 179.

Diverse funding sources. Options include traditional banks, equipment dealers, and online financing solutions.

SBA loan eligibility. SBA-backed loans can offer longer terms and lower rates for equipment purchases.

For instance, consider a construction firm transitioning from costly MCA rentals to an equipment financing plan for a new excavator. The structured terms help them preserve credit and expand operations without disruption to their cash flow.

Revenue-Based Loan or Debt Consolidation Loan

Revenue-based loans and debt consolidation loans provide flexible, income-aligned solutions for businesses struggling with high-cost funding. Both options help smooth out cash flow and break the cycle of aggressive daily deductions.

Here's how they work and why they're worth considering:

Revenue-based loans. Repayments are tied to a percentage of monthly revenue and adjust automatically based on income, making them ideal during seasonal or slow periods.

Debt consolidation loans. Merges multiple MCAs into one predictable monthly payment. They also simplify accounting and free up cash for business growth.

Improved repayment terms. Help stabilize finances and reduce borrowing stress.

Alternative financing flexibility. Options like crowdfunding or hybrid loans can offer better terms.

Credit rebuilding. Structured repayments can improve your business credit profile.

A bakery, for example, may refinance three MCAs into a two-year consolidation loan, cutting their monthly obligation by 40% and regaining room in the budget for seasonal hiring.

Whether you're managing variable revenue or seeking to refinance high-cost debt, these financing solutions give business owners a more stable, forward-looking path.

Regain Control of Your Cash Flow

Merchant cash advance alternatives can offer small businesses lower APRs, flexible repayment structures, and better terms that support long-term financial health. By choosing funding options with manageable repayment plans and transparent costs, business owners can stabilize operations, preserve working capital, and invest in growth with confidence.

Whether you're looking to refinance existing debt or secure new business funding, sustainable financing options can provide the flexibility needed to align with your goals — not work against them.

Clarify Capital helps small businesses find smarter funding solutions. Apply today to explore your options and regain control of your cash flow.

FAQ About Alternatives to Merchant Cash Advance

The following FAQ addresses the most common concerns about merchant cash advance alternatives, helping entrepreneurs explore smarter, more sustainable financing options.

Why Are Merchant Cash Advances Bad?

Merchant cash advances aren't inherently bad, but they often come with high costs that can strain a business's financial health. The effective APRs on MCAs can exceed 100%, and repayment usually involves daily withdrawals tied to sales. For small business owners, this structure can quickly erode cash flow and disrupt operations.

These aggressive repayment schedules can trap businesses in a cycle where one advance leads to another, making it difficult to invest in long-term growth or recover from slow periods. The short-term relief MCAs provide often comes at the expense of financial flexibility and stability.

Switching to structured financing, like a term loan or line of credit, can help small businesses break the cycle. With clear repayment terms and lower interest rates, these alternatives give owners a chance to stabilize cash flow and plan for sustainable growth.

Can I Use My EIN Number To Get a Loan?

Yes, many lenders accept an EIN number when evaluating applications for business loans, especially for established businesses with solid revenue and a history of operations. Using your EIN instead of a Social Security number helps separate your business and personal credit profiles, which is important for protecting personal assets and building business credit.

Eligibility often depends on how long your business has been active and its financial performance. Lenders typically review revenue, bank statements, and other indicators to determine whether you're a good fit for their funding options.

However, some lenders may still require a soft credit check or personal guarantee to reduce risk, particularly for newer businesses or larger loan amounts. If you're seeking capital to support growth, manage cash flow, or meet other business needs, using your EIN can be a smart first step toward securing funding.

How Long Does It Take To Receive a Short-Term Business Loan?

Most lenders can approve and fund a short-term business loan within 24 to 72 hours, depending on the application process, documentation, and credit factors. The overall funding speed often hinges on how quickly you provide required financial records and how well your business meets the lender's criteria.

Alternative lenders typically offer faster turnaround than traditional banks, sometimes funding loans within one business day. Returning clients who've prequalified or borrowed before may also move through the approval process more quickly.

Maintaining up-to-date bank statements, consistent revenue records, and clear documentation can significantly speed up the process, making it easier to get the funds you need right when you need them.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts