When applying for business loans, understanding your debt service coverage ratio (DSCR) can make a major difference in how lenders evaluate your application. The DSCR is a key financial metric used during underwriting to assess a borrower's ability to cover loan payments using business income. It directly impacts how much a lender is willing to approve and at what terms, making it essential for proving repayment capacity and overall financial health.

Most lenders, including those working with Clarify Capital, look for a DSCR of 1.25 or higher, meaning the business earns 25% more than it needs to cover debt obligations. A stronger DSCR lowers perceived credit risk and can lead to a larger loan amount or a better interest rate.

In this guide, we'll break down what DSCR means, how it's calculated, examples of how lenders use it, and actionable tips to improve your score. By understanding your debt service coverage ratio, you can boost your creditworthiness and gain access to better business financing opportunities.

What Is the Debt Service Coverage Ratio (DSCR)?

The debt service coverage ratio (DSCR) is a financial metric that shows how easily a business can meet its debt obligations using available cash flow. It provides lenders with a snapshot of a company's ability to repay loans, helping them to assess financial health and determine repayment risk.

Lenders use DSCR throughout the underwriting process to decide not only whether to approve a loan but also how to structure it, including the loan amount, interest rate, and any debt covenants. DSCR is also used after the loan is issued, serving as a key indicator of repayment reliability during ongoing monitoring.

The DSCR Formula Explained

The basic DSCR formula is:

DSCR = Net Operating Income (NOI) ÷ Total Debt Service

Net Operating Income (NOI). NOI refers to income remaining after subtracting operating expenses, depreciation, and amortization from gross revenue.

Total Debt Service. This includes all principal repayments and interest payments due within a year, representing the company's total annual debt obligations.

A DSCR greater than 1 means the business generates enough income to fully cover its debt. A ratio below 1 signals that cash flow may be insufficient to meet financial obligations, raising concerns about sustainability. As one of the most critical financial ratios in lending, DSCR plays a central role in shaping loan decisions and credit terms.

How To Calculate DSCR Step-by-Step

Understanding how to perform a proper DSCR calculation gives business owners clearer insight into their company's ability to meet debt obligations and maintain strong financial health. Here's a simple, step-by-step breakdown:

Determine Net Operating Income (NOI). Start with your business's earnings before interest and taxes, then subtract operating expenses, depreciation, and amortization. This gives you your NOI — the cash flow available to service debt.

Calculate Total Annual Debt Service. Add up all principal payments and interest payments due over the next 12 months. This figure represents your annual debt service — the total amount the business must repay on its loans.

Divide NOI by Total Debt Service. Use the DSCR formula: DSCR = NOI ÷ Total Annual Debt Service

A result above 1 indicates the business generates enough cash flow to cover its debt. A ratio below 1 suggests potential repayment risk.

Example of DSCR in Action

Let's say a business has $125,000 in net operating income (NOI) and $100,000 in total annual debt service (including principal payments and interest). Using the DSCR formula:

DSCR = $125,000 ÷ $100,000 = 1.25

A DSCR of 1.25 means the business earns 25% more than it needs to cover its annual debt payments. This signals solid repayment capacity and gives lenders confidence in the borrower's financial strength.

Most lenders consider a good DSCR to be 1.25 or higher, which provides a buffer in case cash flow dips. In underwriting for business loans, a strong DSCR often leads to easier loan approval, better terms, and potentially larger funding amounts.

What Is a Good DSCR for Small Business Loans?

A “good” Debt Service Coverage Ratio (DSCR) depends somewhat on the loan type, business model, and lender, as requirements can vary. Nevertheless, most lenders (including those working with Clarify Capital) generally prefer a DSCR of 1.25 or greater, as it provides a buffer beyond merely breaking even.

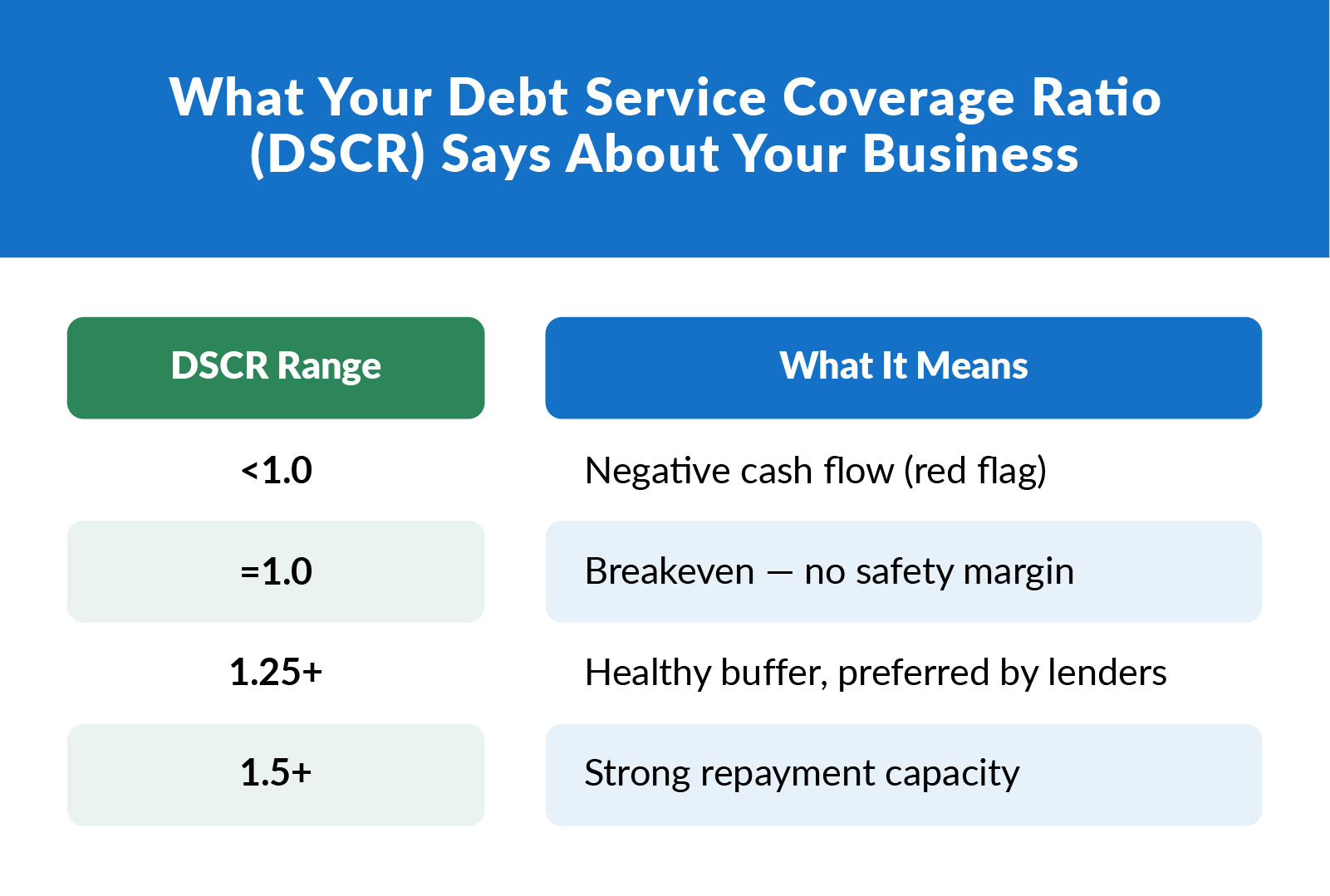

These are the typical DSCR benchmarks lenders expect:

DSCR < 1. This ratio indicates negative cash flow. In this case, the company isn't generating enough income to cover debt payments.

DSCR = 1. This DSCR represents a break even — income equals debt service, but offers no margin for error.

DSCR > 1. This ratio shows sufficient repayment capacity — the higher above 1, the stronger the buffer.

Lenders may adjust their minimum DSCR targets based on industry risk, business stability, or the size of the loan. A higher-risk sector or more volatile revenue stream might require a more conservative DSCR threshold, sometimes above 1.25, to account for potential downturns.

Here's a table comparing how DSCR expectations typically vary by loan type:

| DSCR Requirements by Loan Type | ||

|---|---|---|

| Loan type | Typical minimum DSCR expected | Context/Why it matters |

| Small Business Administration (SBA) 7(a) or 504 business loans | ~ 1.25× (some accept as low as ~1.15×, but most prefer 1.25× or more) | Ensures the business generates enough cash flow to cover debt service, even with fluctuations |

| Commercial real estate loans (income‑producing assets) | ~ 1.25–1.35× (may be higher for riskier property types) | Provides a buffer for property maintenance, vacancy, and variable revenues |

| Traditional small business loans (non‑real estate) | Often 1.25× or more depending on the lender, industry, and business health | Demonstrates ability to meet debt payments from operational cash flow rather than relying on assets or collateral |

Why DSCR Matters

Here's why your DSCR matters to lenders:

Lenders use your DSCR to gauge your repayment capacity and overall financial strength. It influences whether you get approved, how large a loan you can get, and the interest rate or terms offered.

A good DSCR improves your business's credit profile and shows you can sustain debt even during slower periods.

With a strong DSCR, you're better positioned to request larger loan amounts or more favorable repayment plans, which helps align financing with long‑term business goals.

How DSCR Affects Borrowing Capacity

A strong DSCR is one of the clearest indicators of a business's financial health, and it plays a major role in determining borrowing capacity during the underwriting process. Lenders rely on DSCR to evaluate how much debt your business can handle and how reliably it can make payments from its cash flow.

A higher DSCR signals strong financial strength and gives lenders confidence that you can manage larger loan amounts without risk of default. This often results in faster loan approval, lower interest rates, and more flexible business financing terms.

On the other hand, a lower DSCR suggests tighter margins and limited repayment capacity. In these cases, lenders may reduce the approved loan amount or raise borrowing costs to offset the perceived risk.

Improving your DSCR boosts your ability to secure funding and also unlocks more working capital to reinvest in growth, operations, and long-term business stability.

How To Improve Your DSCR

If your debt service coverage ratio is below lender benchmarks, there are several practical ways to improve it. Strengthening your DSCR enhances your company's ability to qualify for business loans, secure better loan terms, and maintain long-term financial health. Here are some key strategies:

Increase revenue. Improve pricing strategies, expand product offerings, or boost sales efforts to generate more cash flow.

Reduce operating expenses. Streamline overhead costs, renegotiate supplier contracts, or cut unnecessary spending to increase net income.

Refinance or consolidate debt. Lower interest payments by refinancing high-cost loans or combining multiple debts into a single loan with better terms.

Extend loan repayment terms. Spread payments over a longer period to reduce your annual debt obligations, improving your debt coverage ratio.

Improve working capital management. Speed up receivables, delay payables strategically, and monitor cash reserves to stabilize short-term finances.

Build Long-Term Financial Stability for Your Business

Your debt service coverage ratio isn't just a number — it's a powerful indicator of your business's financial health, creditworthiness, and borrowing capacity. A strong DSCR signals to lenders that your business has the financial strength to manage its debt responsibly, leading to easier loan approval, better rates, and more flexible underwriting terms.

Whether you're applying for new business loans or planning for future growth, regularly calculating your DSCR helps you stay in control of your finances. Use Clarify Capital's DSCR calculator to assess where you stand and identify areas for improvement.

Ready to turn stronger metrics into funding opportunities? Explore your options and apply today with Clarify Capital.

FAQs About DSCR and Small Business Loans

If you're preparing to apply for business loans, understanding how your debt service coverage ratio (DSCR) affects the process is essential. These FAQs address common concerns about DSCR, offering clarity on how it influences loan approval, terms, and long-term financial health.

What Does a DSCR of 1.25 Mean?

A DSCR of 1.25 means that a business generates 25% more cash flow than it needs to cover its annual debt payments. For example, if a business owes $100,000 in total debt service for the year, it would need to earn at least $125,000 in net operating income to achieve this ratio.

Lenders view a DSCR of 1.25 as a sign of strong financial health and repayment ability. It provides a buffer that protects against revenue fluctuations, making the business a more attractive candidate for business financing.

How Do You Calculate DSCR for Real Estate or Commercial Loans?

To calculate real estate DSCR for commercial loans, use the standard formula: DSCR = Net Operating Income (NOI) ÷ Total Debt Service. For a rental property, NOI typically includes rental income minus operating expenses but excludes non-cash items like depreciation and amortization.

Lenders rely on this financial ratio during underwriting to assess whether a property generates enough income to cover its loan obligations. A higher DSCR indicates lower risk and stronger repayment potential, making it a key metric for qualifying borrowers in real estate financing.

How Does DSCR Relate to EBITDA and Operating Cash Flow?

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and operating cash flow are both profitability metrics commonly used in corporate finance, but they differ from net operating income (NOI) as used in DSCR calculations. While NOI focuses strictly on income from operations (excluding taxes, interest, and non-cash expenses), EBITDA includes a broader view of earnings, and lenders sometimes use it as a proxy for NOI when assessing a borrower's loan repayment capacity.

Operating cash flow reflects the actual cash generated from business operations, making it a useful indicator of a company's ability to cover loan payments and current debt. Together, these metrics provide insight into a business's financial health and help lenders gauge its ability to manage ongoing obligations.

What Role Do Capital Expenditures and the Balance Sheet Play in DSCR?

Capital expenditures (CapEx) represent long-term investments in assets like equipment or property, and while they're essential for growth, they reduce available cash that could be used for debt repayment. As a result, high CapEx can temporarily lower a business's DSCR and impact its ability to qualify for new financing.

The balance sheet also plays a key role in DSCR analysis. Items like current debt, total liabilities, and the company's debt profile help lenders assess repayment risk and overall financial health. In corporate finance, understanding how CapEx and balance sheet structure affect DSCR is critical for managing cash flow, preserving borrowing capacity, and strengthening long-term financial positioning.

How Does DSCR Affect New Loan Applications and Personal Finances?

When applying for a new loan, your debt service coverage ratio (DSCR) is a key factor lenders use during underwriting to assess borrowing capacity and credit risk. A strong DSCR demonstrates that your business generates enough income to cover existing and future debt, improving your chances for loan approval and better terms.

Maintaining a healthy DSCR can also benefit your personal finances as a business owner. It reflects disciplined cash management, which supports both business stability and personal financial planning. Lenders may evaluate DSCR alongside other financial metrics, such as credit scores, to form a complete picture of your repayment ability.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts