Many entrepreneurs don't stop at just one business. In fact, 25% of business owners go on to start more than one establishment, and those who do often outperform the rest — serial entrepreneur-led ventures are 50% larger on average. But while ambition fuels growth, juggling multiple companies requires more than just passion.

To manage multiple businesses successfully, you need more than grit. You need scalable systems, smart delegation, and financial clarity across every venture. Without the right strategy, even the most promising companies can stall or fail.

This guide is for entrepreneurs who are ready to go beyond survival and build long-term business management success. Whether you're balancing a service firm with an e-commerce shop or running multiple startups under one roof, you'll learn proven frameworks to streamline operations, control your time, and maximize profit without losing focus or burning out.

Choose the Right Business Structure

Before you scale across ventures, you need the right legal and operational foundation. Choosing the best structure for owning and managing different businesses affects everything from tax obligations to liability protection and long-term scalability. Entrepreneurs typically choose between forming individual LLCs, establishing a holding company, or using a DBA (doing business as) strategy under a single entity.

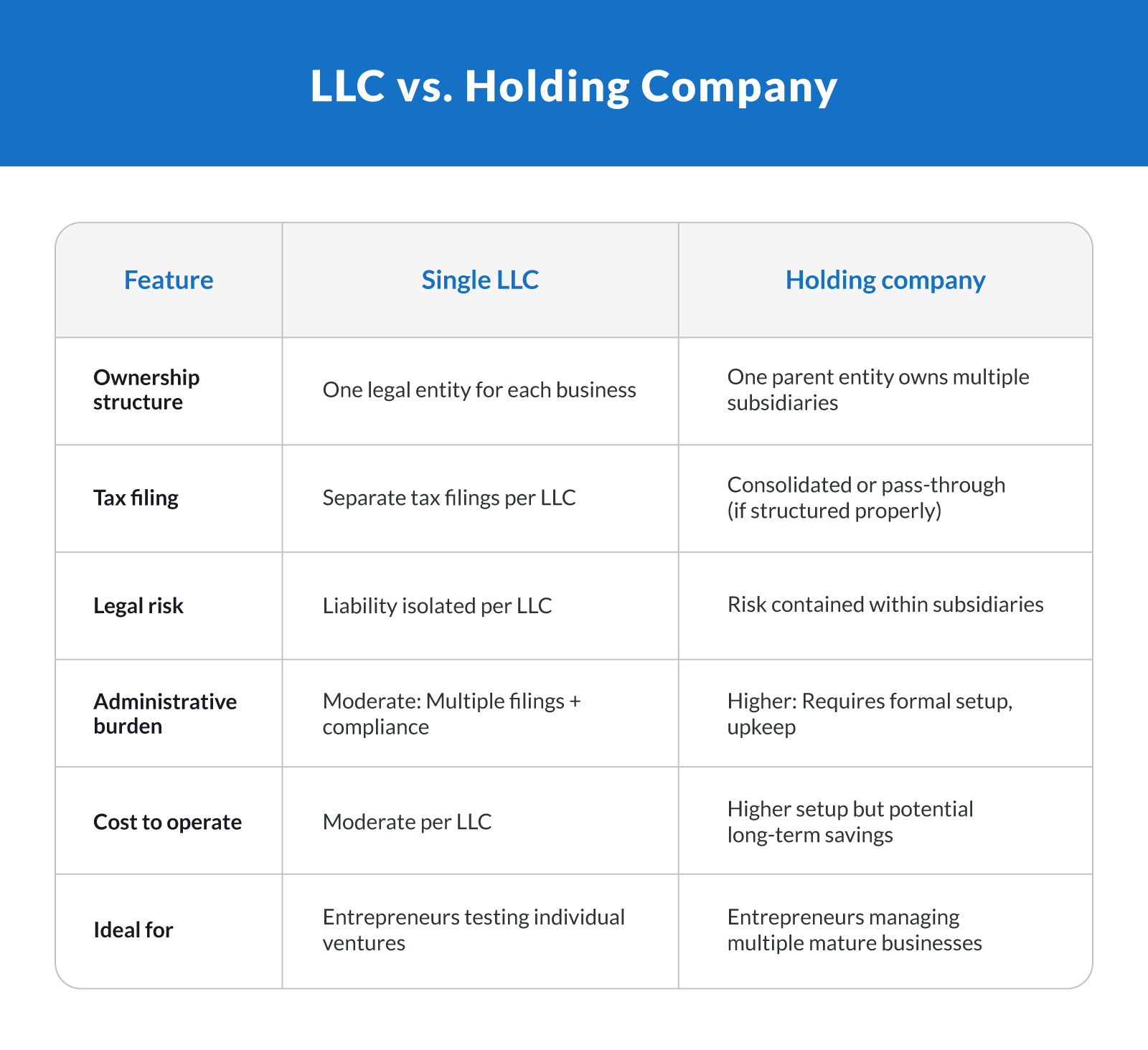

LLC vs. Holding Company vs. DBA

Separate LLCs offer legal protection for each business but can become costly and complex as you grow.

A holding company centralizes ownership, making it easier to manage finances and equity across ventures.

A DBA allows you to operate multiple brands under one legal entity — ideal for businesses offering different products or services without needing full separation.

Here's a simplified comparison:

Why Structure Matters

Businesses with clear, strategic structures are more appealing to investors and buyers.

Yet, only 30% of small businesses successfully sell, often due to poor documentation or legal setup.

Market valuations also vary by type of business — revenue multiples range from 0.42 to 1.2 across sectors, and a clean structure can maximize your valuation.

The structure you choose today shapes your flexibility tomorrow. Whether you're launching three boutiques or managing a consulting firm, tech startup, and e-commerce store, structure smart — so you're ready to grow, pivot, or sell.

Separate and Optimize Finances Across Businesses

When you're managing multiple ventures, financial clarity isn't optional — it's essential. Keeping each business's finances siloed allows you to streamline operations, improve reporting accuracy, and reduce risk. Overlapping expenses or shared accounts can create tax headaches and legal vulnerabilities, especially if one business encounters trouble.

Key Strategies for Financial Organization

Open separate business bank accounts for each venture. This ensures clean recordkeeping and simplifies tax prep.

Use cloud-based bookkeeping software (like QuickBooks, Xero, or FreshBooks) with separate profiles per business.

Implement budgeting tools and dashboards to track spending, profits, and forecast future performance.

Create automated cash flow reports that give you real-time insights for each business entity.

Managing these systems separately not only improves transparency, but also makes each business easier to audit or eventually sell. It also protects one venture from dragging down another financially.

Why does this matter? Companies with multiple income sources perform better—businesses with diversified revenue streams deliver 53% higher shareholder returns. Still, poor financial practices can quickly undermine growth. Nearly 80% of businesses fail within 20 years, often due to mismanaged funds.

By establishing clean, scalable systems early, you set the stage for confident decisions, smoother operations, and long-term profitability.

Delegate and Build an Effective Management Team

Running multiple businesses means you can't — and shouldn't — do it all. To scale without burning out, you must build a strong management team and delegate core responsibilities to the right people. For entrepreneurs juggling multiple ventures, the goal is to lead, not manage every day-to-day task.

Leadership Structures That Work

Start by identifying the essential functions in each business — operations, marketing, finance, customer service — and determine who owns what. Use a delegation matrix to map out responsibilities across ventures. This helps you avoid confusion and ensures nothing falls through the cracks.

Effective strategies:

Hire fractional CXOs (e.g., part-time CFOs or COOs) to bring high-level expertise without full-time overhead.

Outsource specialized roles such as bookkeeping, IT, or content marketing through agencies or freelancers.

Build in-house teams where continuity and brand alignment matter most, like sales or customer support.

Form partnerships with collaborators or service providers who can scale with you.

According to recent data, three-quarters of workers with multiple jobs are running their own business, which means multitasking is the norm — not the exception. And it pays off: serial entrepreneurs earn an average of $101,099 annually.

But hitting those numbers requires trust and structure. Build a management team that runs the business so you can grow the business.

Master Time Management To Run Efficiently

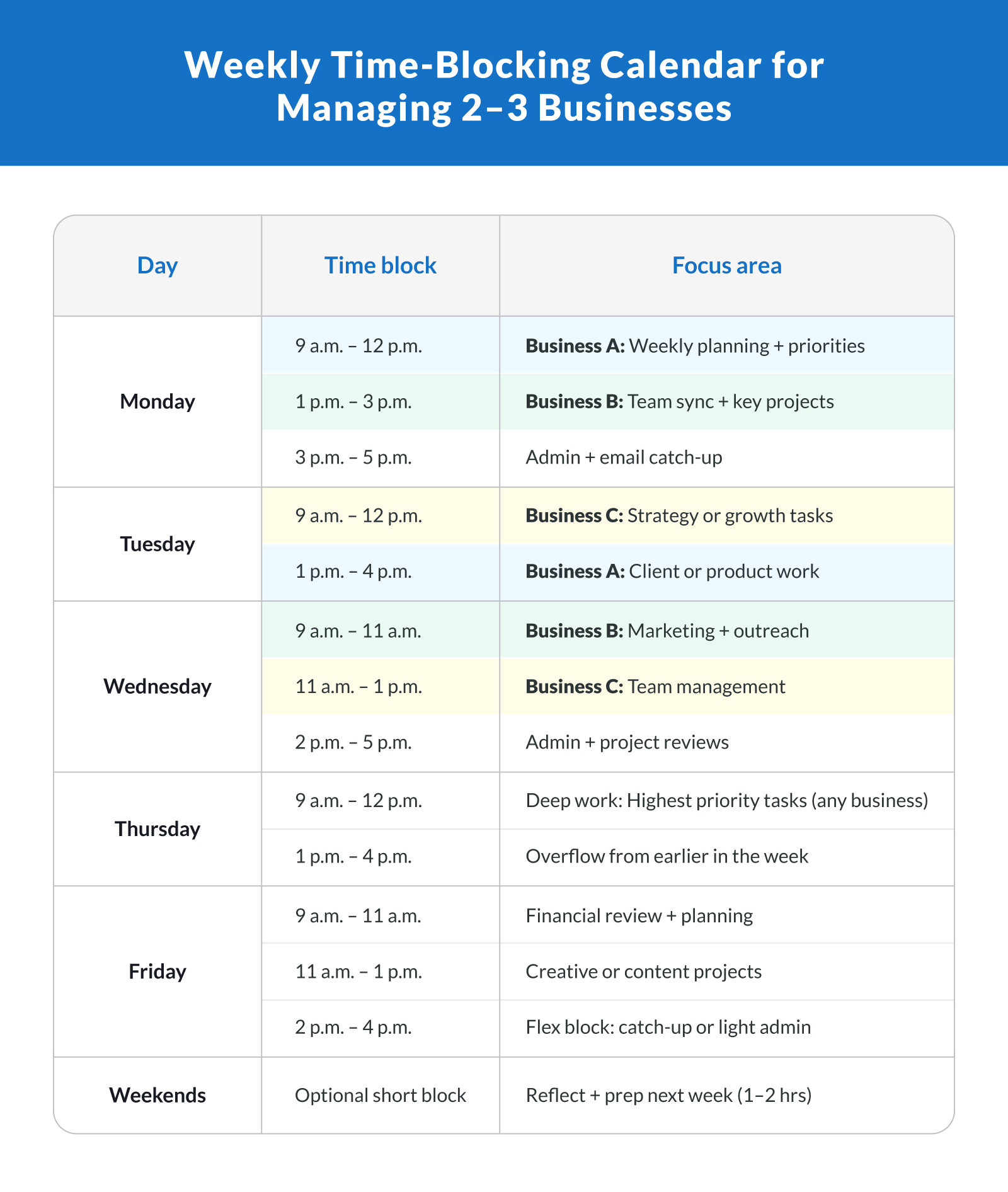

If you're managing multiple ventures, every minute matters. Without structured time management, it's easy to get buried in a never-ending to-do list that drains your energy and slows momentum. Entrepreneurs who scale successfully treat their calendar like a business plan — strategic, intentional, and outcome-driven.

Proven Time Control Techniques

Time-chunking: Dedicate blocks of time to specific business areas (e.g., Mondays for Business A, Tuesdays for Business B).

Task batching: Group similar tasks like emails, calls, or reporting to reduce cognitive load and avoid constant context-switching.

Time-blocking: Assign fixed hours on your calendar for high-impact priorities — then protect them like meetings.

Start by conducting a time audit: track your work hours for a week to see where time leaks happen. Tools like Clockify, RescueTime, or Toggl can reveal hidden inefficiencies and optimize your day-to-day routines.

Why it matters: Small business owners lose 1.5 hours daily to unproductive tasks. That's nearly eight hours a week — an entire workday lost. And yet, 82% of people do not use a time management system, making it a major missed opportunity.

Incorporate digital project management tools like Trello, ClickUp, or Asana to coordinate tasks, track progress, and keep all businesses aligned. By owning your time, you'll sharpen your focus, reduce burnout, and run your companies with greater intention and control.

Implement Systems and Tools for Streamlining

When you're running multiple ventures, manual processes won't cut it. You need scalable systems that reduce friction and boost efficiency. By leveraging the right tech stack — from CRMs to automation tools — you can streamline operations and focus on high-impact work.

Core Tools for Multi-Business Management

CRM (customer relationship management): Tools like HubSpot, Zoho, and Pipedrive help track leads, manage contacts, and unify sales pipelines across ventures.

ERP (enterprise resource planning): Platforms such as NetSuite or Odoo centralize finance, HR, and supply chain tasks for larger, growing companies.

Project management apps: Trello, ClickUp, and Asana allow for cross-functional visibility, real-time task updates, and customizable workflows.

Automation tools: Zapier and Make connect your apps and automate repetitive actions—like syncing contacts between platforms or triggering invoices after a sale.

Dashboards: Platforms like Databox or Google Looker Studio turn raw data into visual insights, improving decision-making across all ventures.

Each tool adds functionality that scales as you grow, and helps maintain visibility and consistency, even when juggling several brands or teams. Yet, 49% of professionals have never conducted a time audit, and that lack of insight often leads to inefficiency.

Companies that invest in systems win. In fact, diversifying companies achieved a 32.8% advantage over focused businesses, largely due to the operational leverage gained from smart systems and well-integrated apps.

The bottom line: If you want to grow without losing control, invest in tech that helps you automate, scale, and streamline your business operations from the inside out.

Plan for Growth, Succession, and Exit

Running multiple business ventures isn't just about what you build — it's also about how you plan to grow, hand off, or sell when the time is right. Without a long-term strategy, even the most promising startup can stall. Building a successful business includes preparing for the day you no longer lead it.

Long-Term Planning Essentials

KPI dashboards: Track financial health, customer acquisition, churn, and profitability in real time. Tools like Databox, Geckoboard, or Google Looker Studio help visualize progress across ventures.

Scaling strategy: Define which businesses have the most potential, and reinvest accordingly. Document processes early so growth doesn't break your systems.

Succession planning: Decide whether you'll train internal leaders, bring in outside talent, or prepare for acquisition.

Exit readiness: Keep financials clean, SOPs up to date, and legal structures tight. This boosts your appeal to buyers and investors.

Why it matters: Only 30% of businesses successfully sell, often due to unclear processes, outdated systems, or incomplete records. And value depends heavily on the sector. Average earnings multiples range from 2 to 3.2, meaning a well-prepped business can generate a substantial payout.

Even if one venture fails, don't give up — 29% of failed business owners start again, and many outperform their first attempt.

Whether your goal is to scale, sell, or step back, plan early. Your future flexibility — and profitability — depends on it.

Your Blueprint for Managing Multiple Businesses

To manage multiple businesses effectively, you need more than ambition — you need structure, strategy, and the right support systems. From choosing the best entity structure and separating finances to streamlining operations and building a strong leadership team, each decision shapes your long-term success. Mastering time management and preparing for growth or exit ensures you stay ahead, not overwhelmed.

The most successful entrepreneurs don't try to do everything themselves. They focus on what moves the needle, delegate the rest, and rely on systems to scale. Whether you're launching a second venture or managing several, the right tools and strategies can turn complexity into clarity — and help you grow with confidence.

Need funding or expert guidance to support your next business move? Explore Clarify Capital's funding and advisory services to get the resources and insight you need to manage, scale, or sell — on your terms.

Frequently Asked Questions About Running Multiple Businesses

If you're exploring how to run multiple businesses effectively, these answers address the most common concerns from entrepreneurs managing diverse ventures across industries like e-commerce, consulting, and more.

What Is the Best Structure for Owning Multiple Businesses?

The best structure depends on your goals and the relationship between your ventures. Many entrepreneurs use a holding company to own multiple entities, offering centralized control and potential tax advantages. Others prefer setting up separate LLCs for liability separation, or using DBAs under one umbrella for simpler brands. Consult a legal advisor to determine the best setup for your small business needs.

How Do Successful Entrepreneurs Manage Time Across Companies?

Successful entrepreneurs use time-blocking, task batching, and digital calendars to assign focused time to each business. They often adopt time audits to identify inefficiencies and use tools like ClickUp or Trello for cross-venture visibility. Effective time management is about prioritizing deep work and minimizing day-to-day distractions across all ventures.

Should I Automate or Outsource My Business Operations?

Ideally, do both. Use automation tools like Zapier to handle repetitive tasks (e.g., invoicing, email follow-ups), and outsource specialized or time-intensive work, like bookkeeping, customer service, or web development. This frees up your bandwidth and supports business growth, especially in fast-paced fields like e-commerce.

How Do I Keep Finances Separate for Each Business?

Open distinct bank accounts and credit cards for every business. Use bookkeeping software like QuickBooks or Xero with individual company profiles. This simplifies tax filing, improves clarity, and helps you analyze financial health across all entities, key to thriving as a multi-business entrepreneur.

Can One Business Legally Fund Another?

Yes, but it must be done properly. Inter-company funding should be well-documented with clear terms, especially if the businesses have different partners or structures. You may need formal agreements or board approval depending on the legal setup. Transparency is essential to stay compliant and protect your ventures.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts