When managing cash flow gaps, many small business owners turn to their unpaid invoices for fast funding. Both invoice financing and invoice factoring are effective tools for accessing working capital, but they function differently — and choosing the right financing solution starts with understanding the differences. In the debate between invoice financing vs. factoring, knowing how each works can directly impact your financial strategy.

Invoice financing lets businesses borrow against outstanding invoices, while invoice factoring involves selling those invoices to a third party for immediate payment. Both help business owners convert receivables into usable capital without waiting weeks or months for customers to pay.

In this guide, we'll break down the key differences between invoice financing and factoring, including pros and cons, typical costs, and which business types benefit most from each. Understanding these options helps business owners make smarter, more informed funding decisions, which improves cash flow and maintains momentum during slow periods or growth phases.

Key Differences Between Invoice Financing and Factoring

While both invoice financing and factoring help turn accounts receivable into working capital, the structure, control, and collections process differ significantly. These key differences can impact your customer relationships, cash flow predictability, and the overall cost of the funding.

For small business owners choosing between financing options, understanding who manages the invoices and how funds are delivered is crucial to selecting the right type of financing. The table below compares how each model works in practice:

| Invoice Financing vs. Factoring | ||

|---|---|---|

| Factor | Invoice financing | Invoice factoring |

| Structure | Loan or line of credit backed by invoice value | Sale of invoices to a factoring company |

| Customer communication | Business retains control of invoicing and collections | Factoring company takes over the collections process |

| Funding speed | Typically, one to two business days after approval | Often, within 24-48 hours after invoice verification |

| Control over accounts | Full control stays with the business | Partial control shifts to the factor |

| Fees and costs | Interest + service fees charged by the financing company | Discount rate + fees, based on invoice amount and risk |

| Impact on customer relationships | Customer rarely knows financing is involved | Customer interacts directly with the factor, which may affect the relationship |

These differences matter, especially if you want to preserve customer experience or need fast access to capital. Choose the model that best aligns with your cash flow goals and business operations.

Pros and Cons of Invoice Financing

When considering invoice financing, it's important to weigh the benefits and limitations based on your business's size, payment terms, and cash flow patterns. For many small business owners, this short-term funding solution offers a practical way to access working capital without giving up control of client relationships. The following are the key advantages to consider.

Pros of Invoice Financing

Recognizing the benefits of invoice financing helps business owners determine whether it supports their current goals and operational needs. Here are some of the top advantages:

Retains customer control. Since your business, not the financing company, manages the client relationship, you preserve trust and brand consistency.

Supports predictable cash flow. Reliable access to working capital helps cover payroll, inventory, and other day-to-day needs during client payment delays.

Easier qualification. Compared to traditional loans, invoice financing typically requires less paperwork and fewer credit checks, making it more accessible to smaller or newer businesses.

Bridges short-term cash gaps. Ideal for businesses with slow-paying clients or long payment terms, invoice financing helps you keep operations moving without waiting on receivables.

Cons of Invoice Financing

Understanding the potential downsides of invoice financing is just as important as knowing the benefits. For small business owners exploring financing options, recognizing the following limitations can help prevent unexpected cash flow issues and support more informed decisions:

Costs can add up. While helpful in the short term, ongoing fees and interest rates can eat into profit margins, especially if invoices take longer to get paid than expected.

Credit or payment history matters. Some lenders assess your credit history or your customers' payment reliability, which can limit access for businesses with inconsistent records.

Not ideal for startups. Without steady invoicing or a track record of receivables, early-stage businesses may struggle to qualify for or benefit from this funding model.

Pros and Cons of Invoice Factoring

If you're considering invoice factoring as a financing solution, weighing the benefits and trade-offs is essential. The following pros and cons will help you assess whether working with a factoring company aligns with your cash flow needs and customer relationship goals.

Pros of Invoice Factoring

Understanding the advantages of invoice factoring helps business owners decide if it's the right fit for unlocking value from unpaid invoices and accounts receivable. Here's what makes it attractive:

Quick access to cash. Factoring delivers a near instant cash advance on receivables, and lenders like Clarify Capital can turn outstanding invoices into usable funds within 24–48 hours.

Easy approval process. Compared to traditional loans, factoring relies more on your customers' credit than your own, making it easier to qualify.

Saves administrative time. The factoring company handles customer payments and collections, freeing up your team to focus on core operations.

Ideal for long payment terms. Businesses serving clients on 30-, 60-, or 90-day terms, or working with credit-limited customers, benefit from improved cash flow predictability.

Cons of Invoice Factoring

Recognizing the drawbacks of invoice factoring helps business owners avoid surprises and determine if the model fits their client and operational structure:

Higher costs. The factoring fee structure is often more expensive than traditional loan interest, especially for longer invoice cycles.

Customer awareness. Clients are typically notified and directed to pay the factoring company, which may lead to confusion or questions.

Brand impact. Involving a third party in customer payments can affect how clients perceive your professionalism or financial position, which could potentially strain customer relationships.

Cost Comparison: How Each Option Affects Cash Flow

When evaluating financing options, it's essential to understand how costs are structured and how they affect repayment and long-term cash flow. Traditional finance providers like banks or online lenders typically charge interest rates on borrowed amounts, while factoring companies apply a factoring fee based on a percentage of the invoice amount.

These costs vary depending on factors like industry risk, client creditworthiness, and how quickly your customers pay. A business with large, slow-paying clients in a high-risk sector might face higher fees than one with consistent payments from well-rated customers.

Unlike loans with fixed repayment schedules, factoring deducts fees from the remaining balance once the client pays, which can affect your bottom line. Understanding the total effective cost of each funding option helps small businesses choose the best strategy for stability and growth.

| Example Scenario: Estimated Cost Impact by Invoice Size | ||

|---|---|---|

| Invoice Amount | Invoice Financing (10% APR Equivalent) | Invoice Factoring (3% Fee for 30 Days) |

| $10,000 | ~$83/month interest | $300 flat factoring fee |

| $25,000 | ~$208/month interest | $750 flat factoring fee |

| $50,000 | ~$417/month interest | $1,500 flat factoring fee |

These examples show how both models can be viable depending on your business's cash flow cycle, credit score, and need for flexibility. Always compare terms from each financial institution to understand your full cost before committing.

When To Consider Alternatives to Invoice Financing and Factoring

While invoice financing and factoring are great for improving short-term cash flow, they're not always the best financing solution for every situation. Some business owners may find better value in other financial products, especially when funding long-term growth or large projects.

Line of credit. A line of credit offers flexible access to capital that can be drawn and repaid as needed, which is ideal for managing recurring expenses or seasonal cash flow gaps.

Term loan. A term loan provides a lump sum of capital repaid over a fixed period, making it more suitable for equipment purchases, real estate investments, or scaling operations.

Accounts receivable (AR) financing. Similar to factoring but with more borrower control, AR financing allows you to use receivables as collateral while maintaining customer relationships.

These alternative funding options offer different advantages depending on your goals, risk profile, and financial outlook. For businesses seeking more structured, longer-term business financing, evaluating all available financing solutions ensures a smarter, more sustainable choice.

How To Choose the Right Option

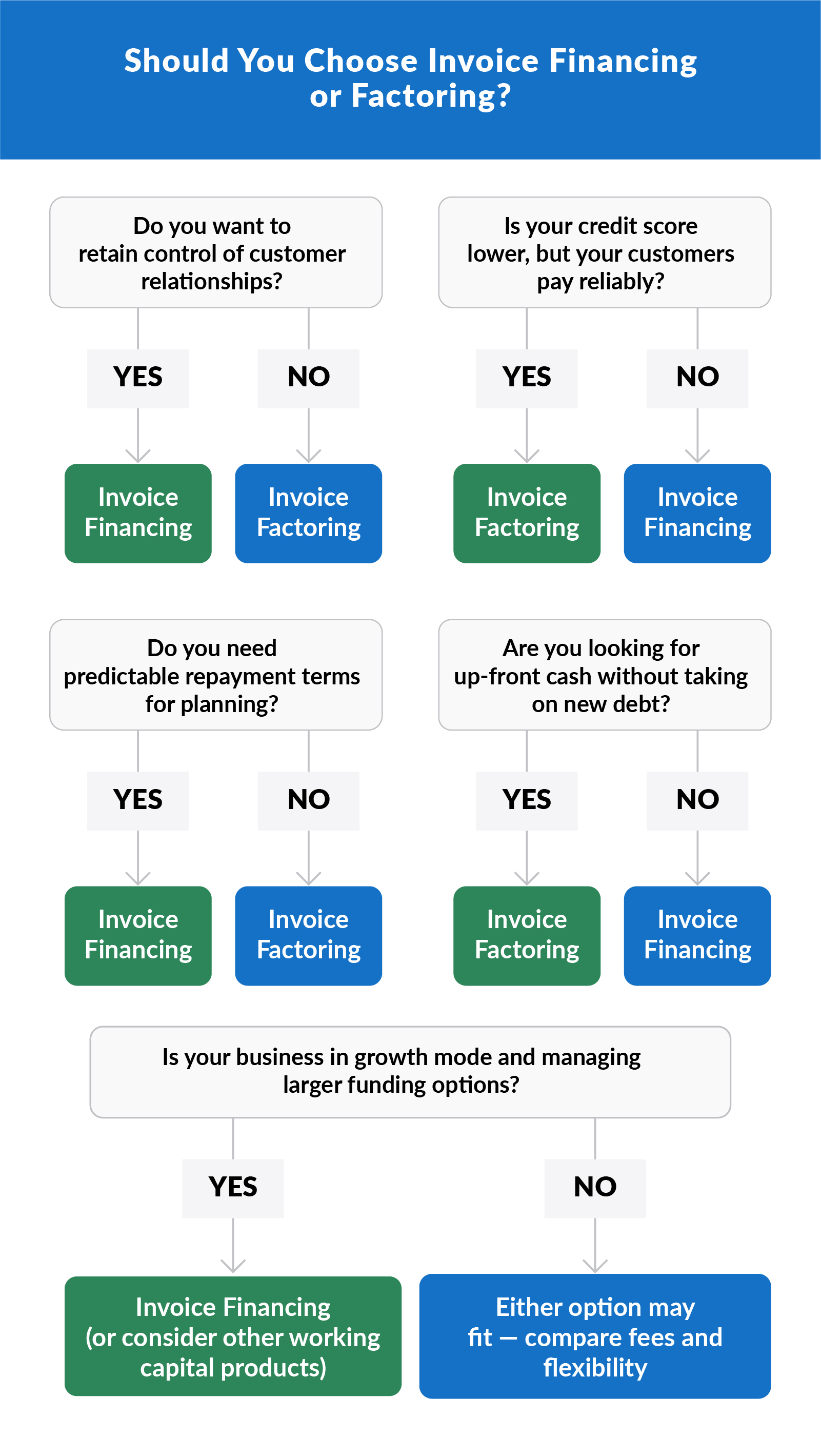

Choosing between invoice financing and factoring depends on your business needs, goals, and the level of control you want over invoice payments and customer relationships. Each method offers distinct benefits — but also comes with trade-offs in cost, flexibility, and customer experience.

Here are the key decision factors to consider:

Cost structure. Financing uses interest-based repayment; factoring applies a fee up front.

Speed of funding. Both offer immediate cash, but factoring can be slightly faster.

Customer control. Financing lets you manage client interactions; factoring involves a third party.

Credit score requirements. Financing may require a higher credit score, while factoring relies more on your clients' creditworthiness.

Business growth goals. Consider how much small business financing you currently need — and how this funding supports long-term plans.

Still unsure which path is right for your business? Connect with a funding expert at Clarify Capital to find the best solution for your cash flow, customer model, and future growth.

FAQs for Choosing Between Invoice Financing and Factoring

Many small business owners face similar questions when deciding between invoice financing and factoring, especially when managing tight cash flow or long client payment cycles. These FAQs address key concerns about control, cost, and eligibility to help you choose the funding option that best fits your operations and growth plans.

How Does Invoice Financing Compare to a Business Line of Credit?

While both invoice financing and a business line of credit offer flexible access to working capital, they differ in structure, collateral, and approval requirements. Invoice financing is secured by accounts receivable, meaning the value of your unpaid invoices determines the amount you can borrow. In contrast, a business line of credit is typically unsecured or based on overall creditworthiness and financial history.

Invoice financing is often easier to qualify for, especially for businesses with limited credit or inconsistent revenue. It's well-suited for addressing immediate repayment gaps tied to customer invoices. A line of credit, on the other hand, provides broader flexibility for long-term cash management, allowing you to draw and repay funds as needed across multiple business needs.

Both options can support healthy cash flow, but choosing the right one depends on whether you need invoice-specific funding or a more general-purpose safety net.

What Is Another Name for Invoice Financing?

Invoice financing is also commonly known as accounts receivable financing or invoice discounting, depending on the region and the structure of the agreement. In some markets, it may also be referred to as AR financing, which describes a funding model where businesses borrow against unpaid invoices to improve their cash flow. The terminology may vary, but the core concept remains the same.

What Is the Difference Between Invoice Discounting and Debt Factoring?

The key distinction lies in control and the collections process. With invoice discounting, the business retains responsibility for customer payments and collections, keeping the arrangement confidential from clients. Debt factoring, by contrast, involves outsourcing collections to a third party and is typically disclosed to customers. This difference impacts both the customer experience and the level of confidentiality in your financing.

Does Applying for Invoice Financing Affect My Credit Score?

Applying for invoice financing may involve a soft pull initially, which doesn't impact your credit score. However, some financing companies may conduct a hard pull before final approval. Always confirm with the lender whether a credit check will be soft or hard, especially if you're comparing multiple offers.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts