Key Takeaways:

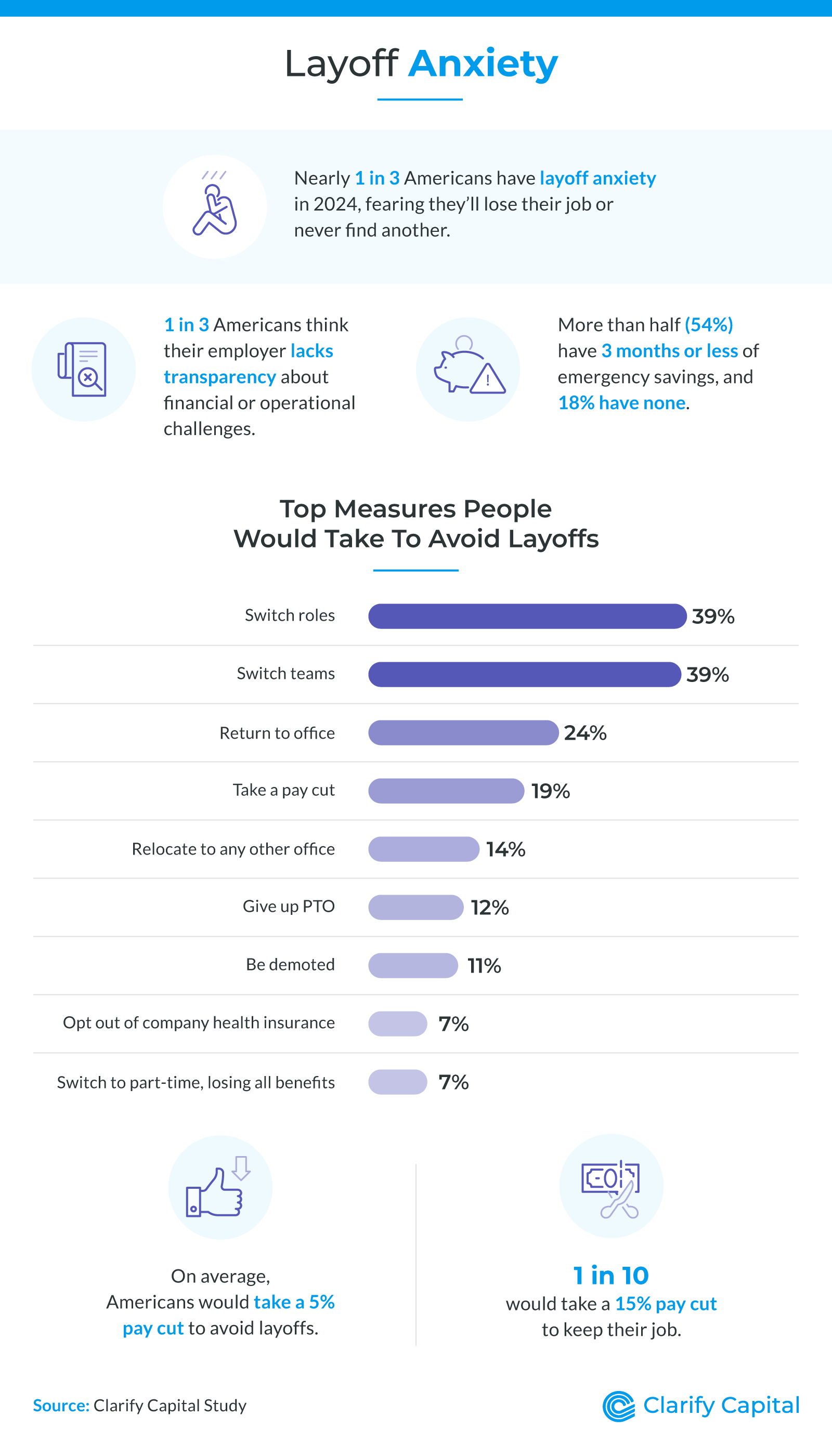

Nearly 1 in 3 Americans have layoff anxiety in 2024.

1 in 3 think their company lacks transparency about financial or operational challenges.

Over half (54%) have 3 months or less of emergency savings, and 18% have none.

Nearly 1 in 5 would take a pay cut to avoid being laid off.

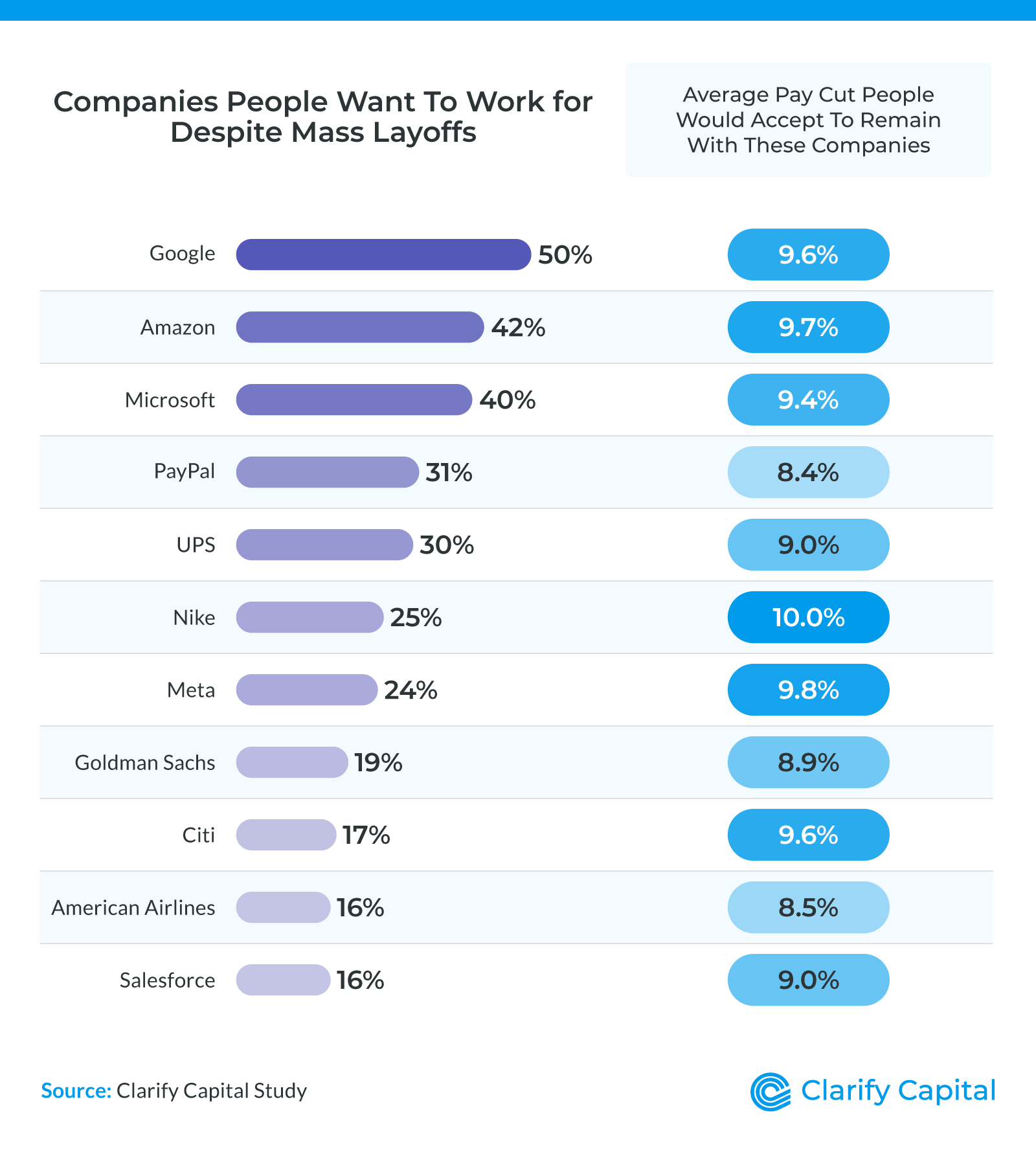

Despite layoffs occurring at Google, 50% would still want to work there, and they would take an average 9.6% pay cut to stay.

Layoff Fears

To begin, Americans share how they are feeling about mass layoffs, how prepared they are to rely on emergency savings, and what they would most likely do to avoid losing employment.

Though we’re just a little over a month into 2024, mass layoffs are happening across the country in all different industries. Nearly 1 in 3 Americans already feel the strain and report being gripped by layoff anxiety this year. This might be due to one-third feeling like their companies lack transparency with their employees about the financial or operational issues they’re facing.

Even more concerning is that over half (54%) have three months or less of emergency savings should they be laid off, and 18% are completely unprepared with no emergency savings. Layoff anxiety has led Americans to consider taking drastic measures in the fight to stay at their jobs — nearly 1 in 5 would take a pay cut to avoid being laid off, and over 1 in 10 would give up PTO. The most common response was changing their daily work: 39% said they would switch roles to stay, and 39% would switch teams.

Securing a position at a globally recognized company is often seen as the pinnacle of career success. However, in the face of widespread layoffs impacting even the largest corporations, does the allure of these industry giants still hold strong? For some, the answer is yes.

Companies People Want To Work For

Even amid substantial job cuts, Google retains its appeal, with half of the surveyed individuals still wanting to work there. Amazon and UPS also showcased continued appeal, with 42% and 30% of respondents willing to work there despite the challenging employment situation.

The loyalty to these companies also extended to financial sacrifices that employees were willing to make. On average, individuals who wanted to work for Google said they would accept a 9.6% pay cut to secure their position there, a testament to the company’s esteemed workplace reputation. Similarly, at UPS, people were willing to forego 9% of their salary, while Amazon’s prospective employees would accept a 9.7% reduction.

These figures not only highlight the perceived value of being associated with such prestigious companies but also reflect the level of commitment potential employees are ready to offer for job security within these firms.

Methodology

Clarify Capital conducted a pulse survey of 1,003 Americans to see how they feel about the mass layoffs occurring in 2024.

About Clarify Capital

Clarify Capital offers tailored financial solutions to help businesses grow, providing access to funding with transparency and efficiency.

Fair Use Statement

Feel free to share these insights into layoff anxiety among American workers for noncommercial use, but please link back to this page for full access to the study’s findings.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts