When opportunity knocks, growing companies often need fast access to capital to answer. Whether you're launching a new product line, opening a second location, or hiring key staff, business expansion loans can provide the growth capital you need to scale confidently. Even successful businesses can run into cash flow gaps during expansion phases, and that's where smart expansion financing comes in.

Expansion financing helps business owners overcome short-term liquidity hurdles while setting up for long-term business growth. From buying equipment to acquiring a competitor, having the right business financing in place ensures growth doesn't stall due to funding shortfalls. Clarify Capital makes the process fast and accessible with a simple online application, competitive terms, and same‑day funding potential.

In this guide, we'll explore the top financing options used for expansion, how to qualify, how much you can borrow, and how to manage repayment while fueling your next stage of growth. Whether you're just starting to scale or gearing up for a major investment, you'll find expert insights and actionable tips to make the most of your funding choices.

What Is a Business Expansion Loan?

A business expansion loan is a form of small business loan designed to help business owners fund planned growth. It provides capital for strategic moves like hiring staff, opening new locations, upgrading equipment, or buying property. Unlike general‑purpose loans, expansion loans focus on supporting business growth and scaling operations.

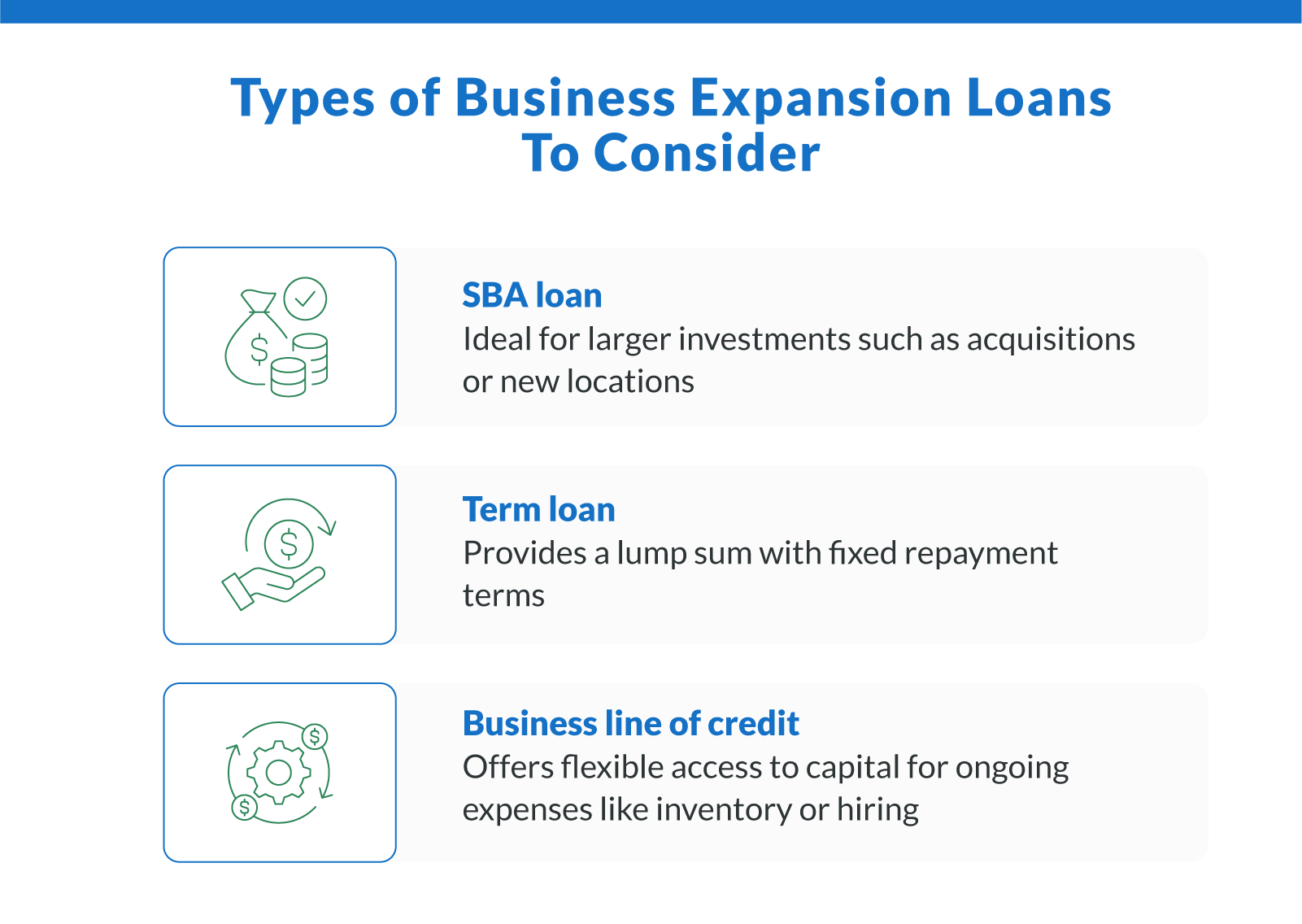

These loans come in different loan programs to match varying needs and qualifications:

SBA loans. Ideal for larger investments such as acquisitions or new locations.

Term loans. Provides a lump sum with fixed repayment terms.

Business lines of credit. Offers flexible access to capital for ongoing expenses like inventory or hiring.

The best option depends on your business model, timeline, and financial goals. Clarify Capital helps match you with tailored expansion financing that fits your stage of growth.

Common Scenarios for Using Expansion Financing

Growing a business isn't one-size-fits-all, and neither is the financing that gets you there. Companies tap expansion financing at different stages, whether they're opening a new location, acquiring competitors, or upgrading operations. Knowing which funding options fit your goals can help you act confidently when opportunities arise.

Opening a Second Location

When business owners expand into a second location, costs like real estate, staffing, and equipment can quickly add up. Expansion loans can cover these expenses so your day-to-day cash flow stays healthy. SBA 7(a) and term loans are common choices for larger amounts and structured repayment that aligns with revenue growth. Clarify Capital's streamlined approval process matches you with lenders and tailored funding options so you can focus on execution.

Purchasing a Competitor

For established businesses looking to expand market share or enter new markets, acquisition financing bridges the gap between opportunity and capital. In these situations, lenders assess due diligence and valuation to ensure the deal is financially sound. Larger purchases often work well with SBA loans or traditional loan programs like term loans. Clarify Capital connects you to lenders who understand business takeovers and help smooth the path to closing.

Scaling Operations and Inventory

Rapid growth or seasonal demand can strain your working capital if you're not prepared. Business lines of credit and working capital loans offer flexible access to funds that help manage supply chain needs, payroll, inventory, and marketing. A revolving credit line acts as a financial cushion. Clarify provides guidance to help you find the right mix of business lines of credit and other funding options for your growth capital strategy.

Investing in New Equipment or Technology

Upgrading tools, machinery, or technology can boost productivity and keep you competitive, but it often requires a significant upfront cost. Equipment financing lets you buy high‑cost assets with manageable monthly payments while preserving cash flow. Compared to leasing, financing can offer tax advantages and long-term ownership benefits. Clarify Capital's competitive rates and wide lender network make it easier for businesses to secure the funding that fits both their business needs and budget.

How Do Business Expansion Loans Work?

Business expansion loans help established companies get capital to grow, but to qualify, you must meet basic eligibility requirements. Lenders usually look at your credit score, monthly revenue, time in business, and overall creditworthiness to evaluate risk and shape your loan offer.

Here's how the application process typically works:

Submit your application. Fill out a simple online form with your business details, revenue, and financing needs. Clarify Capital's streamlined application process takes just a few minutes.

Underwriting and lender match. A lender or Clarify's marketplace reviews your financials, pulling credit data and performance metrics to assess creditworthiness and risk.

Loan approval. Once approved, you will receive an offer with the loan amount, interest rate, loan term, and other terms. Clarify Capital often delivers approvals and offers in the same business days.

Receive your funds. After you accept the offer, funds are usually deposited within 24 to 48 business days, and often faster through Clarify's network.

Repayment begins according to the agreed-upon schedule, typically with fixed monthly payments over 12 to 60 months. Your repayment terms and interest rate depend on the lender, your credit profile, and the loan type. Clarify Capital gives access to competitive rates and a range of options that match your growth timeline.

Pros and Cons of Business Expansion Loans

Business expansion loans offer valuable support for growth initiatives, but like any business financing option, they come with trade-offs. Below are the primary advantages and potential drawbacks to help you make an informed decision.

Business expansion loans offer several key advantages:

Fixed‑rate and predictable payments. You know what you'll owe each month, which makes it easier to plan and manage forecasts.

Flexible terms tailored to your growth stage. Lenders can offer flexible terms that align with your goals and timeline.

Available to established businesses. If your company has strong revenue, time in business, and a solid credit history, you'll likely qualify for more favorable terms.

Quick access to business financing. Funds can often reach your business bank account in as little as one business day, helping you act fast on new opportunities.

However, there are also some challenges to consider:

Down payments may be required. Especially for larger amounts, down payments can put pressure on short‑term cash flow.

Collateral may be needed. Some loan programs require business or personal assets as security for the funds.

Variable rates can increase total repayment. If you don't lock in a fixed rate, variable rates could raise your overall cost.

Higher credit standards apply. Businesses with a lower credit score may struggle to qualify or face higher costs.

Longer loan terms increase total cost. While monthly payments may be lower, a longer loan term could mean paying more over time.

How To Qualify for a Business Expansion Loan

Qualifying for a business expansion loan is easier than many business owners expect, especially when working with a small business lender like Clarify Capital. Unlike bank loans with rigid requirements, Clarify offers flexible financing solutions and a streamlined application process that helps business owners get approved faster.

To qualify for most business expansion loans, you'll typically need:

Minimum credit score of 550. A fair or better rating helps show creditworthiness and improves approval odds.

Monthly revenue of $10,000 or more. Lenders want to see consistent cash flow to support the loan amount and repayment plan.

At least 6 months in business. A longer track record improves your options, but strong financials can help even newer companies qualify.

Basic financial documentation. Be ready to provide recent bank statements, a business plan, or tax returns during the application process.

To strengthen your application, aim for a solid credit profile, updated financials, and a clear plan for how you'll use the funds. Clarify's specialists can walk you through best-fit options, whether you're seeking SBA 7 loans, term loans, or custom funding from alternative business financing providers.

How Much Can You Borrow to Expand Your Business?

The loan amount you can borrow for business expansion depends on factors like your monthly revenue, credit score, time in business, and the loan programs you qualify for. Lenders review these details to assess your ability to repay and set appropriate funding limits.

Most small business owners can expect the following loan ranges:

$5,000 to $500,000 for merchant cash advances. Best for short-term cash gaps, emergency costs, or urgent repairs. Repayment is based on daily or weekly sales.

A few thousand to several million for equipment loans. Use for machinery or tech upgrades. Ideal when equipment drives revenue, and you want to preserve working capital.

Up to $5 million for SBA‑backed loans. Programs like SBA 7(a) work well for commercial real estate, acquisitions, or major expansion plans.

$10,000 to $1 million for lines of credit. Flexible access to funds helps cover seasonal inventory or short gaps in cash flow.

Repayment terms typically range from three months to 10 years, depending on the loan type. Shorter terms mean quicker payoffs, while SBA loans and real estate-backed financing offer extended terms with easier monthly payments.

Clarify Capital helps business owners match with the right business financing and loan amount based on their goals, whether you're investing in commercial property or seeking fast capital to scale operations.

Tips for Managing Repayment and Growth

Once you secure funding, managing your repayment terms and aligning them with your long-term growth plans is crucial. These practices help maintain financial stability and get the most out of your expansion loan:

Monitor cash flow closely. Make sure your monthly income covers your repayment obligations and everyday operating costs.

Track return on investment (ROI). Measure how growth funded by your loan, like a new location or upgraded equipment, impacts revenue.

Explore refinancing if needed. If your cash flow changes or market rates improve, refinancing can lower monthly payments or extend your loan term.

Use working capital strategically. Avoid overextending on expansion if it limits your ability to cover short-term business needs.

Build your creditworthiness. Making timely payments strengthens your profile and can unlock better terms in the future.

Lean on Clarify Capital for guidance. Their advisors can help you assess financial performance and adjust your strategy as your business evolves.

These steps help you manage your loan wisely while supporting sustainable business growth.

Take Your Business to the Next Level

Business expansion loans give you the growth capital to turn your next move into measurable progress, whether you're launching a new location, hiring staff, or upgrading equipment. With the right funding options in place, you can overcome cash flow limitations, increase revenue potential, and scale on your terms.

Clarify Capital makes it simple. Fast online applications, same‑day approvals, and access to competitive rates mean you can focus on business growth, not paperwork. Plus, their flexible financing solutions let you align funding with your strategy and repayment preferences.

Ready to fuel your expansion? Get a personalized loan quote in five minutes from Clarify Capital.

FAQ About Business Expansion Loans

Before applying for a business expansion loan, many business owners have specific questions about interest rates, repayment terms, and eligibility. Below are straightforward answers to help you make an informed decision with confidence.

Should I Take a Loan to Expand My Business?

A business expansion loan can be a smart move if you're investing in opportunities that are expected to generate strong returns. If the projected ROI outweighs the cost of the loan, and your cash flow can support the repayment terms, financing can accelerate your business growth. Make sure you meet eligibility requirements and can commit to the loan without overextending your budget.

What Is the Average Interest Rate on a Business Loan?

The average interest rate on business financing varies based on the lender, your credit profile, bank account history, loan type, and repayment term. Fixed-rate options, like SBA loans, often offer lower fixed-rate pricing, while short-term loans and other financing options may carry higher rates. Clarify Capital connects you with lenders offering competitive rates tailored to your situation.

What Is the Monthly Payment on a $50,000 Business Loan?

Monthly payments on a $50,000 loan amount depend on the interest rate, repayment terms, and loan structure. For example, a $50K loan with a 10% APR and a three-year term could result in monthly payments of around $1,600. Term loans typically offer predictable repayment terms, while some alternative financing options may vary. Use a business loan calculator to estimate costs and compare financing options based on your cash flow and goals.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts