Key Takeaways:

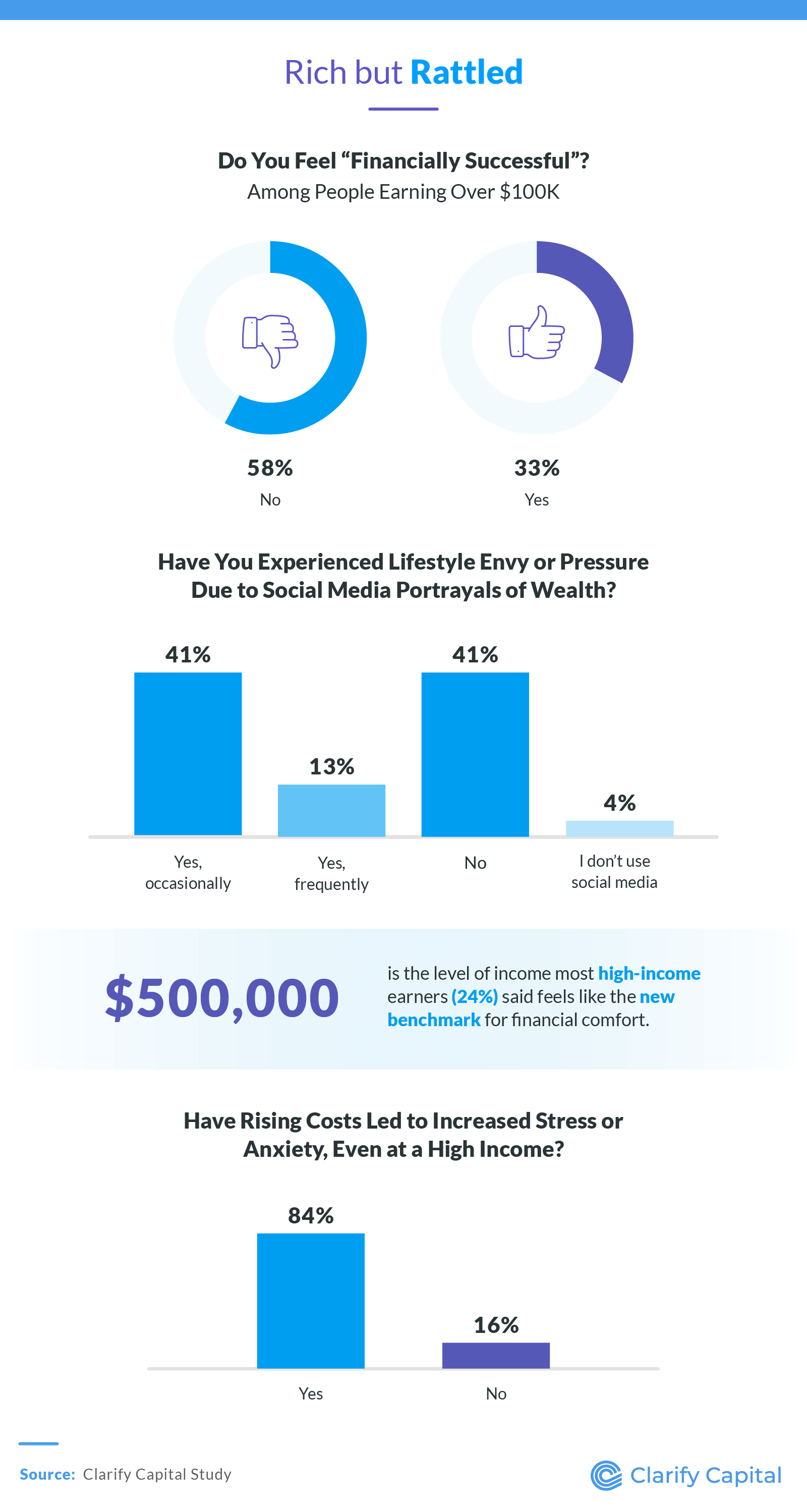

More than half of six-figure earners (58%) no longer feel financially successful.

The new "financial comfort" threshold starts at an income level of $500,000, according to most high earners (24%).

More than 7 in 10 high earners now shop at discount grocery chains.

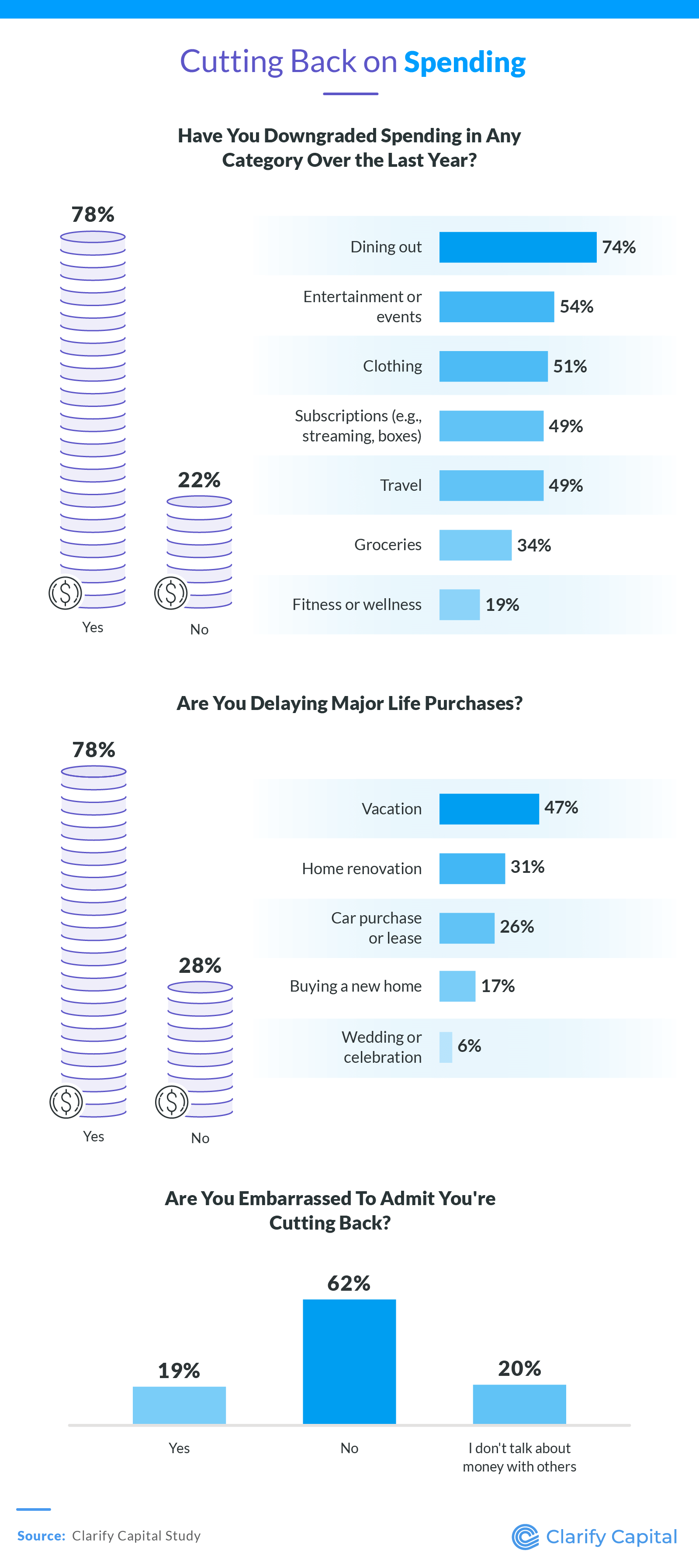

Most higher earners (62%) are not embarrassed to admit they're cutting back.

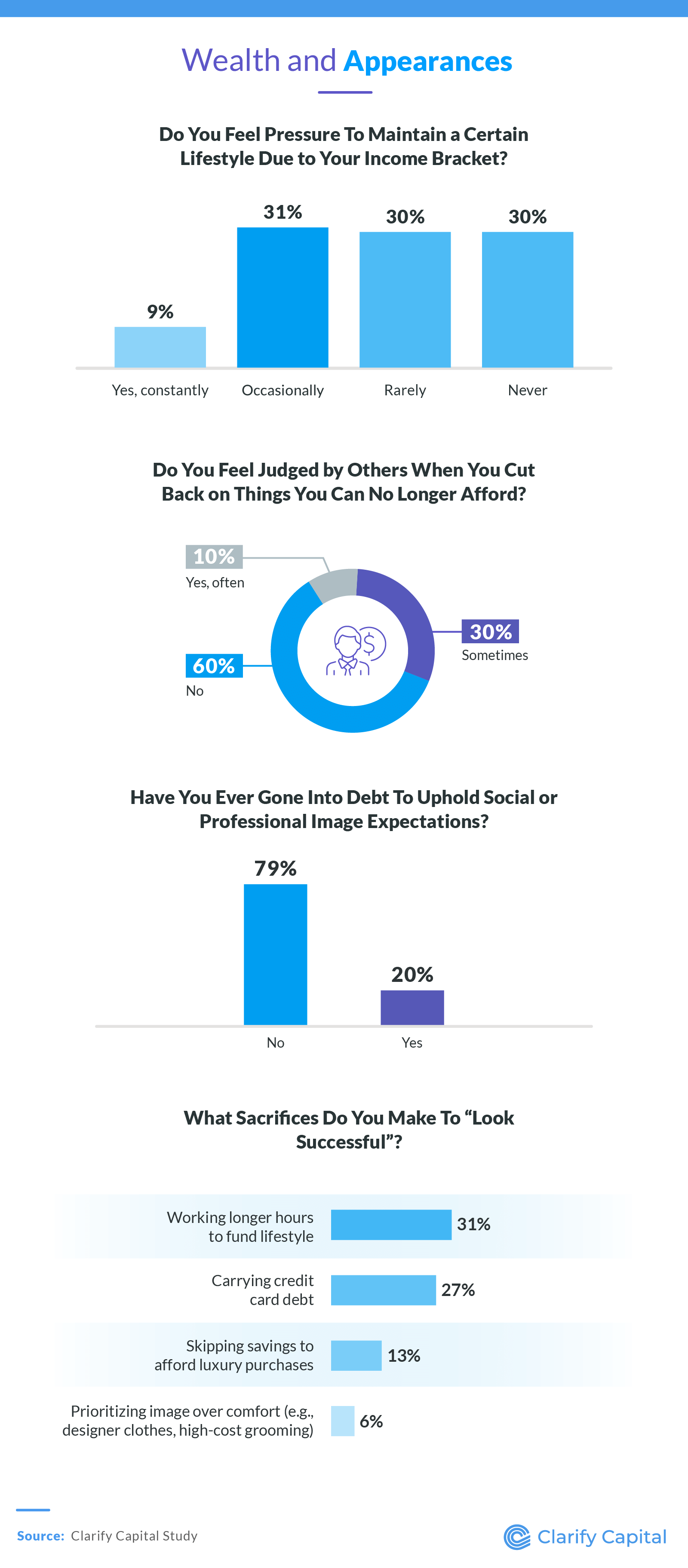

Looking rich is costing over 1 in 3 high earners real wealth and peace of mind as they feel pressure to maintain a certain lifestyle.

Feeling Rich Isn't What It Used to Be

Making a high income doesn't always mean feeling secure. We looked at how different groups feel about their finances.

Despite earning over $100,000 annually, a majority of six-figure earners (58%) said they don't feel financially successful. Women were slightly more likely than men to feel this way at that income level (60% vs. 56%).

Those making $250,000 or more were the most likely to report feeling financially secure (60%). Looking across generations, baby boomers were the most secure group (52%), while younger earners felt less confident. Professionally, people working in marketing had the highest financial confidence (42%), while those in legal services were the most likely to feel unsuccessful (67%).

Rising prices are adding pressure across the board. Most respondents (85%) said they feel stressed and anxious due to increasing living costs. Women (88%) were more likely than men (81%) to say so. By industry, marketing professionals were the most affected (92%), and government employees were the least (78%).

Social media is adding fuel to the fire. Many respondents reported that it triggered feelings of lifestyle envy and pressure to keep up, with Gen Z (79%) and women (63%) being the most affected. By income level, people making less than $125,000 were the most likely to feel envy or pressure due to social media portrayals of wealth (57%).

And while higher earnings help, they don't guarantee peace of mind. When asked what income would make them feel truly comfortable, the most common answer was $500,000 a year, cited by 24% of respondents.

Saving Smarter, Spending Less

Even among those making six figures, careful spending has become a necessity. Over 70% said they now shop at discount grocery stores, 74% have cut back on dining out, and 62% aren't embarrassed to admit they're cutting costs.

When asked whether they've reduced their spending, baby boomers (17%) and men (14%) were the most likely to say they haven't made any cutbacks. While 70% of six-figure earners are postponing major purchases like vacations and home renovations, not everyone is holding back. Consultants (37%), baby boomers (37%), and men (31%) were more likely than other groups to say they haven't delayed big buys.

Younger respondents have made deep cuts. Gen Z was the most likely to have canceled subscriptions (61%), while millennials were the most likely to cut back on clothing (55%) and travel (51%) expenses.

The Hidden Cost of Keeping Up Appearances

For many high earners, trying to "look successful" has financial consequences. Over 1 in 3 said they constantly or occasionally feel pressure to maintain a certain lifestyle because of their income level, and 20% admitted to taking on debt to maintain appearances.

Women (44%) reported feeling more pressure to live up to their income status than men (37%), and those earning $250,000 or more were most likely to feel this pressure constantly. Real estate professionals and Gen Zers reported the highest levels of stress around maintaining a high-income image.

However, not everyone feels this way. Marketing and baby boomer professionals were the most likely to say they never feel pressured to keep up appearances. Lower earners ($100K–$125K) were the most likely to have never felt lifestyle pressure and the least likely to feel judged when cutting back on spending.

Nearly 80% of high earners have made financial sacrifices to uphold a successful image. Gen Xers and those earning under $125,000 a year were most likely to take on credit card debt to look the part. Healthcare professionals were the most likely to work longer hours to fund their lifestyle, while legal professionals admitted to skipping savings for luxury splurges.

Still, there's a bright side. Most high earners (60%) said they don't feel judged when cutting back. That could suggest a growing acceptance of living below one's means. Instead of focusing on appearances, more people may be finding value in making thoughtful financial choices.

Conclusion: Redefining What Wealth Looks Like

In today's economy, income alone doesn't guarantee financial peace of mind. High earners are feeling squeezed by inflation, stressed by social pressure, and more mindful about what it really means to be well-off. As spending habits shift and priorities change, one thing is clear: real wealth is about security, not just status.

Methodology

We surveyed 759 respondents ranging in age from 19 to 73 to explore the new reality of being "well-off," especially in light of the current economic environment. The mean age was 43; 63% of respondents identified as male, and 36% as female. The generational breakdown was 6% baby boomers, 34% Gen X, 55% millennials, and 5% Gen Z. As for income levels, 33% of respondents earned between $100,000–$124,999, 28% between $125,000–$149,999, 23% between $150,000–$199,999, 10% between $200,000–$249,999, and 6% earned $250,000 or more.

Respondents worked in the following industries: tech/IT (30%), healthcare (14%), finance or insurance (13%), education (9%), government (8%), consulting (4%), legal services (2%), marketing or PR (2%), real estate (1%), and other professions (17%). Percentages in this study may not total 100 due to rounding or not all answers being shown.

About Clarify Capital

Clarify Capital helps entrepreneurs and small business owners access funding quickly and simply. Whether you're seeking no-doc business loans or exploring fast business loans, Clarify Capital connects you with financing that fits your goals. In a changing economy, we're here to help you grow with confidence.

Fair Use Statement

If you'd like to share these insights for noncommercial purposes, please feel free to do so. Just be sure to link back to Clarify Capital and provide proper credit.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts