Here are 52 women in business statistics to show you how women entrepreneurs are tackling the industry and growing their businesses.

Women-Owned Business Statistics

Women-owned companies continue to see improvements overall in their revenue and growth post-pandemic. Below are the top statistics for women-owned businesses.

1. Currently, women wield approximately $10 trillion in financial assets within the U.S. This number is expected to surge to $30 trillion by the close of the decade. (CNBC)

2. Women-led companies generated approximately $1.9 trillion in earnings, employed 10.9 million people, and maintained an annual payroll of $432.1 billion. (Census)

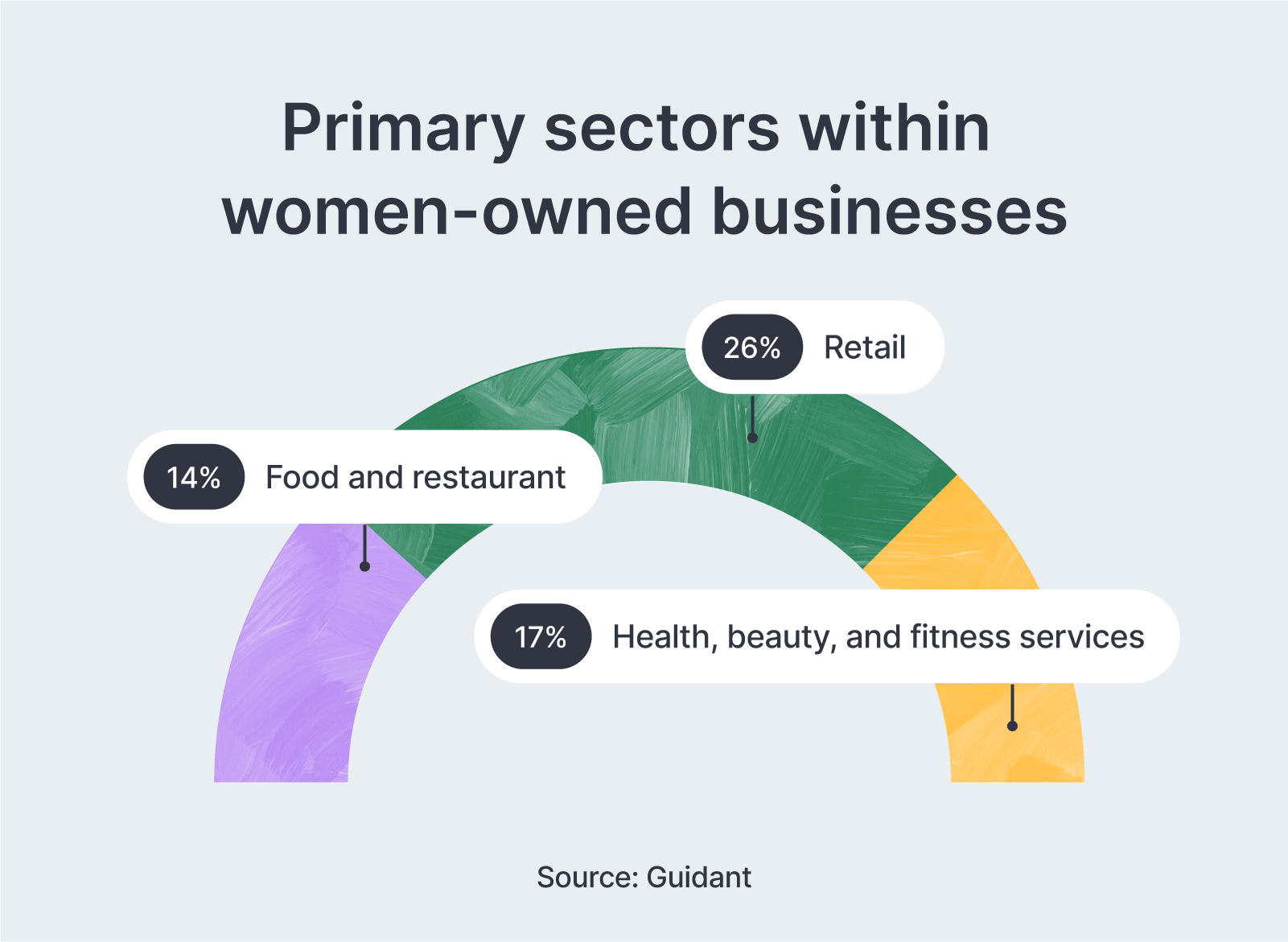

3. The primary sectors within women-owned businesses include retail (26%), health, beauty, and fitness services (17%), as well as food and restaurant (14%). (Guidant)

4. Women-owned companies rose 16.7% between 2012 and 2019, compared to 5.2% for men-owned businesses. (NWBC)

5. 44% of women-owned businesses experienced an increase in annual revenue in 2022. (FED Small Business)

6. In 2022, 21% of women-owned businesses had an annual revenue between $100,001-$250,000. (FED Small Business)

7. 32% of women-owned businesses are zero to two years old. (FED Small Business)

8. Most women business owners fall within the Generation X category (55.7%), while almost one-third belong to the Boomer generation (29.9%). (Guidant)

9. In 2022, 60% of women-owned businesses displayed profitability. (Guidant)

10. 60% of female business owners expressed their happiness as business owners, with 33% indicating a strong "very happy" sentiment and 30% describing themselves as "somewhat happy" in their roles. (Guidant)

11. A significant 59% of women business owners acknowledge having to exert more effort to achieve the same level of success as their male counterparts. (Bank of America)

12. 76.9% of women business owners are over the age of 35. (NWBC)

13. 33% of female business owners identify as Republican, 30% as Democratic and 33% as unaffiliated. (Guidant)

Women-Owned Business Funding Statistics

As the economy shifts, so do funding opportunities for women-owned businesses. Here are interesting statistics on female-run business finances and funding.

14. As of 2022, U.S. female founders receive only 2.1% of venture capital funding. (PitchBook)

15. In 2022, 39% of women-owned businesses applied for a line of credit, 36% for a business loan and 28% for a SBA loan. (FED Small Business)

16. The top priority of women-owned small businesses is getting financial support and more funding (49%). The second priority is to help with the hiring process. (15%). (Quickbooks)

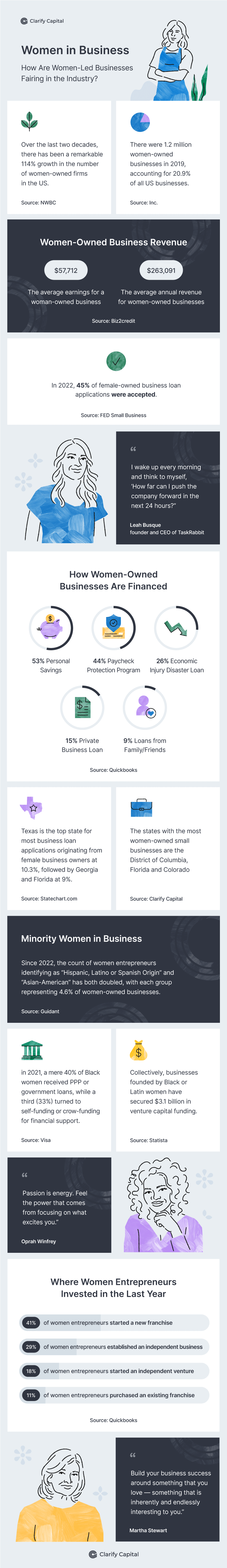

17. Roughly 53% of businesses owned by women are financed through personal savings, while 15% of women-owned businesses are financed through private business loans. (Quickbooks)

18. In 2022, 63% of women owned businesses were at a low credit risk, with only 9% at a high credit risk. (FED Small Business)

19. Women-owned businesses are projected to contribute to approximately 6% of the anticipated global economic growth. (Mastercard)

20. On average, female business owners anticipate attaining equitable access to capital by the year 2031. (Bank of America)

21. In 2022, 52% of women-owned businesses used a large bank as their financial service provider, 38% used a small bank and 27% used a financial institution that wasn't a bank. (FED Small Business)

22. The average business credit score for women-owned businesses is 34. (Experian)

23. Men are two times more likely to gain more than $100,000 in funding than women. (AI Bees)

24. In 2022, 45% of female-owned business loan applications were accepted. (FED Small Business)

Women-Owned Small Business Statistics

Owning a small business is a great accomplishment, but is no easy feat. These are the top statistics for women-owned small businesses in the U.S.

25. Among the 33.2 million small businesses in the United States, approximately 13 million are owned by women. (SBC)

26. 67% of women-owned small businesses believe hiring is now harder post-pandemic. (Quickbooks)

27. 52% of women-led companies have adopted a “remote” workplace policy, while 51% have adopted a flexible workplace schedule. (Quickbooks)

28. The states with the most women-owned small businesses are the District of Columbia, Florida, and Colorado. (Deputy)

29. 71% of women business owners feel prepared to navigate through an economic recession. (Bank of America)

30. The majority of female business owners intend to take the following actions this year: 30% plan to augment their staff, 18% aim to invest in digital marketing, and 17% have intentions to expand or renovate their businesses. (Guidant)

31. 60% of female business owners are self-taught with their financial knowledge. (Bank of America)

32. 47% of women business owners plan to expand their business, while 63% expect an increase in revenue next year. (Bank of America)

33. Before the pandemic, in 2019, the representation of female new business owners stood at 28%, which notably increased to 49% in 2021. (Gusto)

Minority Women in Business Statistics

Minority business owners continue to grow their businesses and showcase a higher representation among female entrepreneurs. Here are some statistics on how minority women in business continue to grow in the economy.

34. 42% of recently established women-owned businesses originate from Black women, while Latine women account for 31%. (SBC)

35. There was a 33% rise in women business owners who identify as "Black or African American" from 2022 to 2023. (Guidant)

36. 75% of female business owners desire greater proficiency in small business finances. (Bank of America)

37. Since 2022, the count of women entrepreneurs identifying as "Hispanic, Latino or Spanish Origin" and "Asian or Asian-American" has doubled, with each group representing 4.6% of women-owned businesses. (Guidant)

38. Collectively, businesses founded by Black and Latino women have secured $3.1 billion in venture capital funding. (Statista)

39. 17% of Black women in the US are currently involved in the starting or operating of new businesses. (Harvard Business Review)

40. 61% of Black women entrepreneurs have businesses in sectors encompassing retail/wholesale or health, education, government, or social services. (HBR)

41. In 2021, a mere 40% of Black women received PPP or government loans, while a third (33%) turned to self-funding or crowdfunding for financial support. (VISA)

Women Entrepreneurs Statistics

Women entrepreneurs continue to shape the business landscape and push for gender equality across the board. Here are recent statistics on female entrepreneurship in the U.S.

42. 45% of female entrepreneurs are more likely to rely on input from a financial advisor. (NWBC)

43. 45% of female entrepreneurs are more likely to manage their financial portfolios. (NWBC)

44. In the United States, women's Total Entrepreneurial Activity (TEA) rate rose from 13.6% in 2020 to 15.2% in 2021. (GEM)

45. In 2021, around 14.5% of women in the U.S. expressed an inclination toward entrepreneurship. (GEM)

46. 27% of female business owners are motivated by a shared yearning for independence, creativity, and flexibility. A significant portion (27%) expressed their aspiration for the freedom and self-governance linked to being their own boss. (Guidant)

47. Out of the total entrepreneur population, 41.5% are women, while 58.5% are men. (Zippia)

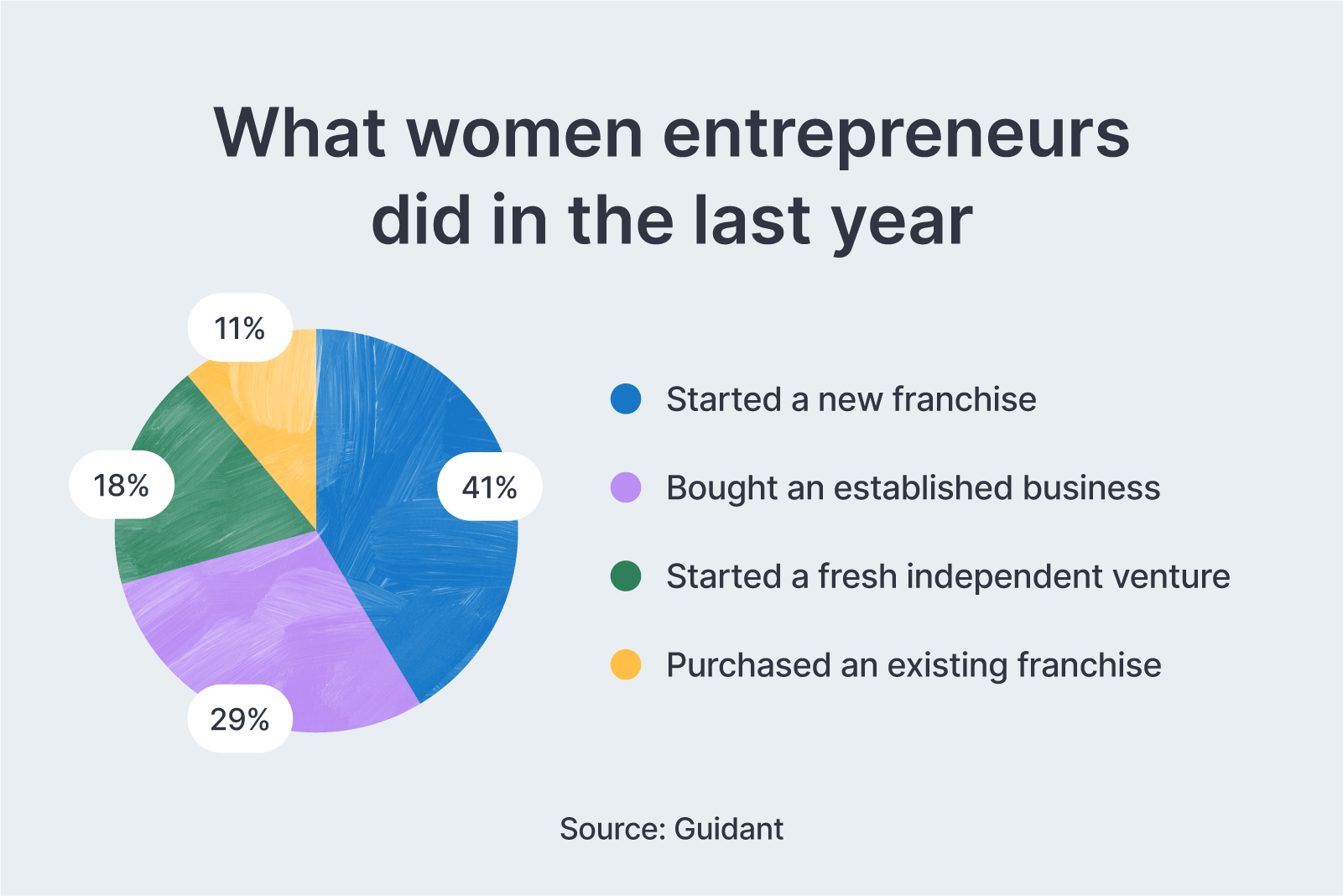

48. In the last year, 41% of women entrepreneurs started a new franchise, with 29% buying an established independent business and 18% starting a fresh independent venture. The remaining 11% purchased an existing franchise. (Guidant)

49. Women entrepreneurs have a 20% higher likelihood than men to establish businesses rooted in their passions. (Guidant)

50. Women earn 88 cents for every dollar earned by men. (Zippia)

Secure Your Small Business Loan With Clarify Capital

Ready to invest in your small business? Clarify Capital will work with you to learn about your goals for your business and make a plan to get you there through a small business loan. Learn more about how Clarify Capital can help your business and apply to see your funding options.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts