When cash flow's tight, a factoring company can be a lifesaver. Instead of waiting weeks or even months for customers to pay, small businesses can turn unpaid invoices into fast cash — no loans, no added debt. Just money in the bank to keep things running.

This guide compares the best factoring companies for small businesses in 2026. You'll see rates, how much they advance, how fast they fund, and a quick list of features for each one. Whether you're in trucking, freight, staffing, or professional services, there's something here for your industry.

If you need to boost cash flow quickly and don't want to deal with the delays of traditional financing, picking the right invoice factoring company can make a big difference. We'll walk you through what to look for, and if you're still on the fence, Clarify Capital can help match you with the best option for your business.

| 2026 Best Invoice Factoring Providers | ||||

|---|---|---|---|---|

| Company | Factoring Rates | Advance Amounts | Funding Speed | Best For |

| Clarify Capital | ~1%–5% | Up to 100% | 24–48 hours | B2B companies and government contractors |

| BlueVine | From ~0.25%/week | Up to ~90% | Within 24 hours (approved) | Online‑first small businesses |

| Fundbox | 4.66%-8.99% | Up to 100% | Next business day | Startups needing credit access |

| altLINE | ~1%-5% | ~85%-95% | 1-2 business days (typical) | B2B companies with longer payment terms |

| Triumph | 1%-4% | Up to ~90% | Same day/instant for freight | Trucking and freight companies |

| RTS Financial | 1%-4% | Up to 97% | Same day | Freight brokers & owner‑operators |

| Riviera Finance | ~2%-5% | Up to 95% | Within 24 hours | Businesses wanting in‑person support |

| eCapital | ~1%-5% | Up to 90% | 24-48 hours | Mid‑sized businesses |

Whether you need money now or a flexible long-term partner, these invoice factoring services offer accessible accounts receivable financing options for all kinds of businesses. Look for same-day funding and an easy online application process, especially if you're running a trucking business, startup, or any operation where cash flow matters.

What Is a Factoring Company and How Does It Work?

A factoring company helps small businesses get quick cash by turning unpaid invoices into working capital. Instead of waiting 30, 60, or 90 days for customers to pay up, businesses sell those invoices to a third party — the factoring company — and get a cash advance. It's a fast way to free up funds without taking out a loan or adding debt.

Here's how invoice factoring usually works:

Submit your invoices. You send your outstanding invoices, typically ones due in 30 to 90 days, to the factoring company.

Get an advance. They'll give you a percentage of the upfront invoice amount, usually between 70% and 90%. The exact amount depends on your industry and how reliable your customer is.

They collect the payment. Your customer pays the factoring company directly, just like they normally would.

Final payout. Once your customer pays, the factoring company sends you the rest of the money, minus their fee — usually around 1% to 5%.

Unlike loans or credit lines, invoice factoring doesn't require collateral or perfect credit. It's based on your customer's ability to pay, rather than yours. That makes it an excellent option if you've got strong clients but uneven cash flow.

Factoring services are especially common in industries like trucking, staffing, healthcare, and professional services, where slow payments can really upset your cash flow. And mid-sized businesses with lots of accounts receivable often use factoring to stay nimble without waiting for checks to clear.

Best Small Business Invoice Factoring Companies in 2026

With so many providers out there, picking the best factoring companies comes down to three things: speed, flexibility, and cost. Whatever stage of growth you're in — just getting started, running a growing organization, or managing a mid-sized service business — the right invoice factoring service can help you get fast cash without the hassle of traditional loans.

Below, we've rounded up the top factoring companies for 2026. We looked at factoring rates, how fast they fund, how flexible their contracts are, and who they work best for. These companies support all kinds of industries, from freight brokers and trucking businesses to professional services and growing businesses.

Clarify Capital

Clarify Capital provides flexible invoice factoring for B2B companies and government contractors. While it's not their core service, their simple application process and fast turnaround make it a strong option for businesses looking to improve cash flow without traditional loans.

Factoring rates between 1% and 5%

Advance amounts up to 100%

Funds available within 24–48 hours

Great for B2B businesses and government contracts

Streamlined application process

Transparent pricing with no long-term commitments

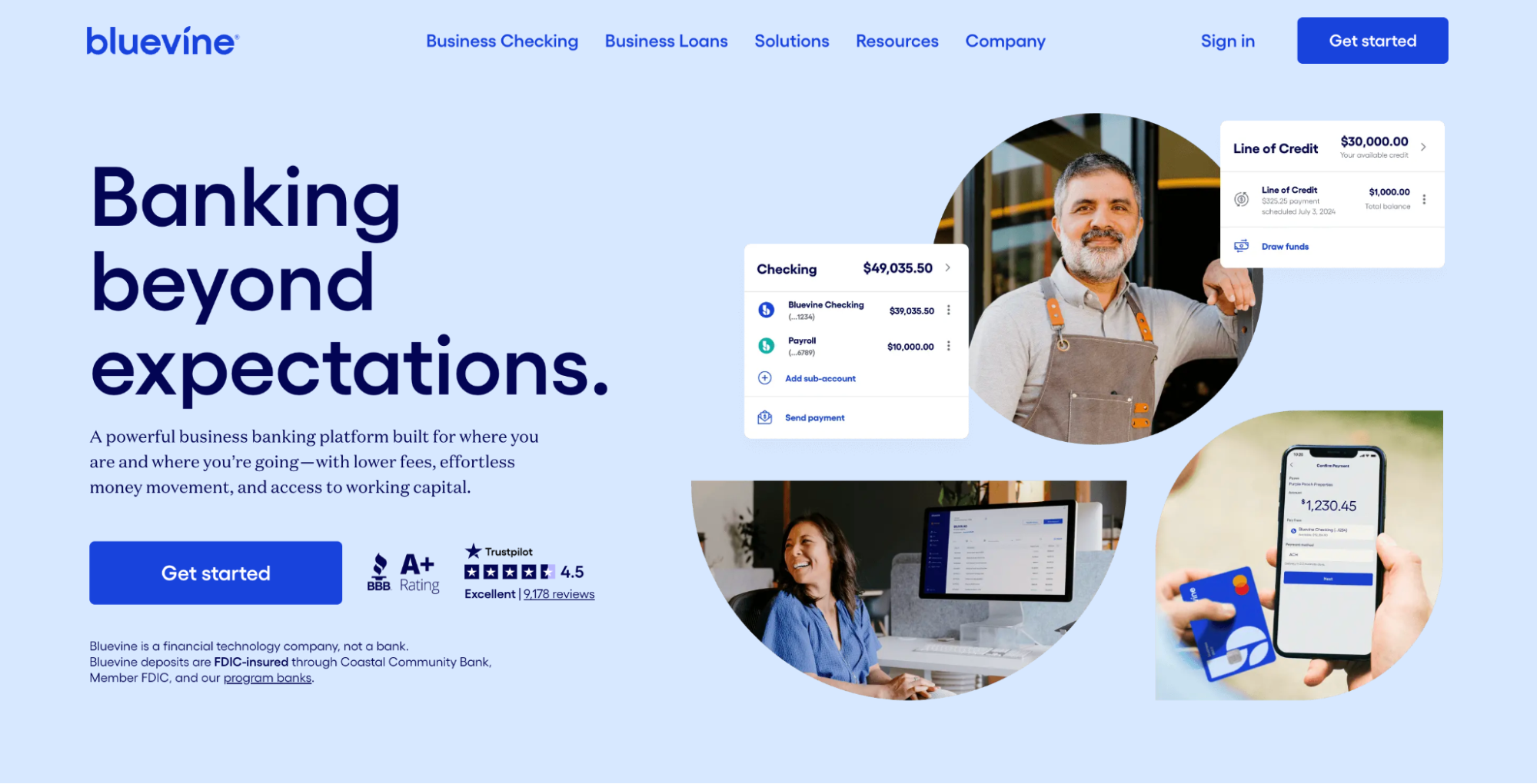

BlueVine

BlueVine takes a tech-first approach to invoice factoring services. It's great for business owners who want fast cash and full control with an easy-to-use online dashboard.

Factoring rates starting at 0.25% per week

Advance amounts up to 90%

Same-day funding for qualified clients

Ideal for tech-savvy small businesses that want fast access and digital tools

100% digital process

Flexible repayment

Fundbox

Fundbox works a little differently with a line-of-credit setup that feels like factoring. Known as invoice financing, it's suitable for startups that want flexibility without getting locked into long-term contracts.

Financing fee of 4.66%+ on the amount drawn

Advance line of credit up to 100% of the invoice value

Funded by the next business day

Apt for startups and small businesses looking for easy credit access

No minimum credit score required

Quick online application

altLINE (The Southern Bank Company)

As a direct lender, altLINE offers competitive factoring rates and dependable support for B2B businesses.

1%-5% factoring rates

Advance amounts between 80% and 90%

Funded within 1-2 business days

Good for B2B companies dealing with longer payment terms

Direct bank funding

White-label options

Triumph Business Capital

Triumph focuses on freight factoring, with customized solutions and same-day cash for trucking industry and logistics businesses.

Factoring rates of 1%-4%

Advance amounts up to 90%

Same-day funding for eligible invoices

Best for Freight and trucking companies

Recourse and non-recourse options

Fuel card programs

RTS Financial

RTS Financial is built for freight brokers and small fleets that need fast access to cash to stay on the road.

Factoring rates of 1% to 4%

Advance amounts up to 97%

Same-day funding in most cases

Excellent for owner-operators and small freight carriers

Access to a freight broker network

Fuel savings program

Riviera Finance

Riviera Finance offers a more personal touch and non-recourse factoring. It's a great pick for business owners who want face-to-face support and less risk.

Factoring rates start at 2%

Advance amounts up to 95%

Funding 24 hours after setup

Ideal for businesses that want in-person service and peace of mind

Non-recourse options

Local representatives

eCapital

eCapital offers flexible terms and quick funding for medium-sized businesses in industries like staffing and logistics.

1%-5% factoring rates

Advance amounts between 70% and 90%

Same-day funding available

A good option for mid-sized businesses that need flexible contracts

Industry-specific services

Online account access

How Much Do Factoring Companies Charge?

Most factoring companies charge a discount rate, which is a percentage of the invoice amount, plus some possible additional fees for things like same-day funding or account setup.

Here's a quick look at the common costs:

Discount rate. This is the main factoring fee, typically between 1% and 5% per month, though it may be broken down weekly. It's what you pay to get quick access to your cash.

Service fees. Some companies add flat charges for handling your account, especially if you don't meet monthly volume minimums or need extra features.

Hidden fees. Watch for charges tied to early cancellation, processing, wire transfers, credit checks, or minimum usage. These can add up, especially if they're not clearly disclosed.

And what affects your pricing:

Invoice volume. The more you factor, the better your rates may be.

Customer credit score. Since factoring is based on your clients' ability to pay, stronger customer credit often means lower fees.

Industry risk. Fields like trucking or construction may have higher factoring rates due to long or tricky payment terms.

As an example, let's say you factor a $10,000 invoice with a 90% advance rate and a 2% factoring fee. You'd get $9,000 up front. Once your customer pays the $10,000, the factoring company keeps $200 (2%), and you get the remaining $800. So your total cost is $200.

Some tips to avoid surprises:

Read the fine print. Pay close attention to the terms, especially around advance rates, payment timelines, and penalties.

Ask about all fees. Be clear on any additional fees tied to wire transfers, ACH payments, or inactivity.

Check for same day charges. Some companies charge extra if you want deposits the same day.

Understanding the full pricing structure helps you avoid hidden fees and make sure you're actually getting a good deal on your invoice value.

When To Choose Factoring Over a Business Loan

If you're a small business owner trying to figure out the best funding option, the decision between invoice factoring and business loans usually comes down to speed, flexibility, and how steady your cash flow is. Both have their perks, and knowing when to use one over the other can save you time, money, and hassle.

Here's how they stack up:

Approval time. Factoring is usually quicker. Most factoring companies offer same-day decisions with little paperwork. Business loans or a line of credit, on the other hand, can take days or even weeks to get approved.

Collateral and credit. Factoring works based on your accounts receivable, regardless of creditworthiness. That makes it great for businesses with strong customers but limited credit history. Loans usually need good credit, and sometimes collateral.

Repayment flexibility. Factoring doesn't require traditional repayments. The factoring company collects directly from your customers. With business loans, you'll have set payments to make, which can be tough if your cash flow isn't consistent.

When To Choose Factoring

Factoring works best for businesses with uneven cash flow, especially if you're stuck waiting on slow-paying clients. It's a useful option for types of businesses like freight, staffing, and professional services where invoice volume is high and working capital is essential to keep things running.

When To Choose a Business Loan

If your revenue is stable and you're planning for long-term expenses, such as buying equipment or expanding, a traditional loan or line of credit may be a better fit. Those financing solutions are built for bigger moves that need more time to pay off.

Expert Tip from Clarify Capital

Thinking about a bank loan? Clarify Capital suggests checking your eligibility before you apply. The basic requirements are:

At least $10,000 in monthly revenue

A minimum of 6 months in business

An active business bank account

At the end of the day, choosing between these funding options depends on whether you need immediate cash, how steady your income is, and whether you want flexible business financing or predictable payments. Both factoring and loans can help you grow — it just depends on your setup and goals.

Advantages and Disadvantages of Factoring Companies

Here's a straightforward look at the pros and cons of using factoring companies for small business financing.

Some advantages include:

Predictable cash flow. Factoring helps turn unpaid invoices into fast cash, which can smooth out the gap between finishing a job and getting paid.

Outsourcing collections. When you work with a factoring company, they often handle collecting from your customers. That saves you time and lets you focus on running or growing your business.

No traditional debt. Since you're selling invoices, not borrowing money, factoring doesn't add debt to your books, which can be a plus when managing your finances.

Potential downsides that could hurt your business include:

Hidden fees. Some contracts come with monthly minimums, processing fees, or long-term commitments. These unseen costs and requirements can chip away at your profits.

Less control over customer experience. Since the factoring company may handle collections, you give up some control over how your customers are treated, which can impact your relationship with them.

Risk of relying too much on factoring. Some businesses lean too heavily on factoring to stay afloat instead of fixing deeper cash flow problems. That can hurt long-term sustainability.

How To Choose the Right Factoring Partner

Factoring companies aren't all the same. Picking the right one takes more than just comparing fees. The best invoice factoring companies match your industry, cash flow needs, and how much risk you're comfortable with.

Here's how to figure out which factoring partner is right for you:

Identify your business priorities. Do you need same-day funding? Higher advance rates? Non-recourse terms? Or a company that knows your industry inside and out?

Compare factoring fees and advance rates. Ask about total costs, not just the headline rate. Such costs may include setup fees, monthly minimums, and early termination penalties. Also, check how much of the invoice you'll get up front.

Review contract flexibility. Some factoring services lock you into long-term deals. Others let you factor invoices when you want. If your revenue is seasonal or unpredictable, a flexible setup is a better fit.

Check out customer service and transparency. Choose a factoring partner that's clear about their terms, has responsive customer support, and makes the application process simple.

Lean into industry specialization. Some invoice factoring companies focus on sectors like trucking or staffing. If they know your space, they'll likely offer better support and be more familiar with common cash flow issues.

Verify their reputation and credentials. Look for positive reviews, a track record of success, and FDIC-insured partnerships if relevant. Don't be afraid to ask for references from other clients.

Need help getting started? Clarify Capital makes it easy to compare the best factoring companies. Just fill out one quick application, and you'll match with a provider based on your invoice volume, industry, and how fast you need funding.

Start your application here. It only takes a few minutes.

FAQs About Factoring Companies

Factoring can be a helpful option for small businesses dealing with slow-paying clients and tight margins. By turning outstanding invoices into fast cash, factoring companies help improve cash flow without adding debt. That gives business owners the flexibility to cover payroll, invest in growth, or keep operations stable. Here are answers to the most common questions about invoice factoring.

What Is the Main Purpose of Factoring?

Factoring helps businesses turn unpaid invoices into working capital quickly. Instead of waiting 30, 60, or 90 days to get paid, a factoring company buys the invoices and gives you most of the money up front. It's a way to get cash in the door fast so you can stay on top of operations.

This kind of invoice financing can be especially helpful for industries like staffing, trucking companies, and service-based businesses with longer payment terms.

How Much Does Working With a Factoring Company Cost?

Most factoring companies charge between 1% and 5% of the invoice amount, depending on your industry, your customer's credit, how much you're factoring, and how quickly you need the cash. Factoring rates in trucking, for example, might be higher than in professional services, due to risk and extra administration overhead.

Some companies throw in perks like fuel cards or discounts if you factor regularly. Just make sure to ask for the full cost breakdown, including any extra fees, so you know what you're really paying.

How Do Factoring Companies Pay You?

Factoring payments usually occur in two parts. First, you get an advance — typically 70% to 90% of the invoice value — soon after approval. Then, once your customer makes the invoice payment, the factoring company sends you the remainder (minus their fee).

Payment terms can vary. Many factoring services offer same-day or next-day deposits, especially if you're already working with them or you're in a fast-moving industry. This setup gives you quick access to the funds you need in other areas of your business.

Got more questions about how lenders use invoice factoring to support small businesses? Clarify Capital can help you find the right fit and get the best advance rates for your needs.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts