Trucking is a major supporter of the U.S. economy, transporting goods across vast distances and keeping businesses running. As consumer demand grows, so does the need for trucking services, making this a great time to start your own trucking company. However, breaking into the trucking industry as an owner-operator or fleet owner requires more than just buying a truck and hitting the road. To be successful, you need to understand federal and state regulations, get financing, and have a clear strategy for long-term growth.

In this comprehensive guide, we'll walk you through starting a trucking business, from building your business plan to finding clients and managing cash flow.

Step 1: Develop a Trucking Business Plan

The first and most critical step in starting any business is creating a well-thought-out trucking business plan. This blueprint will guide your decisions and help you understand how to grow your company profitably.

A business plan isn't just for investors or lenders — it's for you, too. It provides a clear roadmap for your trucking company's future so you can make sure you have a structured approach to growing your business, managing cash flow, and making informed decisions.

Plus, if you plan on securing loans or investors, they will likely ask you for a detailed business plan to evaluate your company's viability.

Here's what should be in a good trucking business plan and how to handle each part:

- Market research. Analyze the trucking industry to identify potential competitors and opportunities. Research the current demand for trucking services, geographic markets, and specialized services (e.g., refrigerated goods, oversized loads).

- Business structure. Decide what kind of business structure you'll use — it will likely be either a sole proprietorship, LLC, or corporation. Each has different legal and tax implications. For example, an LLC offers limited liability protection, which means that it protects your personal assets if your business faces legal trouble.

- Financial projections. Outline your startup costs and operating costs. Initial costs may include purchasing or leasing trucks, insurance, permits, and licenses, while ongoing expenses will cover fuel, maintenance, and salaries. Account for truck purchase down payments and other hefty expenses like insurance premiums.

- Cash flow management. Managing cash flow is critical for a trucking business, especially since you'll often have to cover expenses like fuel and repairs upfront before receiving payment from clients. Consider working with lenders to secure lines of credit to manage these cash flow gaps.

- Target market and client acquisition. Who will you serve? Will your trucking business focus on local deliveries or cross-country hauls?

A strong business plan will serve as your guide and help you start your business on solid ground.

Step 2: Obtain Required Licenses and Registrations

Before your trucks hit the road, there's a significant amount of paperwork involved to comply with state and federal regulations. Here are the main licenses and registrations you'll need:

- Commercial Driver's License (CDL). Anyone driving a truck for commercial purposes needs a CDL. If you're planning to operate as an owner-operator, you'll need to obtain this yourself. Research the specific CDL requirements in your state and the type of CDL you'll need depending on the cargo you plan to haul.

- Federal Motor Carrier Safety Administration (FMCSA) and USDOT Number. To legally operate your trucking business, you must register with the Federal Motor Carrier Safety Administration (FMCSA). You'll also need a USDOT Number if your trucks cross state lines or carry hazardous materials. This number is used to track your company's safety records and compliance with federal regulations.

- MC Number and Operating Authority. An MC number is required for businesses that transport goods across state lines or offer for-hire trucking services. Obtaining operating authority through the FMCSA allows you to conduct interstate commerce. The process can take several weeks, so apply early.

- BOC-3 Process Agent. A BOC-3 process agent must be appointed to handle legal documents on behalf of your business in every state where you operate. This is a requirement for all trucking businesses.

- Unified Carrier Registration (UCR). The UCR ensures that you're compliant with federal regulations if your trucks operate across state lines. This registration must be renewed annually, and the fees are based on the size of your fleet.

Securing these licenses and registrations is essential to legally operating your trucking company. It's a good idea to consult with a transportation attorney or compliance expert to make sure you're meeting all legal requirements.

Step 3: Register Your Business and Choose a Business Structure

After securing the necessary permits and licenses, it's time to make your business official. Here's how:

- Choose a business name. The first step in registering your business is selecting a name. This name should reflect your company's services and be easy to remember. Once you've chosen a name, check its availability with your state's business registry.

- Obtain an Employer Identification Number (EIN). An Employer Identification Number (EIN) is required for tax purposes and is needed to open a business bank account and hire employees. You can apply for an EIN online through the IRS.

- Decide on a business structure. Choosing the right business structure is a critical decision. Consider consulting with an attorney or accountant to determine the best structure for your business, as each option has different tax implications and liability protections. The most common structures for a trucking business are:

- Sole proprietorship. This is simple to set up, but you're personally liable for any debts or legal issues.

- Limited liability company (LLC). This one offers liability protection, separating your personal assets from your business. It's a popular choice for owner-operators.

- Corporation. This option is more complex with stricter reporting requirements, but it can offer better tax advantages for larger businesses.

- Get a business license. Depending on your state, you may need a business license to operate legally. Contact your local business office to ensure you're meeting all licensing requirements.

- Open a business bank account. A business bank account helps you keep your personal and business finances separate. This will make managing your cash flow easier, particularly when it comes to tracking expenses and filing taxes.

Setting up your business properly from the start will protect your personal assets and help streamline your operations.

Step 4: Secure Insurance and Permits

Insuring your trucks and drivers is a vital part of protecting your business from risk. You'll also need various permits to comply with interstate regulations. We cover the primary types below.

Trucking Insurance

There are several types of trucking insurance that you'll need to operate legally and protect your business:

- Liability insurance covers damages to other vehicles and property in case of an accident. This is a mandatory requirement.

- Physical damage insurance protects your trucks in case accidents, fires, or natural disasters damage them.

- Cargo insurance covers the cargo you're transporting if it gets damaged or lost.

- Non-trucking liability insurance covers incidents that happen when the truck is not being used for business purposes.

It's important to get quotes from multiple providers and ensure you have sufficient coverage. Trucking accidents can result in significant financial losses, and skimping on insurance isn't worth the risk.

International Fuel Tax Agreement (IFTA)

The IFTA simplifies fuel tax reporting for commercial carriers operating across multiple states. Once you register for IFTA, you'll need to track your miles driven in each state and report your fuel taxes quarterly.

International Registration Plan (IRP)

The IRP is a tax-sharing agreement between U.S. states and Canadian provinces that allows trucks to operate across state or provincial lines. You'll pay registration fees based on the miles your vehicles travel in each jurisdiction.

UCR Registration and Use Tax

In addition to the UCR registration, some states require you to pay a use tax on your trucks. Check with your state's Department of Transportation to ensure compliance with local regulations.

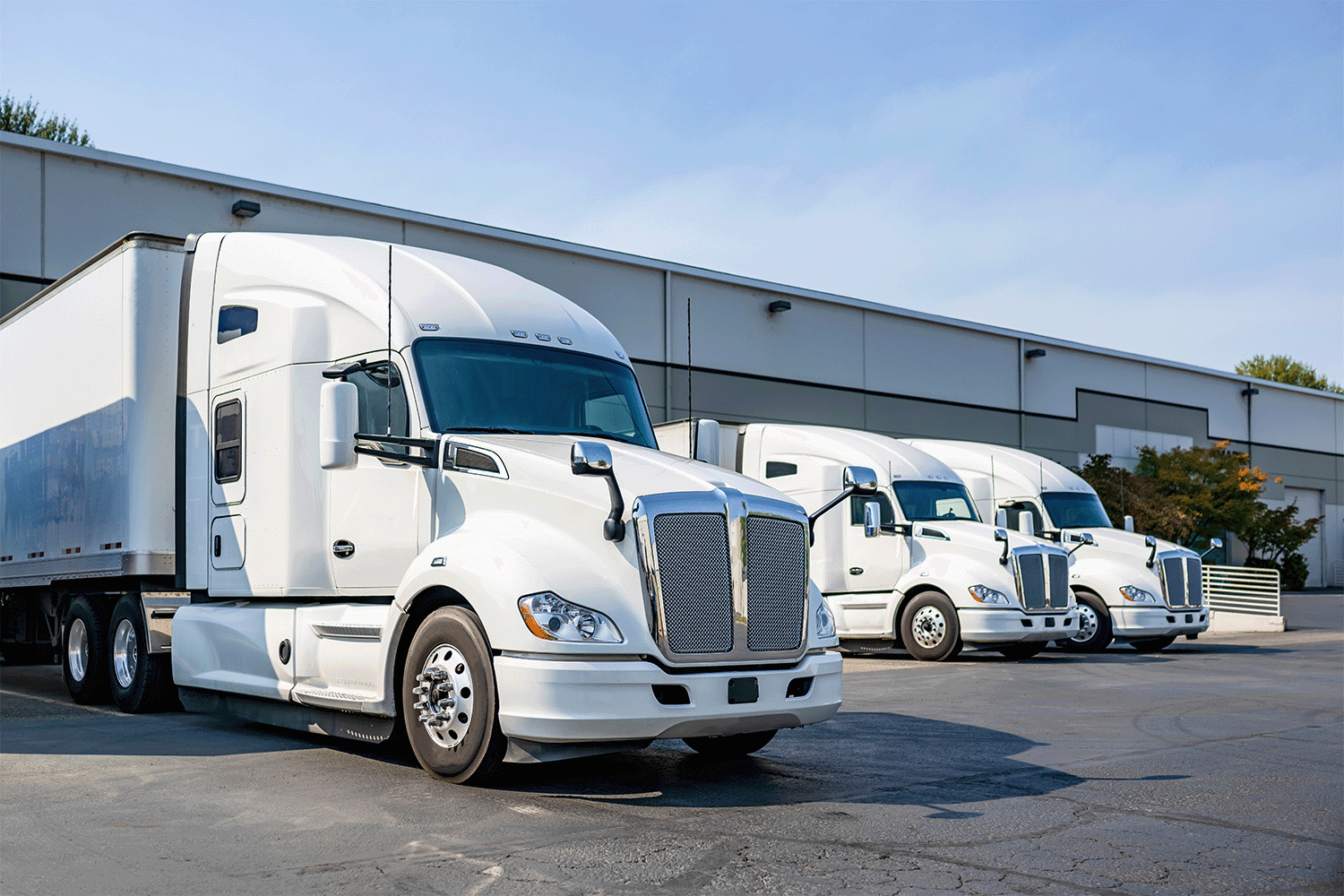

Step 5: Purchase or Lease Trucks and Equipment

Choosing the right trucks and equipment is crucial for the success of your business. You'll need to decide whether to buy or lease your vehicles and equipment based on your financial situation and long-term goals. Let's talk about what you should consider:

New vs. Used Trucks

You'll need to weigh the pros and cons of purchasing new or used trucks:

- New trucks offer greater reliability and come with warranties but are more expensive upfront. They also tend to have lower maintenance costs.

- Used trucks are cheaper initially but can require more frequent repairs and maintenance, which can add up over time.

The decision often comes down to your budget and financing options. If you have the capital or can secure a loan, buying new may save you money in the long run. However, if you're working with a tight budget, used trucks can still be a viable option as long as they're in good condition.

Securing Financing

If you don't have enough cash on hand to purchase trucks, you can explore financing options. Many lenders specialize in commercial vehicle loans that allow you to spread the cost of the truck over time. Be sure to shop around for competitive interest rates and terms.

Leasing Options

Leasing is another avenue to consider, especially if you don't want to commit to a long-term purchase. Leasing allows you to use a truck for a set period with lower upfront costs, but you won't own the truck at the end of the lease term. Leasing can also be great if you want access to the latest equipment without a big investment.

Operating Costs

Owning a truck involves more than just the initial purchase price. You'll need to budget for ongoing operating costs, including:

- Fuel. This is often the largest expense for a trucking business. Consider fuel-efficient trucks to minimize costs.

- Maintenance and repairs. Regular maintenance is essential to keep your trucks running smoothly and avoid costly breakdowns.

- Tires and parts. Over time, these will need to be replaced, so it's important to set aside funds for routine upkeep.

Safety Standards and Compliance

Your trucks must meet all federal safety standards set by the FMCSA. Regular inspections, maintenance, and compliance with safety regulations will keep your trucks on the road and reduce the risk of accidents.

Step 6: Build Relationships and Find Loads

Once your trucks are ready to hit the road, you'll need to find loads to haul. Building strong relationships with shippers and freight providers is essential for growing your trucking business.

On the other hand, load boards are a great way to find your first loads when you're just starting. Load boards are online marketplaces where shippers post available loads, and truckers can bid on them. Popular load boards include DAT, Truckstop.com, and uShip. They let you get started right away, even if you don't have a network of clients yet.

While load boards can help you get your business off the ground, establishing direct relationships with shippers is key to long-term success. Building trust with shippers can lead to consistent, higher-paying contracts. Networking with other owner-operators and truckers can also provide valuable referrals and insights into the industry.

Technology can make your business more efficient and competitive. Use shipment tracking apps to provide real-time updates to clients and implement route optimization tools to save on fuel costs. Automated invoicing systems can also help you manage cash flow more effectively.

Ready To Hit the Road? Start Your Trucking Business Today

Starting a trucking business requires careful planning, compliance with regulations, and the ability to manage both your trucks and cash flow effectively. Here's a quick recap of the steps we just went over:

- Develop a business plan. Outline your strategy, financial projections, and target market.

- Obtain licenses and registrations. Make sure you have the necessary permits to operate legally.

- Register your business. Choose the right business structure and register with the IRS.

- Secure insurance and permits. Protect your trucks and drivers with comprehensive insurance and ensure compliance with interstate regulations.

- Purchase or lease trucks. Decide whether to buy or lease trucks based on your budget and long-term goals.

- Find loads and build relationships. Use load boards and develop relationships with shippers to grow your business.

Starting a successful trucking business takes time, effort, and a commitment to following the necessary legal and financial steps. Be sure to explore additional resources, such as SBA loans, business mentors, and industry associations, to support you along the way. With careful planning and execution, you'll be well on your way to building a profitable and sustainable trucking company.

Looking for funding to get your trucking company rolling? At Clarify Capital, we help small business owners like you secure the financing needed to cover costs, purchase trucks, and manage cash flow. Apply today and take the first step toward getting your trucking business off the ground. Get started here.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts