Running a small business often means juggling day-to-day costs while trying to grow. That's where working capital funding comes in, providing fast access to the cash needed for payroll, inventory, rent, and other essential operational expenses. It helps business owners maintain smooth operations even when cash flow is tight or income is seasonal.

Working capital financing refers to the tools used to meet these short-term needs, from revolving lines of business credit to structured working capital loans and invoice factoring. These options let small businesses bridge gaps between revenue and expenses, keeping the working capital ratio in a healthy range and avoiding disruptions.

In this guide, we'll define what working capital financing is, break down common types of funding, and explain how to evaluate which option fits your business goals. Whether you're assessing your financial statements or planning for growth, understanding your options is the first step toward stronger financial control.

This guide helps business owners make informed, confident funding decisions, ensuring they choose the right short-term financing solution to support their business.

What Is Working Capital Financing?

Working capital financing is a form of short-term business financing that helps cover day-to-day operational costs. It's designed to support essential business needs like payroll, rent, inventory, and utilities, especially during times when revenue isn't enough to meet immediate financial obligations.

Working capital financing provides businesses with the liquidity needed to manage operating expenses and cover short-term funding gaps. This can include short-term working capital solutions, such as business lines of credit or term loans tailored to handle recurring or unexpected costs.

Working capital itself is calculated as current assets minus current liabilities — a key measure of liquidity and a small business's ability to meet short-term obligations. Healthy working capital ensures that small business owners can stay agile, respond to market shifts, and manage ongoing operational costs without disrupting service or growth plans.

This type of funding helps maintain consistent cash flow during seasonal slowdowns or when investing in expansion. By bridging temporary cash shortages, working capital financing keeps operations running smoothly while protecting long-term stability. For businesses facing shifting demand or unpredictable revenue, flexible funding options like these are critical to maintaining momentum.

Common Types of Working Capital Funding

Choosing the right type of financing for your working capital needs is key to maintaining steady cash flow, building business credit, and managing short-term liabilities. Different funding options serve different purposes, and each comes with its own terms, risks, and benefits for borrowers.

Here are some of the most common forms of working capital funding:

Revolving Lines of Credit

A business line of credit gives small businesses flexible, ongoing access to capital, making it one of the most versatile forms of short-term financing. Unlike a one-time loan, this revolving credit option lets business owners draw funds as needed, up to a set limit, and repay only what they use. Once repaid, the credit becomes available again, similar to how business credit cards work.

This flexibility makes lines of credit ideal for managing cash flow, especially during slow sales periods or when unexpected expenses arise. It's often used to smooth out day-to-day operations, like paying suppliers or covering payroll ahead of customer payments.

Eligibility typically depends on factors like time in business, revenue, and credit score. Stronger financials usually mean higher limits and lower interest rates. Because you're only charged interest on the funds drawn, a line of credit can be more cost-effective than lump-sum loans for short-term needs.

Responsible use of a business line of credit can also improve business credit and support a healthier working capital ratio. For working capital funding that adjusts with your business cycles, revolving credit provides both flexibility and control.

Short‑Term Loans

Short‑term loans refer to borrowing a lump sum of money that a business repays over a fixed, relatively brief period, often months rather than years. This structure gives borrowers a definite repayment schedule and a clear understanding of the loan's repayment period, which differs from financing models like revolving lines of credit.

What Defines Short-Term Loans:

Short-term loans offer fast funding with brief repayment periods, making them ideal for immediate cash needs. Features include:

You receive a one‑time lump sum. Once the lender disperses the funds, you begin regular payments.

Repayment terms are usually short, with durations ranging from three months to three years. The most common terms fall in the three-month to two-year window.

Payments often occur monthly, weekly, or even daily, depending on the lender's agreement.

Advantages of Short-Term Loans

This type of business financing offers several benefits for small business owners needing quick funding. They include:

Predictable payments. Because you know exactly how much to repay and when, budgeting becomes easier, which helps manage cash flow and other financial obligations.

Fast funding. Many short-term loans, especially from online lenders like Clarify Capital, can be approved and disbursed within a range of 24 hours or a matter of days.

Flexibility for urgent needs. They're useful for covering short-term operational costs, handling unexpected expenses, or seizing time-sensitive business opportunities.

Types of Lenders: Banks, SBA, Online Lenders

Short-term loans can come from several sources. These include:

Traditional bank loans. These generally offer more favorable interest and repayment terms, but approval often requires strong financial statements and a solid credit history.

Government-backed U.S. Small Business Administration (SBA) loans. SBA‑approved lenders can offer loans for operating capital in addition to long-term needs, though these may involve more paperwork and longer approval times.

Online lenders. These tend to deliver the fastest turnaround and have simpler application processes than banks or SBA‑linked loans; however, they often carry higher interest rates and shorter repayment windows.

Typical Terms, Interest Ranges, and Loan Amounts

When you compare short-term business loans, it helps to understand the typical ranges for principal, rates, and overall cost. Some things to keep in mind:

Short-term loans may range from a few thousand dollars to hundreds of thousands, depending on the lender and business profile.

Interest rates for small business loans vary widely. For well-qualified borrowers, rates on traditional loans, including short-term ones, may start around 7 %-8 % APR.

In contrast, online short-term lenders often charge higher APRs, sometimes significantly higher depending on the credit profile and repayment schedule.

The Role of Strong Financial Statements and Credit Health

Strong financial statements and a solid credit history play a major role in improving eligibility for favorable short-term loans. Lenders look at metrics like revenue, cash flow, and the business's ability to service debt, so demonstrating stable finances can reduce interest rates and increase loan amounts or improve approval odds.

When Short-Term Loans Make Sense

Short-term working capital loans can be a good fit when:

You need a one-time cash injection to cover payroll, rent, or inventory before revenue comes in.

You anticipate a short-term cash flow gap — for example, due to seasonal demand swings or delayed receivables.

You want predictable repayment rather than managing a revolving credit balance.

You need funding quickly and don't have time for the longer approval cycles often required by traditional or SBA lenders.

In the context of business financing, a solid short-term loan can bridge temporary funding gaps and help small business owners meet financial obligations without disrupting operations, offering both speed and financial clarity.

Invoice Factoring and Invoice Financing

Invoice factoring and invoice financing offer two powerful ways for businesses to convert unpaid invoices into usable cash, helping to cover short-term needs without waiting for customers to pay. Both help boost liquidity and support steady cash flow, but they work quite differently and suit different business situations.

Invoice factoring means selling outstanding invoices (i.e., your accounts receivable) to a factoring company at a discount. The factor pays you a portion of the invoice value up front, then takes over collecting payment from your customer. You receive the remainder, minus fees, once the customer pays.

Invoice financing (also called accounts receivable financing) uses your unpaid invoices as collateral for a short‑term loan. You retain ownership of the invoices and keep collecting payments, but you get cash immediately based on those receivables.

In short, factoring sells the invoice; financing borrows against it.

How They Improve Liquidity and Support Working Capital

By unlocking value tied up in unpaid invoices, both factoring and financing convert otherwise illiquid receivables into working capital. This fast funding helps businesses cover operational costs, such as payroll, inventory, or accounts payable, without waiting for clients to pay. That speed can be especially helpful when managing day‑to‑day business expenses or navigating seasonal dips in revenue.

Typical Fees, Timelines, and Risks

Before choosing invoice factoring as a funding solution, it's important to understand the costs, speed of access, and potential trade-offs involved. While factoring can provide quick liquidity and easier approval than traditional loans, the structure comes with specific financial and operational considerations, including:

Factoring fees (also called discount rates) usually range from 1% to 5% of the invoice value per month, although rates can vary depending on factors like the customer's creditworthiness, invoice terms, and the business's invoice volume.

Using factoring, businesses generally receive 70% to 90% of the invoice value upfront. The remaining portion is paid after the customer settles the invoice, minus the factoring fee.

Approval and funding are often faster and easier than with traditional loans, since eligibility depends more on the creditworthiness of your customers (the invoice debtors) rather than your own financial history.

However, there are trade‑offs and potential drawbacks:

Factoring reduces profit margins because you're selling invoices at a discount. Over time, fees and any extra charges (e.g., administrative or service fees) can add up.

If a customer delays payment or defaults, the factoring arrangement could become costly — especially if you've chosen a “recourse” factoring agreement, where you remain responsible if the invoice isn't paid.

With factoring, you sometimes give up control over customer relationships, as the factoring company handles collections. That can affect customer experience or privacy.

Common Use Cases — Who Benefits Most

Industries or businesses with a high volume of B2B sales and long payment cycles often turn to invoice factoring or financing. Examples include:

Manufacturers buying raw materials while waiting 30–90 days for customer payments.

Service firms, consultants, or agencies that bill clients on net terms and face irregular cash flow between invoicing and payment

Any small business owner who needs fast liquidity to cover operational costs (payroll, rent, accounts payable) without taking on additional long‑term debt or waiting weeks for receivables to clear.

How To Decide Between Factoring and Financing — and What To Check First

When evaluating whether invoice factoring or financing fits your business needs, pay attention to:

The creditworthiness of your customers (invoice debtors) since it heavily affects approval and rates.

Your tolerance for giving up control over collections (factoring) vs. keeping customer relationships (financing).

The true cost of factoring, including discount rates, service fees, reserve accounts, and any recurring charges.

The volume and regularity of invoices — businesses with consistent receivables tend to get better terms.

How urgently you need cash and whether you prefer speed (factoring) or maintaining long-term customer relationships (financing).

Using invoice factoring or financing thoughtfully gives small business owners a potent lever for managing cash flow and meeting short-term business expenses, letting them steer through growth phases or cycles of delayed payment with greater stability.

Supplier Credit

Supplier credit, also known as trade credit, is a type of informal working capital arrangement where vendors allow businesses to delay payment for goods or services. Instead of requiring immediate payment, suppliers extend deferred payment terms, typically ranging from 15 to 90 days, giving small businesses more time to manage accounts payable and preserve liquidity.

This credit functions like interest-free financing. Unlike short-term loans or other structured working capital funding options, there are usually no fees or formal applications required. That makes it a popular choice for managing short-term working capital needs, especially for recurring operational expenses.

Common advantages of supplier credit include:

No interest or financing fees. Payments are simply deferred, not marked up.

Stronger vendor relationships. Timely payments help build trust and may lead to better terms over time.

Ease of access. Typically, no bank account, collateral, or paperwork is needed.

However, there are also risks:

Late payments can damage supplier trust. This may result in stricter terms or loss of credit privileges.

Limits depend on relationships. New or struggling businesses may not qualify for generous terms.

Industries like retail, manufacturing, construction, and hospitality often rely on supplier credit to keep business expenses predictable while smoothing out their cash flow. Though not issued through banks or the Small Business Administration, trade credit remains a key part of everyday business financing for companies that need flexibility without added cost.

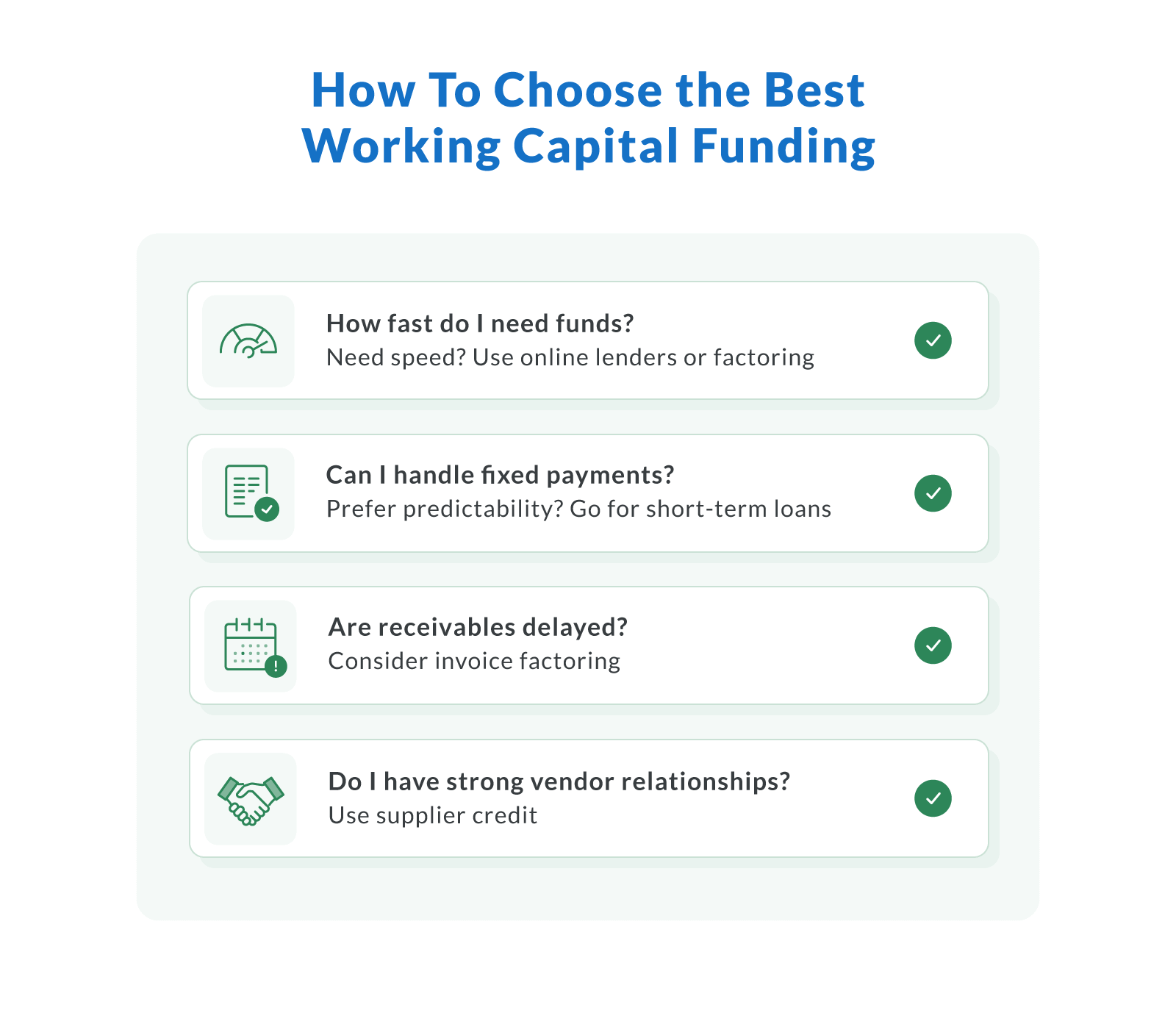

Comparing Funding Options

Not all types of working capital financing are created equal — each comes with different trade-offs in terms of cost, speed, flexibility, and risk. For small business owners, choosing the right option means understanding how repayment terms, credit score requirements, and collateral obligations align with current business needs and cash flow.

Before applying for any short-term financing, it's essential to review your financial statements and working capital ratio to assess eligibility. Tools like Clarify Capital's funding calculators can help estimate repayment costs, interest rates, and potential risks across different funding options.

The table below breaks down the core pros and cons of the most common working capital funding sources:

| Comparison of Common Working Capital Funding Options | |||

|---|---|---|---|

| Funding option | Pros | Cons | Typical use cases |

| Business line of credit | Flexible access to funds; reuse limit as needed; pay interest only on what you use | May require a strong credit score; variable interest rates | Covering cash flow gaps, seasonal business needs |

| Short-term loan | Lump sum with fixed repayment; fast approval from online lenders | Less flexible; interest applies to the full amount | Equipment, inventory, or project costs |

| Invoice factoring | Fast access to cash from accounts receivable; credit score is less critical | Reduces profit margin; may affect customer relationships | Businesses with long payment terms or slow-paying clients |

| Supplier credit | No interest; builds vendor trust; informal setup | Late payments can harm relationships; credit limits vary | Retail, construction, food services — industries with recurring purchases |

Each option impacts financial obligations differently, so it's important to align your choice with the health of your working capital ratio, cash flow consistency, and whether or not you have fixed assets like real estate or equipment to secure the financing.

Strengthen Your Cash Flow With Smart Funding Choices

Choosing the right working capital funding isn't just about solving short-term needs; it's about creating financial flexibility that supports sustainable business growth. Whether you're managing cash flow gaps, investing in expansion, or covering everyday expenses, aligning your financing with specific goals, spending priorities, and repayment terms is key.

Smart use of business financing depends on a clear understanding of your financial statements and balance sheet. Evaluating the right funding options — from fast funding lines of credit to invoice factoring or supplier credit — helps small business owners respond confidently to changing conditions without sacrificing long-term plans.

Clarify Capital offers transparent tools and guidance to help you compare funding options and choose the best fit for your goals, cash flow, and eligibility.

Ready to take control of your business's financial future? Explore flexible working capital funding solutions and apply today through Clarify Capital.

FAQ About Working Capital Funding

Small business owners often have questions when navigating working capital funding and managing cash flow. Below are answers to some of the most common concerns about business financing, eligibility, and how to choose the right funding options for short-term and long-term needs.

How Is Working Capital Funded?

Working capital is typically funded through several sources, each offering different levels of speed, cost, and flexibility. Common providers include banks, online lenders, factoring companies, and financial institutions offering small business loans or merchant cash advances.

Traditional banks may offer competitive rates, but they often require strong credit history, a solid working capital ratio, and detailed financial statements. Online lenders, on the other hand, provide faster access and more flexible terms, though sometimes at higher rates. SBA-backed loan programs also offer favorable repayment structures for eligible small businesses.

Factoring providers fund capital by advancing cash based on outstanding receivables, improving short-term liquidity. To qualify for any of these funding options, eligibility usually depends on time in business, annual revenue, and creditworthiness. Required documentation may include tax returns, bank statements, balance sheets, and cash flow projections — all used to assess your ability to repay and manage working capital effectively.

What Are the Best Sources for Working Capital Funding?

The best sources of working capital funding depend on your business's specific needs, timeline, and financial profile. Top lender categories include:

Traditional banks. They offer competitive interest rates and larger loan amounts, but often require strong credit and detailed documentation.

Fintech and online lenders. They provide faster approvals and more accessible short-term loans, which are ideal for small business owners needing quick business financing.

Government-backed programs. SBA loans and similar initiatives offer low rates and long repayment terms but come with stricter eligibility requirements and slower approval.

To find the best fit, compare each lender's costs, terms, and repayment flexibility. A funding option that works for inventory purchases might not suit payroll coverage or expansion plans. Always align the loan structure with your business needs and cash flow cycle. The right match helps minimize risk while maximizing the impact of your working capital funding.

Which Working Capital Option Is Fastest?

For fast funding, online lenders typically provide the quickest access to working capital funding. Options like invoice factoring, merchant cash advances, and business lines of credit can be approved within 24 to 72 hours, depending on the approval process and required documentation.

In contrast, traditional banks and SBA-backed short-term loans may take several days to weeks due to more rigorous underwriting. The speed of business financing largely depends on factors like your business credit score, revenue, and how quickly you can provide financial documents.

For example:

Online lenders: Approval and funding in as little as one to three business days

Traditional banks: One to three weeks, especially for larger working capital loan requests

Invoice factoring: Often approved within 24–48 hours if accounts receivable are well documented

If speed is the priority, digital lenders and fintech platforms offer the most efficient route to working capital.

Working Capital Loan vs. Factoring: Which One Is Best?

Deciding between a working capital loan and invoice factoring depends on your cash flow situation, customer payment cycles, and funding urgency. Both serve short-term needs, but they operate differently and suit different types of small business models.

Choose a working capital loan if your revenue is reliable and you want predictable repayment with full financial control.

Opt for invoice factoring if cash is tied up in receivables and you need immediate access to funds without adding traditional debt.

Funding options should match your operational rhythm, and choosing the right one helps you maintain a healthy cash flow while meeting your ongoing financial obligations.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts