This article explores our findings about how different generations and industries are responding to economic uncertainty. From adjusting spending habits to seeking new job opportunities, we'll look at the ways Americans are preparing for a potential downturn. We'll also reveal how business owners are adapting their strategies to stay resilient in the face of economic challenges.

Key Takeaways:

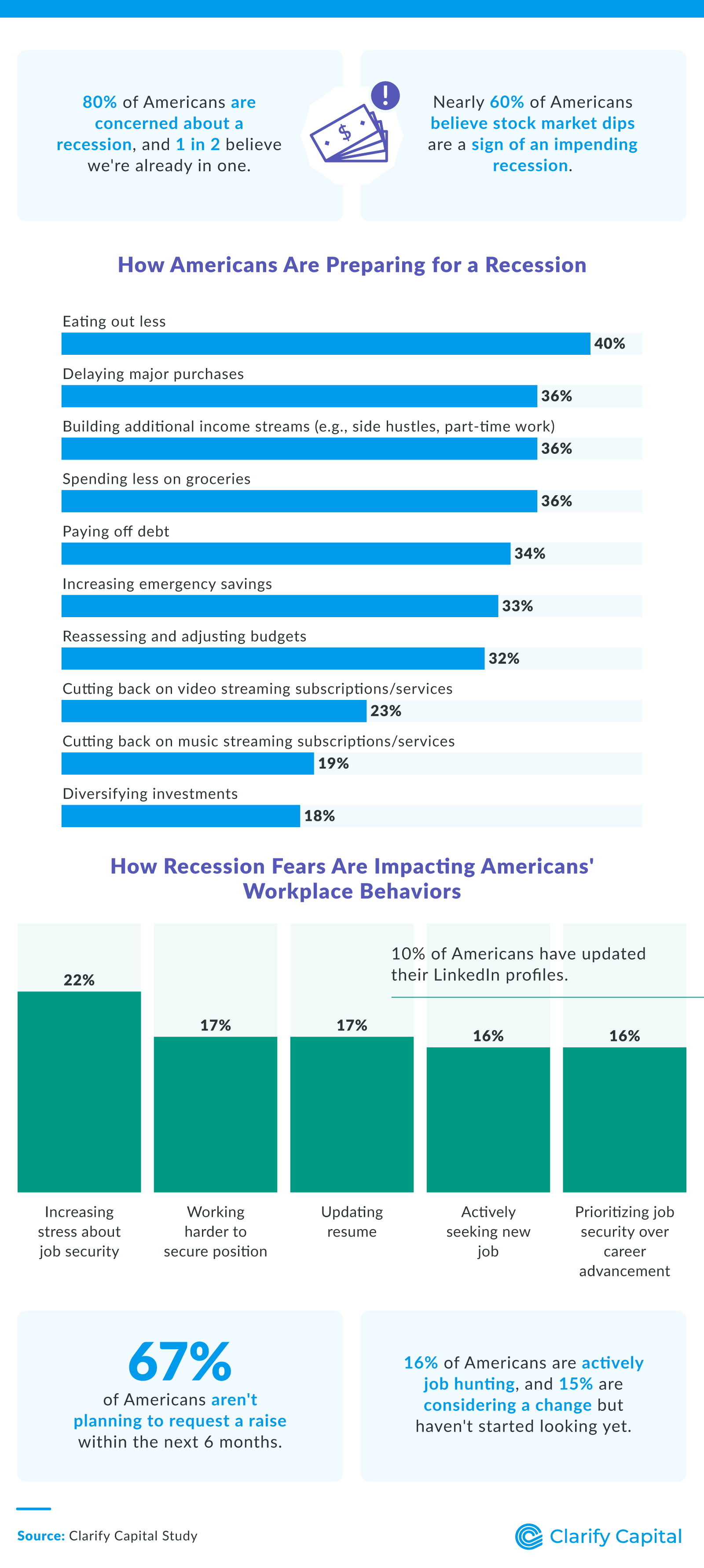

80% of Americans are concerned about a recession, and 1 in 2 believe we're already in one.

Nearly 60% of Americans believe stock market dips are a sign of an impending recession.

Amid economic concerns, 35% of Americans aren't expecting a raise this year, and 27% expect a smaller raise than in previous years.

16% of Americans are actively job hunting, and 15% are considering a change but haven't started looking yet.

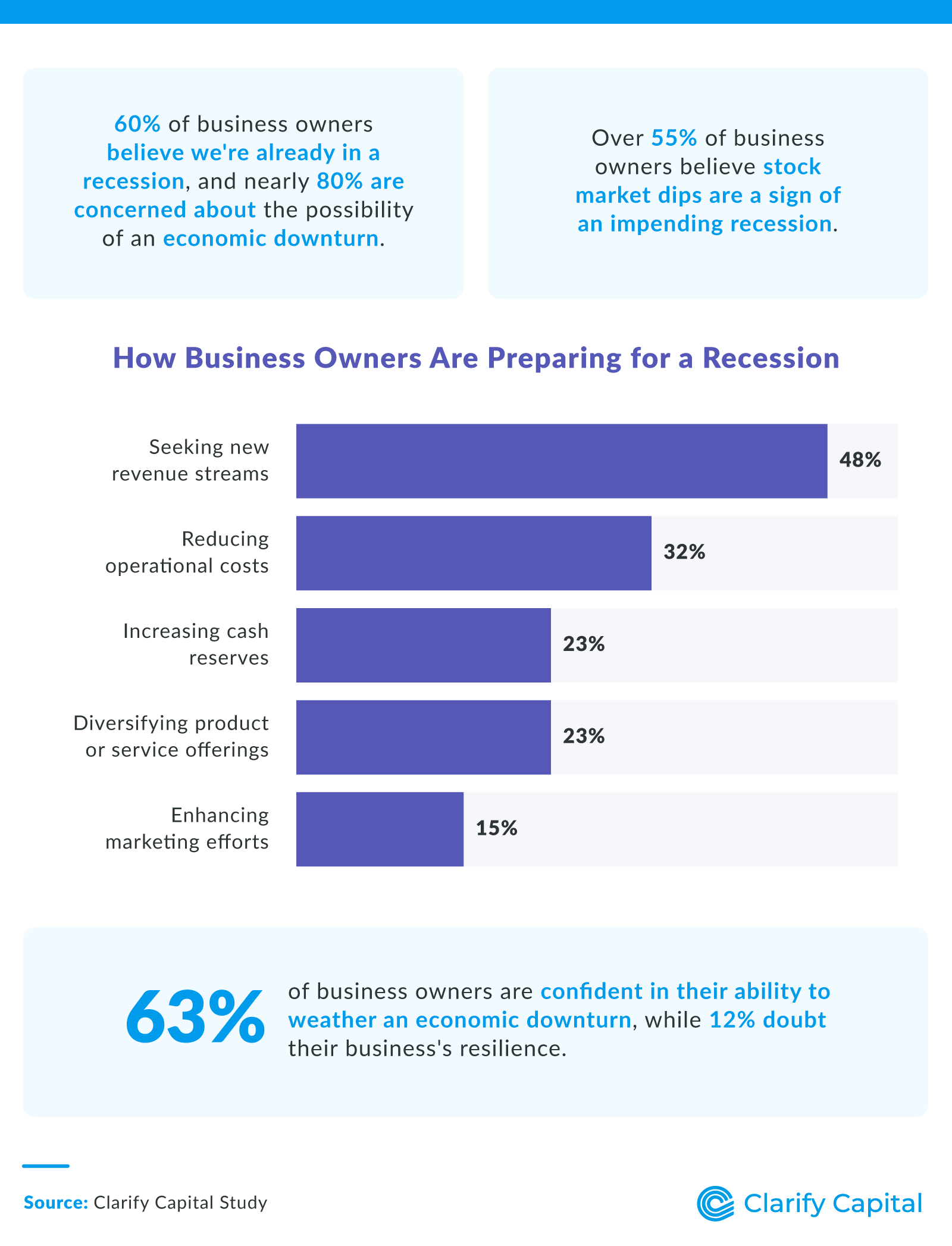

60% of business owners believe we're already in a recession, and nearly 80% are concerned about the possibility of an economic downturn.

63% of business owners are confident in their ability to weather an economic downturn, while 12% doubt their business's resilience.

Economic Anxieties and Preparations

80% of Americans are concerned about a recession, and 1 in 2 believe we're already in one. Recession concern by generation:

- Baby boomers: 71%

- Gen X: 78%

- Millennials: 82%

- Gen Z: 78%

Industries most concerned about a potential recession:

- Tech

- Healthcare

- Finance

- Education

- Manufacturing

Nearly 60% of Americans believe stock market dips are a sign of an impending recession. Belief by generation:

- Baby boomers: 54%

- Gen X: 50%

- Millennials: 60%

- Gen Z: 61%

67% of Americans aren't planning to request a raise within the next 6 months. Not asking for a raise by generation:

- Baby boomers: 80%

- Gen X: 79%

- Millennials: 65%

- Gen Z: 58%

Amid economic concerns, 35% of Americans aren't expecting a raise this year, and 27% expect a smaller raise than in previous years.

33% of Americans plan to request a raise within the next 6 months, aiming for an average increase of 7%.

16% of Americans are actively searching for new job opportunities, while another 15% are contemplating a change but haven't started looking yet.

Actively searching for new jobs by generation:

- Baby boomers: 2%

- Gen X: 8%

- Millennials: 18%

- Gen Z: 22%

Actively searching for new jobs by industry:

- Information technology (IT)

- Healthcare

- Fiance

- Retail

- Manufacturing

Buckling Up For a Recession

60% of business owners believe we're already in a recession, and nearly 80% are concerned about the possibility of an economic downturn.

Over 55% of business owners believe stock market dips are a sign of an impending recession.

How business owners are preparing for a recession:

- Seeking new revenue streams: 48%

- Reducing operational costs: 32%

- Increasing cash reserves: 23%

- Diversifying product or service offerings: 23%

- Enhancing marketing efforts: 15%

- Pausing new hiring: 10%

- Negotiating with suppliers for better rates: 7%

- Taking out a business loan: 4%

84% of business owners do not plan to give their employees a raise.

Among businesses planning to grant raises this year, the average increase is expected to be 7%.

4% of business owners plan to cut employee perks. Perks business owners plan to cut:

- Bonuses

- Subsidized meals or snacks

- Company-sponsored events (e.g., team outings, holiday parties)

- Flexible work arrangements (e.g., remote work options, flexible hours)

- Employee recognition programs (e.g., awards, incentives)

63% of business owners are confident in their ability to weather an economic downturn, while 12% doubt their business's resilience.

Methodology

For this study, we surveyed 800 American employees and 200 American business owners about their perception of the current state of the economy. The average age of employees was 40. Generationally, 5% of these respondents reported being baby boomers, 22% as Generation X, 59% as millennials, and 14% as Generation Z. The average age of business owners was 44. Generationally, 14% of these respondents reported being baby boomers, 31% as Generation X, 48% as millennials, and 6% as Generation Z.

About Clarify Capital

Clarify Capital helps business owners secure the financing they need to thrive in today's competitive marketplace, including no-doc business loans and fast business loans. Our tailored financial solutions support entrepreneurial dreams, turning visions into reality.

Fair Use Statement

We encourage you to share these findings for noncommercial use; please attribute the original source with a link

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts