Key Takeaways:

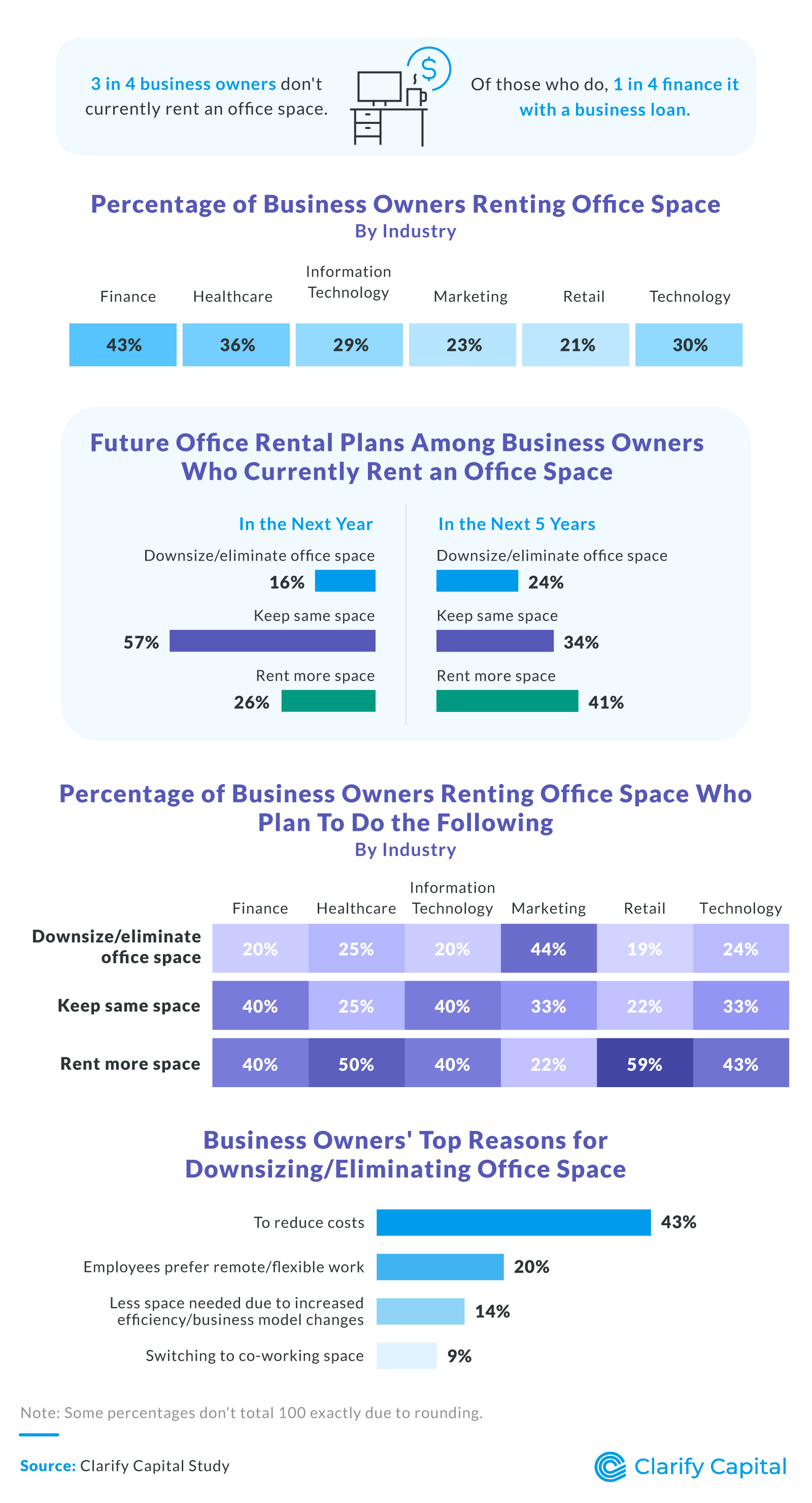

3 in 4 business owners don’t currently rent an office space.

Of those who do, 1 in 4 finance it with a business loan.

16% of business owners who currently rent an office space plan to decrease or eliminate it in the next year; 24% plan to within the next 5 years.

Business Owners’ Office Rental Plans

3 in 4 business owners don’t currently rent an office space, but among those who do, 1 in 4 finance it with a business loan.

16% of business owners who currently rent an office space plan to decrease or eliminate it in the next year; 24% plan to within the next 5 years.

Marketing businesses (44%) are the most likely to downsize or eliminate office space in the next 5 years.

Reducing costs (43%) is the top reason why businesses want to downsize or eliminate office space, followed by their employees’ preference for remote or flexible work (20%).

Top Factors Influencing Office Space Rental Decisions

- Cost: 52%

- Location: 41%

- Need space for company operations: 23%

- Amenities (parking, kitchen, etc.): 17%

- Lease flexibility: 16%

- Potential to increase employee productivity: 14%

- Financing availability: 12%

- Loan terms (interest rate, repayment period, etc.): 10%

- Potential to enhance company culture: 9%

- Proximity to public transportation: 6%

Plans for Workspace Growth

26% of business owners who currently use an office space plan to increase the space within the next year, and 41% plan to do so within the next 5 years.

Retail businesses (59%) are the most likely to rent more office space in the next 5 years, followed by healthcare businesses (50%).

17% of those not renting office space plan to do so in the next 5 years.

Methodology

We surveyed 663 business owners and entrepreneurs about their future plans and attitudes toward renting office space. Among those we surveyed, 51% were fully remote, 27% were hybrid, and 22% were in-office. For industry breakdowns, only industries with 30 or more respondents were used.

About Clarify Capital

Clarify Capital is a leading provider of business financing solutions, offering a range of loan options to help entrepreneurs and small businesses thrive.

Fair Use Statement

You may share these findings about the future of workspace rentals for noncommercial purposes, but please include a link back to this page when doing so.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts

![7 Best Equipment Financing Companies and Loan Options [2024]](/assets/blog/best-equipment-financing-companies/best-equipment-financing-companies-small-3874c9814fbefadd9f9419a140059f72e2893541ce88c7548a49986f0e852ee2.jpg)