Our recent study looks into this emerging trend, exploring how business owners and employees view the integration of crypto into their financial strategies. From crypto loans to digital paychecks, we'll uncover the potential benefits, perceived drawbacks, and the surprising level of openness to these new financial tools across different generations and industries.

Key Takeaways:

- 1 in 4 business owners support the idea of taking out crypto loans for their business.

- Within the next year, 1 in 10 businesses seeking financing will opt for a cryptocurrency loan instead of a traditional loan.

- Nearly 10% of business owners are considering paying their employees in crypto.

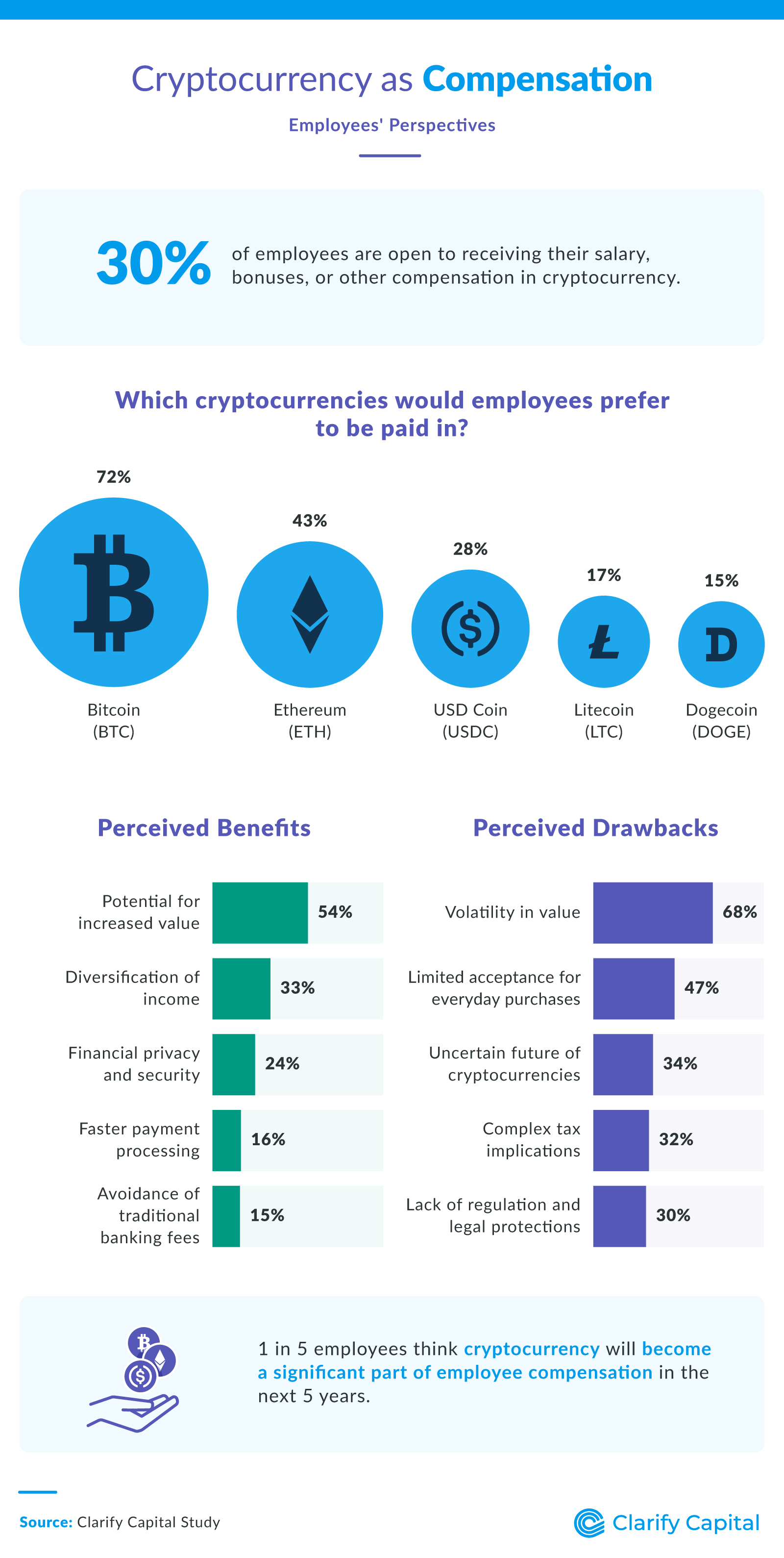

- 30% of employees are open to receiving their salary, bonuses, or other compensation in cryptocurrency.

Are Crypto Loans the Next Big Thing for Businesses?

Cryptocurrency loans are becoming a hot topic in the business world. More and more business owners are looking at this new way to get funding for their companies.

One-quarter of business owners supported the idea of using crypto loans for their business. When we broke it down by age, we saw some interesting differences:

- Gen Z: 50%

- Millennials: 28%

- Gen X: 27%

- Baby boomers: 15%

Younger business owners seemed the most open to this idea. We also found that some industries were more interested than others. Here's how the support for crypto loans ranked across different sectors:

- IT

- Retail

- Finance

- Entertainment

- Hospitality

Plus, 1 in 10 businesses looking for financing said they'd choose a crypto loan over a regular bank loan in the next year. Business owners shared their favorite types:

- Centralized crypto loans: 47%

- Peer-to-peer (P2P) crypto loans: 37%

- Decentralized crypto loans: 21%

- Flash loans: 11%

- Margin loans: 8%

But we didn't just ask about loans. Almost 10% of business owners were thinking about paying their employees in cryptocurrency. Why? These were the top five reasons:

- To rely less on regular banks

- To give employees more financial privacy and security

- To stay ahead of new trends in how people get paid

- To give employees a chance to invest

- To make it easier to pay people in different countries

As business owners, it's important to keep an eye on these new trends. They could change how we run our companies and pay our employees in the future.

Employees Weigh In: Crypto as Compensation

While businesses explore crypto loans, employees are also considering cryptocurrency's role in their paychecks. Let's look at how workers view the idea of receiving their compensation in digital currencies.

We found that 30% of employees have been open to receiving their salary, bonuses, or other compensation in cryptocurrency. Here's how that openness broke down by generation:

- Gen Z: 39%

- Millennials: 32%

- Gen X: 23%

- Baby boomers: 15%

When it came to preferred cryptocurrencies for payment, employees had clear favorites. These were the top five most popular cryptos they preferred to get paid with:

- Bitcoin (BTC): 72%

- Ethereum (ETH): 43%

- USD Coin (USDC): 28%

- Litecoin (LTC): 17%

- Dogecoin (DOGE): 15%

Employees saw several potential benefits to crypto compensation, too:

- Potential for increased value: 54%

- Diversification of income: 33%

- Financial privacy and security: 24%

- Faster payment processing: 16%

- Avoidance of traditional banking fees: 15%

But they also recognized some drawbacks:

- Volatility in value: 68%

- Limited acceptance for everyday purchases: 47%

- Uncertain future of cryptocurrencies: 34%

- Complex tax implications: 32%

- Lack of regulation and legal protections: 30%

Looking ahead, 1 in 5 employees thought cryptocurrency would become a significant part of employee compensation in the next five years. As employers, it's worth considering how these attitudes might shape future compensation strategies.

The Crypto Revolution in Business

With a quarter of business owners open to crypto loans and 30% of employees willing to receive compensation in digital currencies, it's clear that cryptocurrencies are more than just a passing trend. They could shift how we think about money, financing, and compensation.

However, this shift could have its challenges, like volatility, regulatory uncertainty, and limited acceptance. Businesses and employees alike will need to carefully weigh the potential benefits against the risks. One thing is certain: the conversation around crypto in business is just beginning, and it's one that forward-thinking leaders can't afford to ignore.

Methodology

For this study, we surveyed 800 American employees and 200 American business owners to explore their perceptions of cryptocurrency loans. The average age of employees was 39. Generationally, 4% of these respondents reported being baby boomers, 23% as Gen X, 59% as millennials, and 14% as Gen Z. The average age of business owners was 45. Generationally, 13% of these respondents reported being baby boomers, 37% as Gen X, 43% as millennials, and 7% as Gen Z.

About Clarify Capital

Clarify Capital helps business owners secure the financing they need to thrive in today's competitive marketplace, including no-doc business loans and fast business loans. Our tailored financial solutions support entrepreneurial dreams, turning visions into reality.

Fair Use Statement

Let's keep the conversation going! Feel free to share this data noncommercially, but please link back to this page to join the discussion.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts