Whether you're a small business owner, an early-stage startup, or seeking working capital for expansion, unsecured loans offer fast access to funds without tying up valuable assets. In 2025, new online lenders and fintech underwriting methods are changing the landscape, making unsecured business loans more accessible even with moderate credit histories.

Understanding Unsecured Business Loans

Unsecured business loans are a common financing option used by many entrepreneurs and small business owners. Unlike secured business loans, which require you to put up assets like real estate or equipment as collateral, unsecured loans are issued based on your creditworthiness and ability to repay.

Most unsecured loans are issued as a lump sum that you repay over a fixed term, ideal for predictable cash flow needs.

Think of it this way: if a secured loan is like borrowing money with a safety net (your assets), an unsecured loan is more like a trust-based agreement. The lender is essentially saying, "We believe in your business enough to lend you money without requiring collateral."

These small business loans are often used for various purposes, including:

Working capital to keep your operations running smoothly during slower business cycles.

Covering business expenses for unexpected costs like repairs, inventory purchases, or marketing campaigns.

Business expansion to finance new projects, open new locations, or hire additional staff.

Because they don't require collateral, unsecured loans are super helpful for startups and small businesses that may not have significant assets to offer.

Unsecured vs. Secured Loans

The main distinction between unsecured and secured loans is the collateral requirement. With secured loans, you must offer something of value to back the loan. This could be real estate, vehicles, or other business assets (as opposed to personal assets). If you can't repay the loan, the lender could seize the collateral to recover their money.

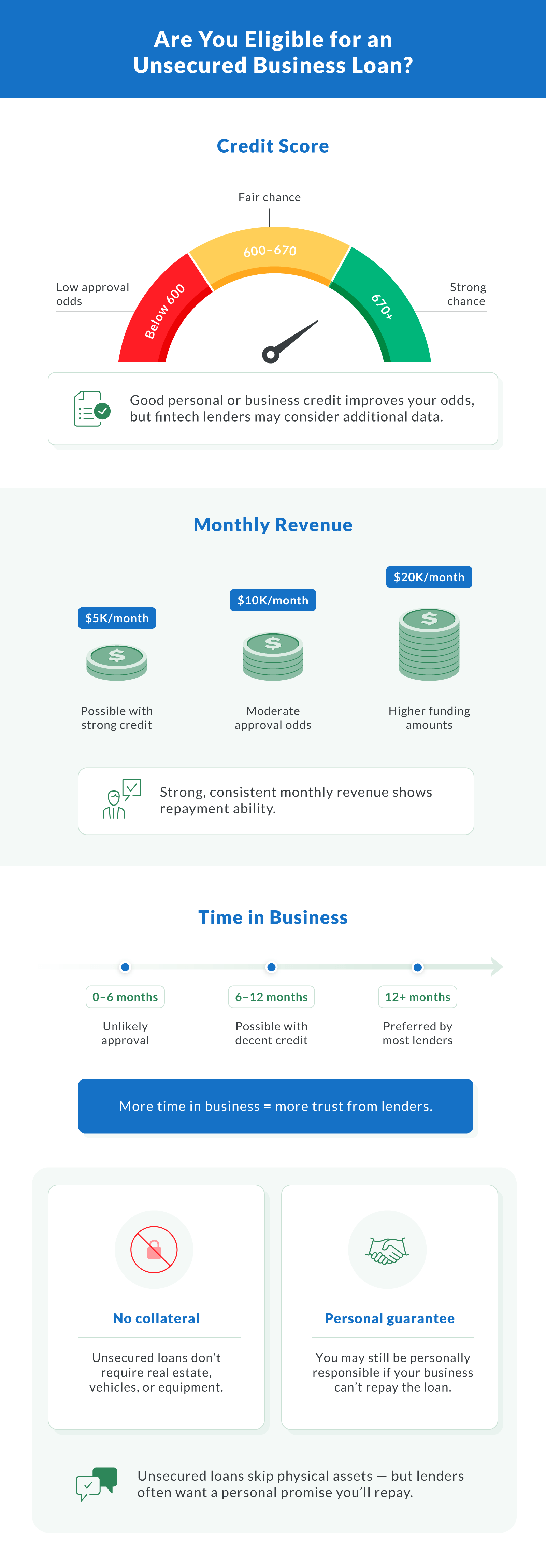

In contrast, unsecured loans rely on your credit score, business history, and the lender's assessment of your ability to repay. While this makes unsecured loans more accessible to businesses without significant assets, it also means that interest rates could be higher to compensate for the increased risk to the lender.

With new online lenders, unsecured loans can sometimes rival secured loan approval times, thanks to faster decision-making and fewer hoops.

Secured vs. Unsecured Loans Comparison

Choosing the right type of business loan starts with understanding how secured and unsecured loans stack up. This comparison highlights the main differences in collateral requirements, eligibility, and repayment structures, so you can decide which option best meets your business needs and risk tolerance.

| Feature | Secured Business Loans | Unsecured Business Loans |

|---|---|---|

| Collateral Required | Yes – business or personal assets | No collateral required |

| Approval Speed | Slower – involves asset appraisals | Faster – streamlined application and fewer documents needed |

| Interest Rates | Lower interest rates | Higher interest rates |

| Typical Use Case | Large purchases, real estate, and long-term capital expenditures | Short-term needs, working capital, cash flow bridging |

| Risk to Borrower | Lower – lender can seize collateral | Higher – based solely on creditworthiness and repayment ability |

| Loan Amount Range | $50,000 to $5 million+ | $10,000 to $500,000 |

| Credit Score Sensitivity | High – strong personal and business credit scores required | Moderate – income and credit records both matter |

| Repayment Terms | Longer terms (3–10+ years) | Shorter terms (6 months to 5 years) |

Strategic Benefits of Unsecured Loans for Business Growth

Unsecured loans offer a handful of strategic benefits that make them an attractive option. Let's take a closer look at these advantages:

Financing Flexibility

One of the major benefits of unsecured loans is their flexibility. Since you don't need to offer collateral, these loans can be accessed by a broader range of businesses, including startups and small businesses that might not have substantial assets. This makes it easier to obtain business funding quickly, so you can jump on opportunities as they arise.

Flexible repayment terms ranging from 6 months to 5 years help businesses manage cash without vehicle or real estate at risk.

For example, let's say you run a small retail business and you're offered a great deal on bulk inventory. With an unsecured loan, you can get the funds you need quickly to take advantage of the opportunity without worrying about putting up collateral.

Simple Application and Approval Process

The application process for getting an unsecured loan is generally more straightforward and faster than for secured loans. Without the need to assess collateral, lenders can focus on your creditworthiness and business history, streamlining the approval process.

Eligibility requirements typically include a good credit score, a solid business plan, and a demonstrated ability to repay the loan. While the approval times can vary, they are often quicker than for secured loans, making unsecured loans a great option when you need funds fast.

Asset Preservation

Because unsecured loans don't require collateral, they let you preserve your business assets. This is particularly important for businesses that need to protect their assets for operational purposes or future opportunities.

For instance, if you own a fleet of delivery vehicles, using them as collateral for a secured loan could put your operations at risk if something goes wrong. With an unsecured loan, you can keep those vehicles on the road while still getting the business financing you need.

Improvement in Business Credit

Taking out an unsecured loan and repaying it on time can positively impact your business credit score. This, in turn, can open doors to better financing options in the future, including lower interest rates and larger loan amounts.

Building a strong business credit history is essential for long-term growth, as it shows lenders that your business can manage debt.

When Do Unsecured Loans Make the Most Sense

Unsecured business loans truly shine in specific scenarios, especially when you need working capital fast and lack sufficient collateral. They're ideal for startups with limited physical assets, businesses facing short-term cash needs, or entrepreneurs aiming to scale quickly without tying up valuable resources. Because underwriting leans heavily on your creditworthiness and cash flow, these loans offer flexibility in loan amounts, typically ranging from $10,000 to $500,000, making them perfect for one-off projects or unexpected opportunities.

Key Considerations When Choosing Unsecured Loans

While unsecured loans offer many benefits, they often feature higher interest rates and shorter repayment periods. Make sure your monthly payments align with projected cash flow. You'll need to carefully consider your loan options and find the loan that best suits your business needs. Here are some key factors to keep in mind:

Interest Rates and Repayment Terms

Unsecured loans typically have higher interest rates than secured loans. That's because they pose a greater risk to lenders. The solution is to compare rates from different lenders and understand how your credit score will affect the terms of your loan.

Before signing on the dotted line, make sure you're clear on the repayment schedule. Finding out what your monthly payments will be can make it easier to manage your cash flow and avoid any surprises.

Loan Amount and Types of Financing

Unsecured loans are available in various amounts, depending on your business's needs and financial situation. Determine how much funding you require and what type of loan or financing will best support your goals.

For example, if you need ongoing access to funds, a line of credit might be more suitable than a term loan. On the other hand, if you have a specific project in mind, a term loan with a fixed repayment schedule could be a better choice.

Also, consider whether a personal guarantee is required. While unsecured loans don't require collateral, some lenders may ask for a personal guarantee, which means you'll be personally responsible for repaying the loan if your business can't.

Lenders and Financial Institutions

Not all lenders are created equal, and it's important to choose one that aligns with your business's needs. Online lenders, banks, and credit unions all usually offer unsecured business loans, but their terms, rates, and eligibility requirements can vary significantly.

Online lenders, including peer-to-peer platforms and fintech startups, offer rapid approvals and may evaluate business performance instead of relying solely on credit scores, a notable shift in 2025.

The Small Business Administration (SBA) also offers loan programs that can provide additional support and resources for small businesses. Working with a lender who understands your industry and can offer expert advice is crucial to getting the best deal.

Common Misconceptions About Unsecured Loans

Despite their growing popularity, unsecured business loans are still widely misunderstood. Misconceptions can cause business owners to overlook this financing option, even when it's a better fit than secured loans. Let's clear up some of the most common myths:

Myth: You Need Perfect Credit To Qualify

Reality: While a strong credit score can help secure better repayment terms, it's not the only factor lenders consider, especially in 2025. Many online lenders now use alternative underwriting models that evaluate your business credit, cash flow, and overall financial performance. This shift allows borrowers with fair to poor credit but healthy revenue to access capital that would have previously been out of reach.

Myth: Unsecured Loans Always Charge Sky-High Rates

Reality: Unsecured loans typically have higher interest rates than secured loans since there's no collateral to back the debt. But that doesn't mean they're unaffordable. Lenders now offer competitive rates, especially to borrowers who offer a personal guarantee or demonstrate strong creditworthiness. Funding options from credit unions and reputable online lenders can be surprisingly cost-effective, especially for borrowers with good credit and a solid business plan.

Myth: Loan Amounts Are Always Small

Reality: There's a common belief that unsecured loans are only good for covering short-term gaps. In reality, loan amounts can reach into the hundreds of thousands—if your balance sheets, revenue, and monthly payment history show that your business can manage the repayment. Lenders evaluate the full picture of your operations, so businesses with good cash flow and established business credit may qualify for larger loans than expected, even without valuable assets as collateral.

Real-World Examples

Sometimes, the best way to understand the benefits of unsecured loans is to see how they've helped other businesses grow. Here are a few real-world examples that illustrate the strategic use of unsecured loans:

Example 1: The Retail Expansion

A small retail business in a growing neighborhood was looking to expand its operations by opening a second location. The business owner didn't have enough assets to secure a traditional loan, but with an unsecured loan, they were able to obtain the necessary funding.

The loan allowed the business to secure a prime location, hire additional staff, and stock up on inventory for the grand opening. Within a year, the new location was profitable, and the business owner was able to repay the loan ahead of schedule.

Example 2: The Tech Startup

A tech startup needed working capital to bridge the financial gap between product development and revenue generation. With limited assets, a secured loan was not an option, so the founders turned to an unsecured loan.

The loan provided the necessary funds to keep the business running while they finalized their product and secured their first round of venture capital funding. The flexibility and quick access to funds allowed the startup to stay on track and achieve its growth milestones.

Example 3: The Service Business

A service-based business with seasonal fluctuations in revenue needed to manage its cash flow during the off-season. An unsecured credit line offered the perfect solution, providing the business with flexible access to funds when needed.

The business owner used the line of credit to cover payroll, marketing expenses, and other operational costs during slower months. This approach helped the business maintain stability and prepare for the busy season.

Lessons Learned

These case studies highlight several key takeaways:

Timing is everything. Quick access to funds can make it possible to seize growth opportunities.

Flexibility matters. Unsecured loans provide flexibility that can be invaluable for many types of businesses with fluctuating needs.

Credit matters. Keeping a good credit score is the best way to secure favorable loan terms.

Trend Insight: Fintech Underwriting Expands Access

In 2025, fintech platforms are breaking barriers by relying on cash-flow underwriting, analyzing real-time revenue instead of just personal credit scores. This approach helps underserved borrowers, especially those with thin credit history but strong monthly payments and regular deposits, qualify for unsecured business loans at more favorable terms.

Making Informed Decisions: Tips for Entrepreneurs and Small Business Owners

Making the right decision about financing can have a lasting impact on your business. Before applying, check your credit limit, credit history, and maintain up-to-date balance sheets. Presenting accurate financials strengthens your application. Here are some practical tips to help you make informed choices:

Assess your business needs. Before applying for a loan, take the time to assess your business needs and financial situation. Understand what you need the funds for, how much you require, and how quickly you can repay the loan.

Prepare a strong business plan. A solid business plan is essential when applying for any type of financing. It demonstrates to lenders that you have a clear strategy for using the funds and a plan for repayment. Be sure to include financial projections, market analysis, and a detailed description of how the loan will support your business goals.

Seek expert advice. Don't go it alone. Consult with financial advisors, accountants, or business mentors who can help you get through the loan application process, find the best terms, and avoid potential pitfalls.

Explore all your options. Unsecured loans are just one of many financing options available to businesses. Take the time to explore other options, such as secured loans, lines of credit, and SBA loans, to ensure you're choosing the best solution for your business.

Unlock Your Business's Potential with Unsecured Loans

Unsecured business loans are a flexible, accessible financing option for businesses looking to grow without the burden of collateral. Whether you're a small business needing quick access to funds or an established business aiming to expand, unsecured loans can provide the capital you need to achieve your goals.

By understanding the strategic benefits of unsecured loans, from flexibility and speed to preserving your assets and building your credit, you can make informed decisions that maximize your business's potential.

Ready to unlock fast, flexible funding? Apply today with Clarify Capital and get the capital you need to grow, no collateral required!

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts