Dental practice lenders offer specialized financing options tailored to the unique needs of the dental industry. From acquiring new equipment to purchasing an existing practice, choosing the right lender is critical to accessing capital at every business stage — especially when loan terms, eligibility, and funding timelines vary widely.

This guide breaks down each type of dental practice loan to help you evaluate options confidently and understand lender expectations. It doesn't matter if you're planning a buy-in or looking to expand an established operation; no matter the need, you'll find helpful tools to make informed decisions.

Understanding Dental Practice Loans and Financing Options

Dental practice loans are funding solutions designed specifically for dental professionals. Unlike general small business loans, they account for dental industry revenue models, equipment costs, and long-term growth projections.

Most lenders offer financing options such as SBA loans, traditional term loans, and revenue-based loans. These vary in structure and terms, often requiring health care-specific underwriting, such as production revenue, DSCR, and practice valuation.

Here is a comparison of key loan types available to dental professionals:

| Dental Loan Types Comparison | |||||

|---|---|---|---|---|---|

| Loan types | Average loan size | Term length | Interest rates | Eligibility | Funding timeline |

| SBA loans | $50,000-$5M | Up to 25 years | 5%-15% | Strong credit, business plan, collateral | 30-90 days |

| Term loans | $25,000-$500,000+ | One to 10 years | 6%-30%+ | 670+ credit, 3+ months revenue history | One to 10+ days |

| Revenue-based loans | $25,000-$10M+ | Varies | 20%-40% | $10,000+ monthly revenue | One to two days |

1. Startup Dental Practice Loans: Building From the Ground Up

Starting a dental practice from square one requires a large amount of capital. You'll need to cover things like equipment, construction, and commercial space, all of which can be costly. While some lenders offer startup financing, Clarify Capital focuses on revenue-based loans that require a minimum of $10K in monthly revenue and six months of business history.

Some of the most common financing options for startups include:

SBA loans. Government-backed loans that offer favorable terms but involve lengthy approval processes and strict qualifications.

Term loans. Lump-sum loans from traditional or online lenders can be used to fund equipment and construction.

Construction financing. Used for building dental offices from the ground up, often bundled with real estate and equipment financing.

To obtain financing, typical requirements include:

Detailed business plans. Lenders want to see projected cash flow and a clear roadmap for your business.

Credit approval. Most lenders require a minimum credit score of 670, with better rates for 700+.

Industry experience. Some lenders prefer borrowers who have previous experience managing a dental practice.

2. Acquisition Financing: Buying an Existing Dental Practice

If you're planning to purchase an existing dental office, a practice acquisition loan can help. It's a good option for dentists who'd rather step into a practice that already has patients and steady revenue in place. These loan options differ from startup financing in that they focus on business valuation and transition planning rather than speculative projections.

Key acquisition financing features:

Business valuation. Loan amounts are based on the assessed value of the target practice, typically 65%-80% of annual collections.

Seller financing. In many cases, the seller agrees to finance part of the purchase to ease the transition.

SBA preferred lenders. These institutions can offer expedited SBA processing, especially for health care practice acquisitions.

Interest rates and terms vary based on credit, collateral, and practice cash flow. Most lenders will request the selling dentist's production and expense reports to evaluate the deal.

3. Expansion Loans: Growing Your Existing Practice

Once your practice is making money, expansion financing can help you scale bigger. You can use these funds to build a second location or upgrade to modern equipment. Either way, lenders offer flexible options to support growth.

You can use expansion financing to:

Hire staff. Cover costs for onboarding hygienists, assistants, or administrative support.

Add rooms. Fund interior renovations or dental suite expansions.

Upgrade equipment. Purchase new imaging tech, chairs, or sterilization systems.

Expand real estate. Acquire adjacent units or purchase property.

Lenders may recommend working capital loans or lines of credit for short-term needs, especially when tied to cash flow improvements. Rates and terms are often more favorable for practices with strong profit margins and established operations.

What Do Dental Practice Lenders Look for in Applicants?

Lenders use underwriting to assess whether a borrower is financially stable and likely to repay the loan. For dental practice loans, underwriters evaluate a mix of business performance, creditworthiness, and professional background.

Here's what most dental practice lenders prioritize:

Revenue requirements. Most lenders require $10,000+ in monthly revenue and at least six months of business history.

DSCR (debt service coverage ratio). This key metric helps determine whether your practice generates enough cash flow to cover loan payments.

Collateral. While Clarify Capital offers revenue-based loans that don't require collateral, traditional lenders may secure loans with real estate, equipment, or business assets.

Credit score. A score above 670 is often the minimum, with better rates offered at 700+.

Professional experience. Dentists with several years of clinical or management experience are viewed more favorably.

Business plan quality. A clear, well-documented plan increases approval odds, especially if you're pursuing a practice acquisition or expansion.

Understanding these factors can help practice owners prepare stronger applications and reduce approval delays.

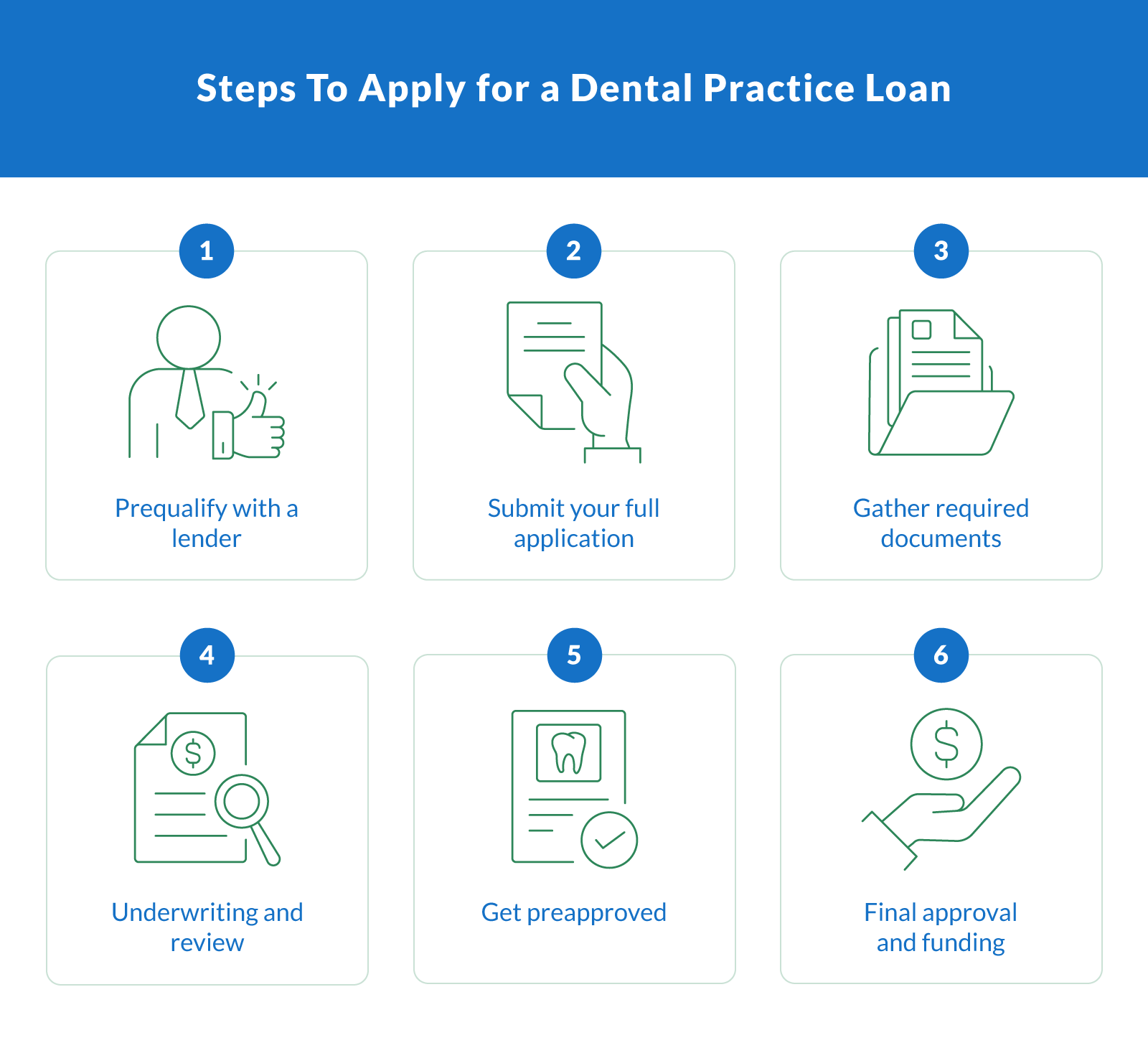

How To Apply for a Dental Practice Loan (Step-by-Step Guide)

Applying for a dental practice loan is straightforward when you know what to expect. Here are the typical steps you'll need to take:

1. Prequalify With a Lender

Provide a lender with your basic business details and an overview of your financials to get matched with loan offers without affecting your credit.

2. Submit Your Full Application

Fill out the lender's application.You'll need to provide documentation like business license, tax returns, and practice financials.

3. Gather Required Documents

This typically includes:

Three months of recent bank statements

Personal and business credit reports

Business checking account information

Profit and loss statements

Equipment quotes (if applicable)

4. Underwriting and Review

The lender will take some time to go over your revenue, credit score, debt-service coverage ratio (DSCR), and the overall financial health of your dental practice.

5. Get Preapproved

If you're eligible, you'll receive a conditional approval and a detailed offer outlining loan terms and rates.

6. Final Approval and Funding

Sign the final loan documents, and wait for your funds to come in. Clarify Capital offers same-day funding to qualified borrowers.

Which Dental Lender Is Right for You?

Picking the right lender comes down to finding one whose loans actually fit your business goals. Keep these points in mind as you compare your options:

Competitive interest rates. Compare APRs across offers to find cost-effective solutions.

Flexible repayment terms. Look for lenders that offer term lengths suited to your cash flow.

Loan amounts that meet your goals. Whether you need $50K for equipment or $1M for expansion, ensure the lender can fund your full need.

Transparent fee structure. Avoid lenders with hidden fees or confusing terms.

Industry-specific experience. Favor lenders who understand the dental industry and offer tailored underwriting.

Fast approvals. Timely funding is key, especially if you're acquiring a practice or under contract.

Quality customer support. Reliable communication matters throughout the loan's lifecycle.

Clarify Capital makes this easier by connecting dental professionals with vetted, top-rated lenders. You'll receive competitive offers, personalized loan guidance, and support through every stage of the process.

Types of Lenders Offering Dental Practice Financing

Different lenders will have different terms and borrower requirements. It's important to know the difference so you can pick the best option for your business goals.

Consider how each option might align with your timeline, credit profile, and desired loan structure.

| Types of Dental Practice Lenders | |||

|---|---|---|---|

| Lenders | Pros | Cons | Notes |

| Banks | Lower rates, trusted institutions | Slow approval process, strict underwriting | Must be an FDIC member and equal housing lender |

| Credit unions | Member-focused service, competitive rates | May require membership, limited loan products | Often community-based and relationship-driven |

| SBA lenders | Long terms, lower rates via government backing | Complex application, longer funding timeline | Must meet small business eligibility |

| Online lenders | Fast approval, less paperwork | Higher interest rates, shorter terms | Ideal for practices needing quick access to capital |

| Dental-specific lenders | Industry expertise, flexible loan structures | May have niche offerings only | Tailored practice financing solutions |

Dental Industry-Specific Loan Features To Know

When financing a dental practice, you will see several loan features come up. It's important that you understand what these details mean and whether or not they are borrower-friendly.

Interest-only periods. Many dental loans offer early-stage interest-only payments to ease cash flow during renovations or new location buildouts.

Fixed vs. variable rates. Fixed rates offer predictable payments; variable rates may start lower but fluctuate over time.

Refinancing. Practices with improved revenue or credit can refinance existing loans to secure better terms.

Flexible repayment. Some lenders offer seasonal payment options or graduated repayment schedules that align with production-based revenue.

These features reflect how the dental industry operates — often requiring upfront capital with delayed ROI. Make sure any loan terms you accept work with your production timeline.

Take the Next Step With Confidence

Finding the right dental practice financing means partnering with a lender that understands your goals. Together, you can focus on launching a new practice, acquiring an existing one, or expanding operations; whatever the next stage of growth looks like for you.

Tailored financing solutions are available to help you thrive in the dental industry. Ready to move forward? Apply today with Clarify Capital and get matched with lenders offering fast approvals, flexible terms, and personalized guidance.

FAQs: Dental Practice Loan Requirements and Lender Insights

Still have questions about dental practice loans? These quick answers cover common lender requirements and application steps, so you can be prepared.

Do I Need Collateral To Get a Dental Practice Loan?

Not always. Some lenders, like Clarify Capital, offer revenue-based loans that don't require collateral. However, traditional loans—especially SBA loans—may require real estate, equipment, or other business assets to secure financing. Lenders typically assess collateral based on liquidation value, not market value.

What Are Typical Interest Rates for Dental Practice Financing?

Rates can vary widely. You will generally see a range from 5% all the way up to 30%, depending on the lender, type of loan, and your borrower profile. It's common to see fixed rates for term loans, while interest-only periods may apply during the first few months. To get a better rate, you'll need a strong credit history and established cash flow. A large down payment can also lower your interest rate.

What Documents Are Needed To Apply for Dental Practice Financing?

Typically, most lenders will ask for:

Three months of bank statements

Business license and tax ID

A credit report

Detailed business plan and financial projections

You can improve the odds of your loan application by including extra documents, like equipment quotes or associate agreements. Make sure that you submit accurate and complete paperwork to avoid delays in the loan process.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts