Access to funding can make or break a small business. Whether it's for managing cash flow, covering business expenses, or investing in growth, having the right financing options is crucial. A secured business line of credit offers a flexible way for business owners to borrow as needed rather than taking out a lump sum loan. By using collateral such as real estate or equipment, borrowers can qualify for lower interest rates and higher credit limits.

Unlike an unsecured option, a secured credit line reduces risk for lenders, making it easier to get approved even with less-than-perfect credit history. Businesses that need ongoing access to working capital can benefit from this structure, ensuring they only pay interest on what they use.

This article will cover how secured credit lines work, how to qualify, and how they compare to other business financing options. By the end, you'll know whether this type of funding is the right fit for your long-term business needs.

What Is a Secured Business Line of Credit?

A secured business line of credit is a type of business financing that requires collateral, such as real estate, inventory, or accounts receivable, to back the borrowed funds. Unlike a traditional business loan, which provides a lump sum upfront, a business line of credit allows business owners to draw only the amount they need up to a predetermined limit.

This financing option is different from an unsecured business line of credit, which does not require collateral but often comes with stricter approval requirements and higher interest rates. Because lenders take on less risk with a secured business line of credit, they generally offer more favorable terms, making it a great choice for businesses that have valuable assets but need flexible access to capital.

How Does a Secured Business Line of Credit Work?

A secured business line of credit works similarly to a credit card in that borrowers can withdraw funds as needed rather than receiving a fixed loan amount all at once. This flexibility allows business owners to manage short-term expenses without taking on unnecessary debt. Unlike a credit card, however, this type of financing typically offers lower interest rates and higher credit limits.

Business owners only pay interest on the amount they borrow, not the entire credit line. Once funds are repaid, they become available to borrow again. Because the credit line is secured by business assets, lenders are often more willing to extend larger credit limits and better repayment terms.

Benefits of a Secured Business Line of Credit

One of the biggest advantages of a secured business line of credit is access to lower interest rates compared to unsecured loans. Because lenders have collateral as security, they offer more competitive terms, making this option ideal for businesses looking to manage cash flow efficiently.

Additionally, secured credit lines often come with higher credit limits, allowing businesses to cover larger expenses or take advantage of growth opportunities. For business owners with a strong credit score and established financial history, this type of financing can provide a reliable source of working capital. While unsecured loans may be easier to obtain in some cases, they usually come with higher interest rates, making them a more expensive option in the long run.

How To Qualify for a Secured Business Line of Credit

To qualify for a secured business line of credit, business owners must meet specific lender requirements. While criteria vary, most financial institutions evaluate the following factors:

Credit score. A strong credit score increases approval odds and may result in better loan terms.

Credit score. A strong credit score increases approval odds and may result in better loan terms.

Annual revenue. Lenders require proof of consistent revenue to ensure repayment ability.

Business checking account. Many lenders require applicants to have a business bank account to track transactions.

Financial statements. Lenders review balance sheets, income statements, and cash flow reports.

Collateral. Businesses must provide assets, such as real estate or equipment, to secure the credit line.

Credit approval. Lenders assess creditworthiness by evaluating financial health, debt obligations, and overall risk.

Meeting these eligibility criteria improves the chances of securing a business line of credit with favorable terms.

How To Apply for a Secured Business Line of Credit

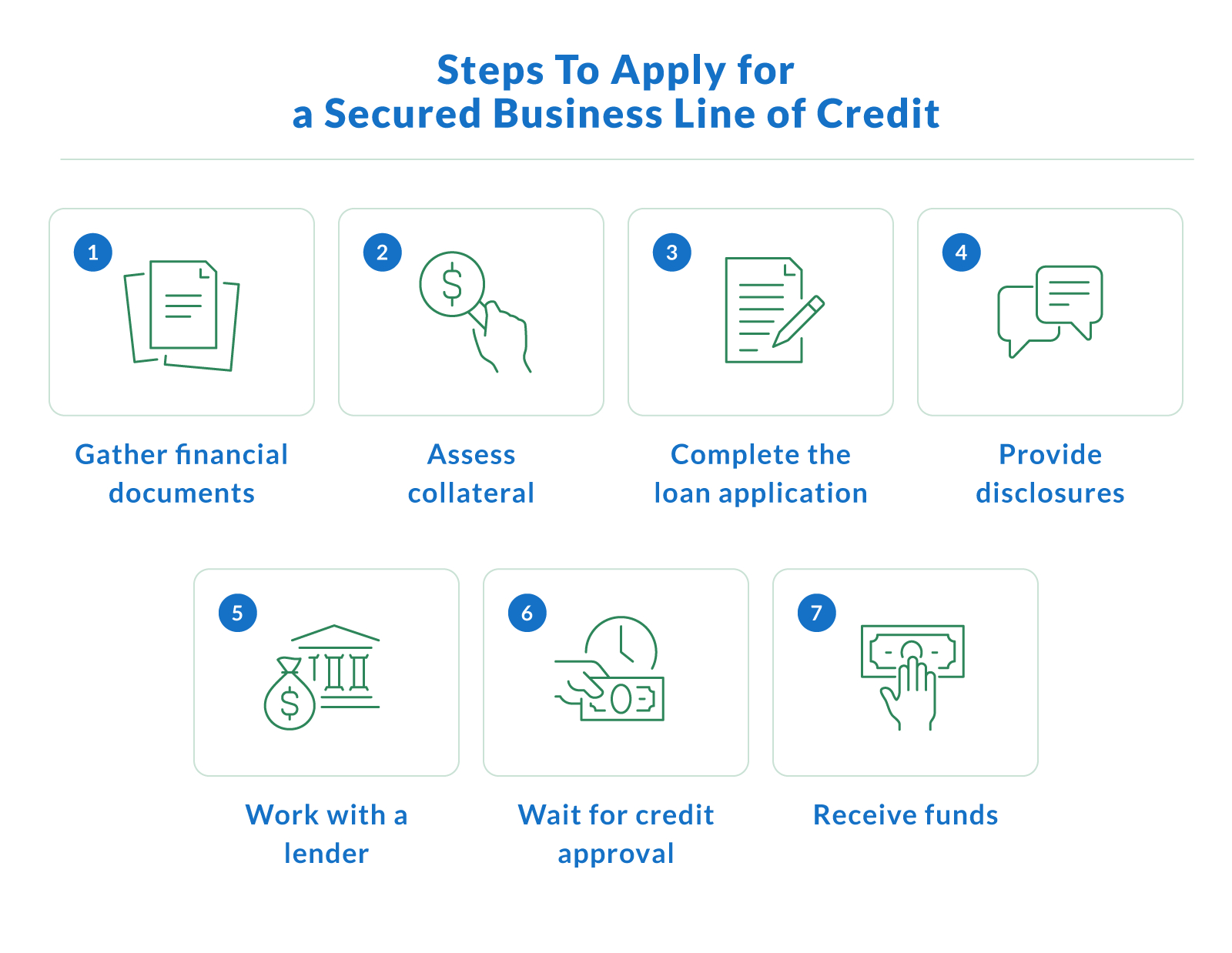

Applying for a secured business line of credit involves several steps. Lenders, including banks, credit unions, and online lenders, have different requirements, but the general process remains the same:

Gather financial documents. Prepare financial statements, tax returns, and business records to demonstrate financial health.

Assess collateral. Identify assets that can be used as collateral, such as real estate or equipment.

Complete the loan application. Submit a detailed loan application with business and personal financial details.

Provide disclosures. Be ready to disclose outstanding debts, business expenses, and existing credit obligations.

Work with a lender. Choose a financial institution like Clarify Capital that offers the best loan terms based on business needs.

Wait for credit approval. Lenders will review credit history, revenue, and collateral before approving the application.

Receive funds. Once approved, access the credit line and use funds as needed for short-term business expenses.

The application process can take several business days, depending on the lender and the complexity of the financial review. Choosing the right financial institution — whether a bank, credit union, or online lender like Clarify Capital — will get you the most competitive terms for a secured business line of credit.

Where To Get a Secured Business Line of Credit

Business owners can access a secured business line of credit through various financial institutions, each offering different terms and credit offers. While traditional banks and credit unions remain popular options, online lenders provide fast, flexible business financing solutions.

Traditional banks. Large banks, such as Bank of America, offer secured credit lines to established businesses. These institutions are Member FDIC and may require extensive documentation.

Credit unions. These nonprofit financial institutions often provide competitive interest rates and lower annual fees compared to traditional banks.

Online lenders. Alternative lenders, such as Clarify Capital, offer quick approvals with minimal paperwork. Unlike many lenders, Clarify Capital does not charge an origination fee for secured business loans.

SBA-backed lenders. Businesses that meet Small Business Administration (SBA) requirements may qualify for government-backed credit lines through participating lenders.

Each option has unique benefits, so businesses should compare repayment terms, fees, and overall flexibility before selecting a lender.

Secured Business Line of Credit vs. Other Financing Options

A secured business line of credit is just one of many financing options available. Depending on business needs, other funding sources may be a better fit:

Term loans. Ideal for businesses that need a lump sum upfront with predictable repayment terms over several years.

Cash advance. Best for short-term loans with higher interest rates and daily repayment requirements.

Business credit card. A good choice for covering routine purchases with added perks like rewards programs.

SBA loans. A type of government-backed funding that provides long-term financing with lower interest rates but requires a lengthy approval process.

For large one-time investments, a term loan or SBA loan may be preferable. However, businesses needing continuous access to funds for short-term expenses may benefit more from a secured business line of credit.

FAQs About Secured Business Lines of Credit

Secured business lines of credit can be a great financing option, but business owners often have questions about how they work, who qualifies, and what makes them different from other funding solutions. Understanding the key factors — such as credit approval, collateral requirements, and interest rates — can help you make informed decisions about whether a secured credit line is the right choice.

Below are answers to some of the most commonly asked questions.

Can an LLC Have a Secured Business Line of Credit?

Yes, LLCs can apply for a secured business line of credit. Lenders assess credit approval based on the business's credit rating, financial health, and available collateral. A strong credit history and stable revenue increase the chances of approval.

What's the Easiest Business Line of Credit to Get?

An unsecured business line of credit is generally easier to obtain than a secured one, as it does not require collateral. However, this option often comes with higher interest rates and stricter approval requirements based on creditworthiness.

Is a Secured Business Line of Credit a Good Idea?

This type of credit depends on business needs and financial stability. If a business has valuable assets and wants access to a revolving credit line with lower interest rates, a secured business line of credit is a smart choice. However, businesses that lack collateral may need to explore alternative financing options.

Take the Next Step Toward Business Growth

A secured business line of credit provides business owners with flexible access to funds while benefiting from lower interest rates and higher credit limits. It's an excellent option for businesses that need working capital to cover expenses, manage cash flow, or seize growth opportunities without taking on a large, fixed-term loan. By using collateral, businesses with a less-than-perfect credit history can qualify for better terms compared to unsecured financing.

While a secured line of credit offers advantages, it's important to assess your long-term financial strategy and ability to repay borrowed funds. Businesses that have valuable assets and want cost-effective, ongoing access to credit will find this type of business financing particularly beneficial. Before applying, compare different financing options and ensure you meet lender requirements.

With the right approach, a secured credit line can be a powerful tool for financial stability and business growth.

Are you looking for a flexible funding solution with lower interest rates? A secured business line of credit may be the perfect fit for your business. Get the financing you need with competitive terms and expert support. Apply today with Clarify Capital and secure the working capital your business needs.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts