Choosing the right financing option is crucial for small business owners, especially when traditional business loans aren't accessible. Many entrepreneurs find themselves weighing small business personal loans against dedicated business loans, trying to decide which funding type fits their needs, eligibility, and long-term goals. Each option offers unique benefits and potential drawbacks, impacting interest rates, repayment terms, and credit requirements differently.

This guide explores the in-depth differences between personal loans and small business loans, providing clarity on the benefits, risks, and ideal scenarios for each. By understanding these distinctions, you'll be better positioned to secure financing that supports your cash flow, aligns with your business objectives, and sets your venture up for long-term success.

What Are Small Business Personal Loans?

Small business personal loans are a type of financing where business owners use personal loans to fund business-related expenses. Unlike dedicated business loans, these loans are issued directly to the individual rather than the business entity, making the borrower personally responsible for repayment.

Typical characteristics of small business personal loans include:

Loan amounts. Personal loans generally provide smaller lump sums compared to business loans, typically ranging from a few thousand up to $50,000 or slightly higher, depending on the lender.

Repayment terms. These loans usually have shorter, fixed-rate repayment terms, often ranging between one and five years, offering predictable monthly payments.

Faster application process. The loan application process for personal loans is often quicker and simpler, with fast funding available from online lenders, banks, and credit unions, sometimes within a few business days.

Eligibility criteria. Approval primarily depends on the borrower's personal credit score and credit history, annual income, and debt-to-income ratio rather than business performance metrics.

This reliance on personal creditworthiness makes personal loans particularly accessible to startups, new businesses, or business owners with limited business credit history.

Comparing Small Business Personal Loans and Business Loans

Choosing the right type of loan can significantly impact your business's financial health, cash flow, and growth potential. While both financing options provide essential working capital, their differences in eligibility requirements, available loan amounts, repayment terms, and interest rates can make one option more advantageous than the other. Here's a detailed comparison to help small business owners determine the best financing options based on their unique business needs and financial circumstances.

Before a deep dive into the specifics, here's a quick glance at how these two loan options compare:

| Feature | Small Business Personal Loans | Business Loans |

|---|---|---|

| Interest rates | Higher interest rates | Lower, more competitive interest rates |

| Loan amounts | Smaller amounts (usually up to $100,000) | Larger amounts, potentially millions |

| Repayment terms | Shorter, fixed terms | Longer, flexible terms |

| Eligibility requirements | Personal credit score and personal income | Business credit, revenue, cash flow, business history |

| Collateral requirements | Typically unsecured | Often require collateral (e.g., real estate, equipment) |

| Application process | Fast, minimal documentation | Detailed financial disclosures, business plans, longer approval |

| Funding speed | Quick (within days) | Longer (weeks to months, unless using online lenders) |

| Interest rates | Typically higher | Generally lower and more competitive |

| Use of funds | Flexible; suitable for smaller, short-term needs | Specific business expenses or large investments (e.g., commercial real estate) |

Approval and Application Process

Understanding the differences in the approval and application process helps you choose the right financing for your business.

Personal loans: Personal loans feature a streamlined application process, which is ideal if you need quick access to funds.

Fast and simple application. Typically, it involves filling out an online form that can be completed within minutes.

Minimal documentation is required. Usually limited to basic personal information, proof of income, and a personal credit check.

Rapid funding timeline. Borrowers may receive loan offers and approvals within one to three business days.

Business loans: By comparison, traditional business loans and SBA loans involve a more extensive application and approval process, including thorough financial disclosures and lender reviews.

Detailed documentation is required. Lenders typically request comprehensive financial documents, including business plans, tax returns, financial statements, and bank account statements.

Extensive credit reviews. Lenders review both business and personal credit histories, assessing financial health and the borrower's ability to repay.

Longer processing time. Approval and underwriting can take several weeks or longer, particularly with SBA loan programs.

Interest Rates and Fees

Understanding the cost of borrowing is crucial to deciding between personal and business financing.

Personal loans: Usually have higher interest rates compared to business loans, though still competitive based on the borrower's personal credit profile.

Rates vary by creditworthiness. Higher personal credit scores typically earn borrowers lower interest rates.

Transparency in pricing. Most personal loans clearly disclose annual percentage rates (APR) and fees upfront, simplifying comparisons.

Business loans: Typically offer more favorable interest rates due to collateral or SBA backing but can involve more fees and complex underwriting.

Competitive interest rates. SBA loans offer some of the lowest rates available due to Small Business Administration guarantees.

Fees and underwriting costs. Business loans may include origination fees, processing fees, or prepayment penalties, particularly traditional loans from banks or credit unions.

Credit and Eligibility Requirements

Qualification criteria differ significantly between personal loans and business loans, influencing borrower eligibility and available financing options.

Personal loans: Primarily depend on the borrower's personal financial profile, making them accessible to individuals with established personal credit.

A personal credit score is critical. Most lenders require a strong credit history and a credit score typically above 660 to secure competitive rates with credit approval.

Income verification. Lenders evaluate personal annual income to confirm repayment capacity.

Easier qualification. Startups and small business owners with limited business history or fluctuating business revenue can often qualify more easily.

Business loans: Eligibility for business loans focuses on both personal and business financial strength, considering broader criteria.

Business credit scores and history. Lenders review your business credit score, business bank accounts, and financial statements, such as profit-and-loss statements and tax returns.

Annual revenue requirements. Many lenders require annual revenue minimums, often at least $100,000 annually.

Established business operations. Generally, it requires the business to be operational for at least one to two years, except for specialized loan options such as SBA microloans.

Collateral or guarantees. Often require collateral, a personal guarantee, or business assets as security.

Loan Amounts and Terms

The size and duration of financing vary between personal loans and business loans, influencing which option aligns best with your business needs.

Personal loans: These typically provide smaller sums suitable for immediate, less capital-intensive business needs.

Loan limits. Usually capped around $100,000, making them appropriate for smaller projects or startup costs.

Shorter repayment terms. Repayment typically occurs within one to five years, offering predictable, manageable monthly payments.

Business loans: Provide more substantial financing, making them ideal for substantial investments or longer-term projects.

Larger financing amounts. Business loans, including SBA loans, can range from hundreds of thousands to several million dollars.

Flexible repayment schedules. Terms typically span from a few years up to 25 years, especially for real estate loans, reducing pressure on monthly cash flow.

Long-term growth funding. Suitable for funding commercial real estate acquisitions, major equipment purchases, and significant working capital.

Purpose and Use of Funds

Understanding how you can utilize funds is crucial when choosing the right financing solution.

Personal loans: Offer flexibility but may include certain usage restrictions outlined by the lender.

Typical uses include:

Startup expenses and initial business costs

Debt consolidation to improve cash flow

Short-term operational expenses or bridging gaps in business cash flow

Business loans: Specifically structured to accommodate a wide range of business-related expenses, providing clearer guidelines and typically fewer restrictions.

Common business uses include:

Purchasing commercial real estate or business property

Equipment loans for new machinery or technology

Large-scale working capital needs, like payroll or inventory expansion

Long-term growth investments, such as acquiring competitors or expanding locations

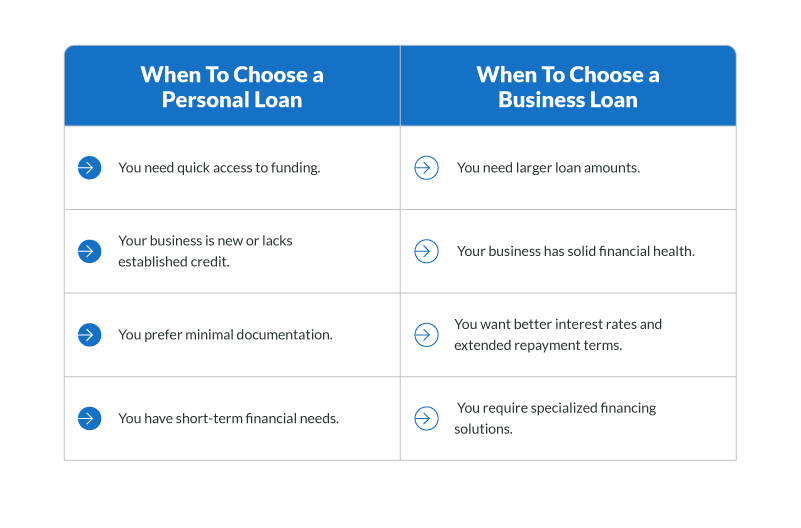

When To Choose a Personal Loan

Personal loans can be a convenient financing option for small business owners under certain circumstances. Consider choosing a small business personal loan if:

You need quick access to funding. Personal loans offer fast funding, often available within just a few business days, making them ideal for entrepreneurs who need immediate financial support.

Your business is new or lacks established credit. Personal loans rely on your personal credit score and income rather than business history, making it easier for startups or new small businesses to qualify.

You prefer minimal documentation. The application process is straightforward, often completed online, with little more required than proof of personal income and a credit check.

You have short-term financial needs. Personal loans typically cover immediate expenses such as small equipment purchases, initial inventory, debt consolidation, or temporary cash flow gaps.

When To Choose a Business Loan

Choose a business loan if your business requires more substantial financing, has an established financial track record, or is planning significant investments.

You need larger loan amounts. Business loans, particularly SBA loans, can offer substantial business funding suitable for major investments, such as commercial real estate, large-scale equipment purchases, or extensive operational expansion.

Your business has solid financial health. Established business owners with strong annual revenue, a stable cash flow, and good business credit scores are typically ideal candidates for business loans.

You want better interest rates and extended repayment terms. Traditional business loans and SBA loans generally provide lower interest rates and more flexible repayment schedules, easing cash flow management and reducing the overall cost of financing.

You require specialized financing solutions. SBA loans, equipment loans, and business lines of credit offer tailored terms specifically structured to support the unique financial and operational needs of small businesses.

FAQs About Small Business Personal Loans

Below, we answer some common questions:

Can I Use a Personal Loan for Business Purposes?

Yes, you can use a personal loan for business purposes, especially if you have a new or startup business lacking an established credit history. Personal loans are flexible financing options suitable for smaller or short-term business expenses. However, it's important to carefully assess loan terms, interest rates, and monthly payments to ensure this option aligns with your overall business financing strategy.

Do Business Loans Affect Personal Credit Scores?

In many cases, obtaining a business loan can affect your personal credit score, particularly if the loan requires a personal guarantee. Missing payments or defaulting on a business loan can negatively impact your personal credit. Conversely, timely repayment can positively influence both your business and personal credit scores, potentially improving your future financing options.

What Is the Minimum Credit Score Needed for a Business Loan?

Most traditional lenders and financial institutions typically require a minimum personal credit score of 680 or higher for business loans, including SBA loans. However, alternative lenders or fintech providers might have lower eligibility requirements, allowing business owners with credit scores as low as 600 to qualify, though usually at higher interest rates and stricter terms.

How Fast Can I Get Funding with a Personal Loan Compared to a Business Loan?

Personal loans typically have a fast and streamlined application process, often providing funds within a few business days or even the same day. In contrast, traditional business loans, especially SBA loans, involve detailed underwriting and financial disclosures, resulting in longer approval times—often several weeks or months. If you require immediate working capital, a personal loan might offer quicker relief.

Can a Startup Qualify for a Business Loan?

Startups can qualify for business loans, especially through specialized options like SBA 7(a) and microloans or equipment financing. Traditional lenders typically require a detailed business plan, realistic financial projections, and collateral to offset their lending risk. While startups may face stricter eligibility requirements, alternative financing options like merchant cash advances or online lenders may offer more flexible loan terms and quicker approval times, even if the borrower lacks a strong credit history.

Choosing the Right Loan for Your Business

Whether you're launching a new business or growing an established enterprise, understanding the differences between small business personal loans and business loans can significantly impact your financial health and growth prospects. Personal loans offer quick access and flexibility ideal for small, short-term needs, while business loans provide substantial funds with better rates suited for larger investments.

Ready to secure the funding that best fits your business needs? Clarify Capital offers expert guidance and competitive financing options tailored for small business owners. Explore your options and apply today to start achieving your business goals.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts