Diversity and inclusion are often at the forefront of economic discussions, making it important to understand the entrepreneurship experiences of people identifying as non-white, including Black, Hispanic, Asian, Pacific Islander, American Indian, and those of mixed ethnicity.

Key Takeaways:

Hawaii, Texas, and Florida are the best states for minority business owners.

Wisconsin, Alaska, and Iowa are the worst states for minority business owners.

14% of minority entrepreneurs started their business because their previous company let them go.

Over half of minority entrepreneurs (54%) are unaware of funding opportunities for minority business owners.

The Best States for Minority Entrepreneurs

The interactive table below ranks the 50 U.S. states as well as Washington, D.C., based on a handful of key factors influencing their favorability for business owners of non-white ethnicities. States with a higher overall score earned a higher overall rank.

Hawaii, Texas, and Florida led the nation as the top states for minority small business owners. These locations have proven to be fertile ground for diverse entrepreneurial ventures to not only sprout but flourish. Conversely, Wisconsin, Alaska, and Iowa landed at the other end of the spectrum, with conditions that may pose challenges to minority business growth.

Our findings revealed a broader geographical trend, where states west of the Mississippi River exhibited a more conducive environment for minority entrepreneurs compared to their eastern counterparts. This westward tilt in opportunity suggests possible differences in economic, cultural, and policy factors that influence the success of minority-owned businesses across the country.

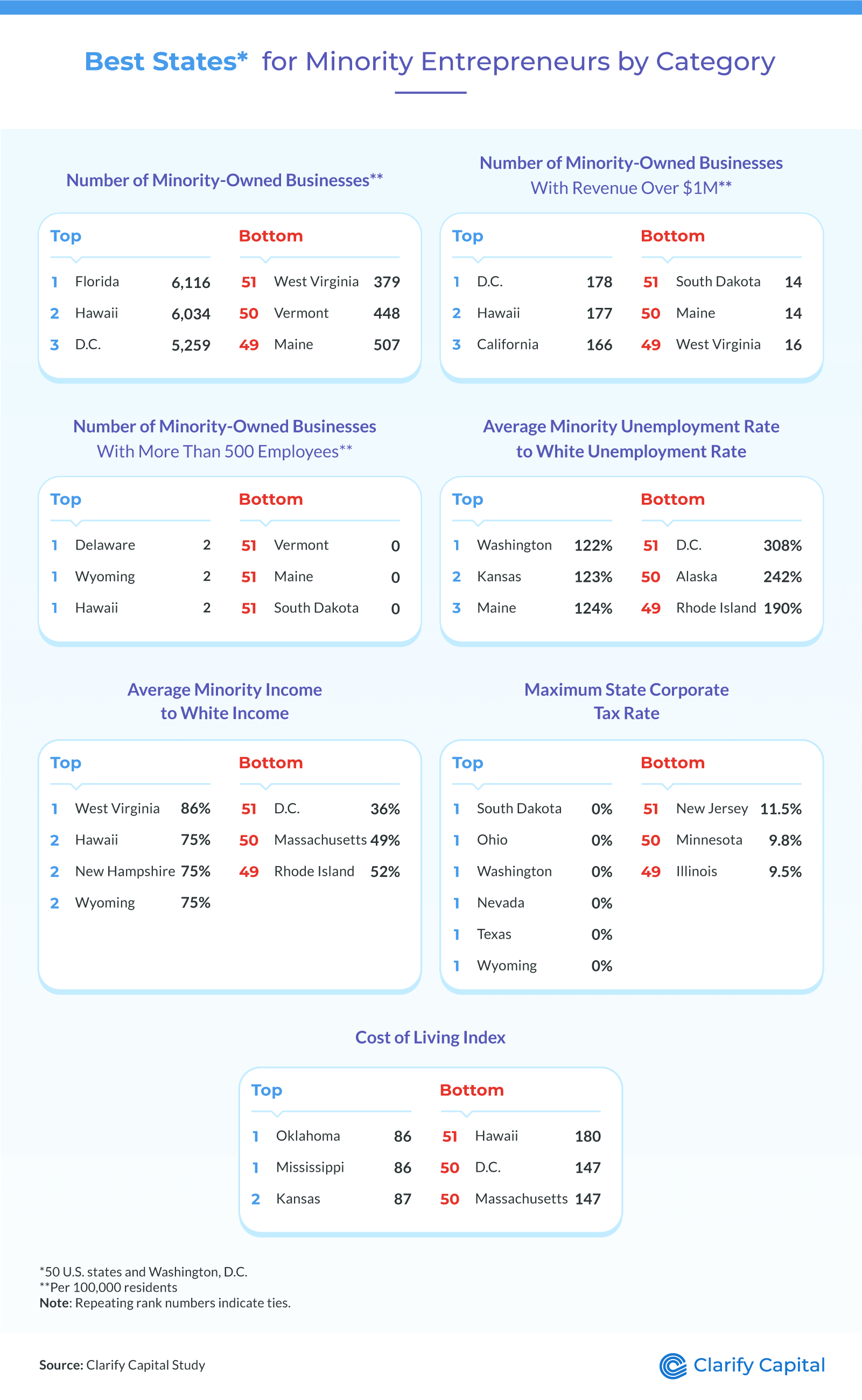

Next, we’ll break down the top-ranking states for minority small business owners by each category in our meta-ranking and take a look at the states that ranked at the bottom, too.

The spirit of diverse enterprise appeared to thrive in the sunlit streets of Florida, the lush landscapes of Hawaii, and the historic corridors of Washington, D.C. — these locations boasted the highest number of minority-owned businesses per 100,000 residents. Washington, D.C., and Hawaii also had the most minority-owned businesses per 100,000 residents with over $1 million in revenue.

Yet, this was marred by economic inequity in Washington, D.C., Massachusetts, and Rhode Island, where we noticed significant income gaps between white and non-white residents. West Virginia had the smallest income gap, with non-white workers earning $86 for every $100 white workers earned, but there’s still room for improvement.

These disparities extended to employment numbers as well. Washington, D.C., Alaska, and Rhode Island showed the most pronounced differences in unemployment when comparing white and non-white populations. For example, for every 100 unemployed non-minorities in D.C. there were 308 unemployed minority workers. This means minority-owned businesses in these areas may be less likely to start out on equal footing compared to white-owned businesses — on top of the challenges minority-owned (especially Black-owned) businesses disproportionately face compared to others.

Being a Minority Entrepreneur

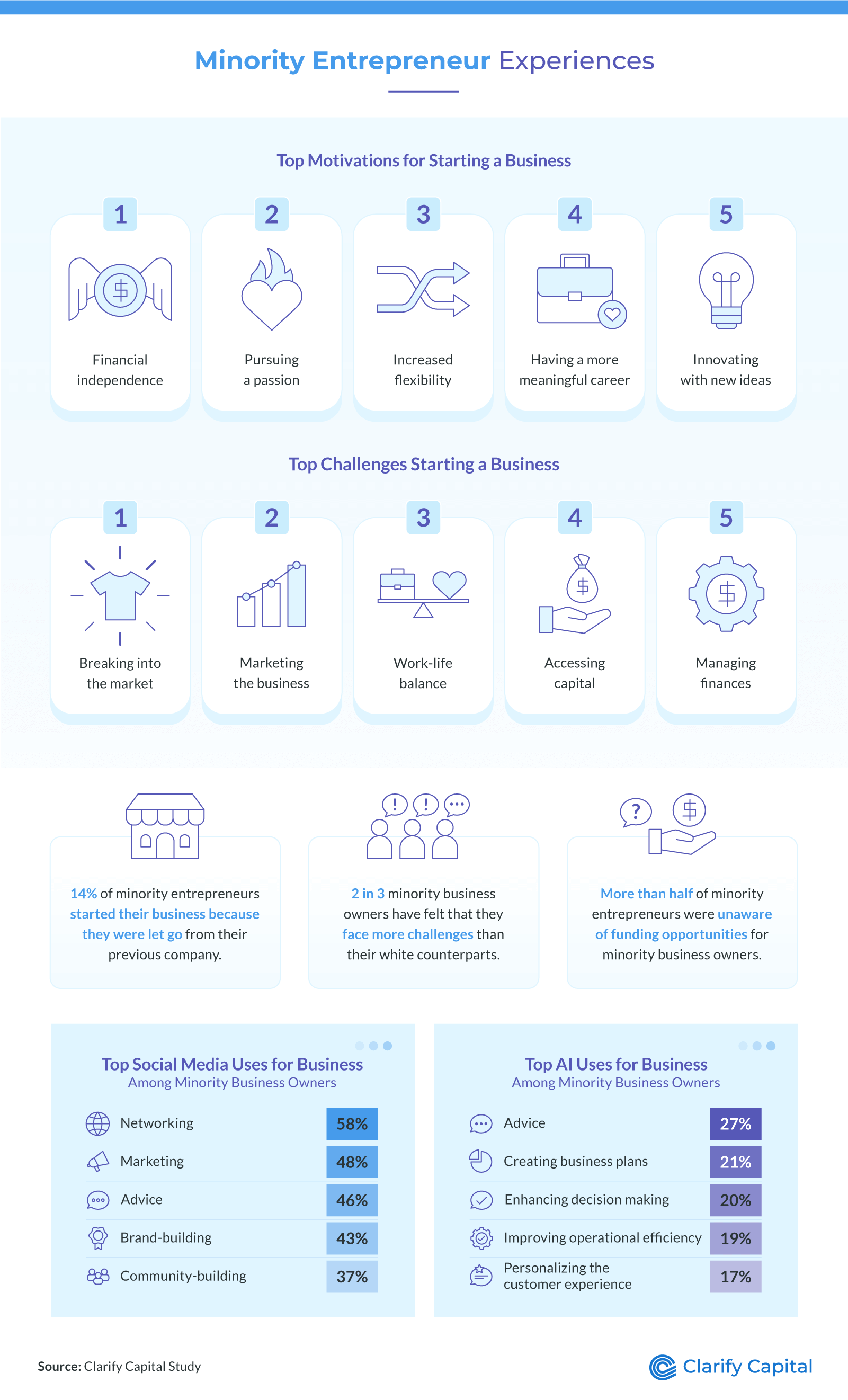

Beyond the economic picture illustrated by our business demographic analysis, we asked 500 non-white entrepreneurs about their business ownership experiences and sentiments.

Tech industry layoffs have resulted in a recent surge in entrepreneurship, with many laid-off workers embarking on new business ventures. This trend resonated with the experiences of 14% of the minority business founders we surveyed, who started their business because they were let go by their previous company. Overall, the top motivations for starting their own business included financial independence, pursuing a passion, and the greater flexibility of being your own boss.

Many of them could have had more help starting their business as well. Over half of the entrepreneurs surveyed (54%) were unaware of funding opportunities specifically tailored to minority business owners. At least technology can offer business owners a leg-up. Of those using social media for business, most respondents have used it for networking; among those using AI, most used it as a resource for business advice.

Starting a Business as a Minority

Our study shows that while some states like Hawaii, Texas, and Florida are great places for minority-owned businesses, residents in other states face greater challenges. There’s also a big gap in knowledge about funding and other help available specifically for these entrepreneurs. Moving forward, it’s important for key players, from government officials to local business groups, to help break down the obstacles minority entrepreneurs face.

This includes making sure they know about the resources out there for them and using technology and social networks to connect and grow their businesses. This not only helps minority business owners but also could make the American business scene richer and more diverse.

Methodology

We gathered data from various sources to determine the best states, including Washington, D.C., for minority business owners identifying as Black, Hispanic, Asian, Pacific Islander, American Indian, and mixed ethnicities, including the following:

U.S. Small Business Administration (number of minority-owned businesses and the number of those with revenue over $1,000,000)

U.S. Census Bureau American Business Survey (number of minority-owned businesses with more than 500 employees)

Economic Policy Institute (unemployment rates by race)

National Institute on Minority Health and Health Disparities (average income by race)

Tax Foundation (maximum state corporate tax rate)

Missouri Economic Research and Information Center (cost of living data)

Scores were normalized and then given the following weights:

Number of minority-owned businesses per 100,000 residents (20%)

Number of minority-owned businesses with revenue over $1M+ per 100,000 residents (20%)

Number of minority-owned businesses with more than 500 employees per 100,000 residents (20%)

Minority-to-white unemployment rate (20%)

Minority-to-white average state income (7.5%)

State corporate tax rate (7.5%)

Cost of living by state (5%)

Additionally, we surveyed 500 minority entrepreneurs about their experiences.

About Clarify Capital

Clarify Capital is dedicated to empowering small business owners by providing instant business loans up to $5 million with low rates and fast approval. We treat clients like family and offer a personalized and supportive experience for every entrepreneur.

Fair Use Statement

You are welcome to share these findings for noncommercial purposes, provided that you include a link back to this page.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts