Patients get seen. Claims go out. But the money only shows up weeks later, or sometimes not at all. Many health care providers feel that they're squeezed by slow-paying customers and delayed insurance reimbursements. The 2024 State of Claims report from industry giant Experian shows that year over year, claims denials are rising, pushing payments even further out for clinics and hospitals.

What is medical refactoring? It's a financing solution where a provider sells accounts receivable tied to insurance claims or patient balances to access immediate cash for operations.

Also known as medical invoice factoring, medical factoring is built for teams delivering real health care services that are stuck waiting on payers. It can help stabilize cash flow and reduce day-to-day cash flow issues you're battling because of payer delays and claim rework.

If working capital keeps slipping while you wait to get paid, factoring may bridge the gap so you can meet expenses on time and keep care moving. In the guide below, you'll see how it works, who benefits, what it costs, and how to choose the right partner so your practice can focus on patients, not paperwork.

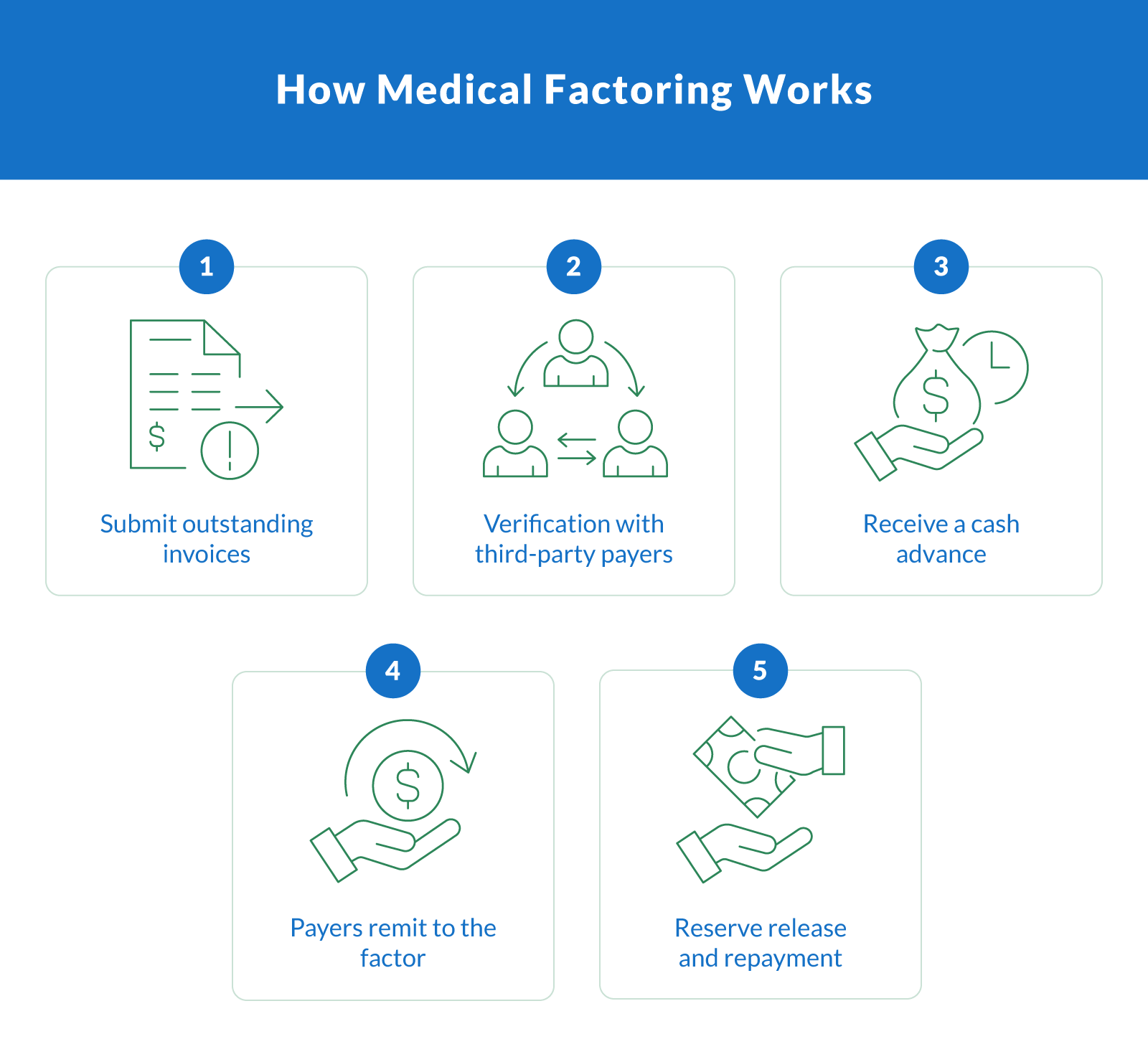

How Medical Factoring Works: A Step-by-Step Breakdown

Waiting on payers ties up the lifeblood of a practice: its working capital. Here's how it works when you use medical receivables factoring to turn accounts receivable into operating cash without financing. For context, Medicaid must pay 90% of clean claims within 30 days and 99% within 90 days. Unfortunately, that still leaves weeks where bills and payroll can't wait.

Here's how medical receivables factoring works in practice:

Submit outstanding invoices: You share recent claims, an A/R (accounts receivable) aging report, and basic practice details. The factoring company reviews payer mix, average invoice value, and claim status.

Verification with third-party payers: The factor validates eligibility and claim quality with Medicaid, Medicare, and private insurance to confirm the likelihood and timing of payment.

Receive a cash advance: Once approved, you get working capital against your receivables. This typically consists of advance rates of 80-95% of the invoice value, often within 24 hours, deposited into your business account.

Payers remit to the factor: Third-party payers send the claim proceeds directly to the factor. The factor then applies those funds to the related receivable.

Reserve release and repayment: After the payer's money arrives, the factor releases the remaining reserve to you, minus the agreed repayment fee. Your net cash equals the initial advance plus the reserve, less the factoring fees.

What this means for your practice: You convert the slow-moving receivables into immediate liquidity. The repayment happens automatically when Medicaid, Medicare, or private insurance pays out the claim (not through fixed monthly debt service). That structure can smooth cash gaps caused by things like batching cycles, edits, or appeals.

Exact advance rates and pricing depend on claim aging, payer reliability, and overall risk, but the core flow stays the same: verified claims in, cash advance out, then the balance is released when the payer funds the account.

Who Can Benefit From Medical Invoice Financing?

Some health care providers run lean, others run large, but all feel the crunch when payers take their time. If your revenue sits in A/R while expenses hit daily, medical factoring can steady the gap across many health care services and settings. Here's who can stand to benefit the most:

Private medical practices. Independent medical practices and medical providers have to deal with overhead while waiting for insurance reimbursement. Factoring frees cash to cover payroll, rent, and supplies.

Nursing homes and long-term care. Nursing homes and skilled health care facilities bill multiple payers, which slows down collections. Factoring smooths out cash between cycles.

Home health care agencies. Home health care teams advance caregiver hours long before claims get paid. Converting A/R helps keep visits staffed and compliant.

DME and supply companies. Durable medical equipment service providers face costs upfront for their inventory. Factoring unlocks cash tied up in payer approvals and rentals.

Diagnostic, lab, and imaging centers. Procedure-heavy medical businesses submit high-volume claims. Faster access to receivables supports reagents, maintenance, and throughput.

Behavioral and mental health clinics. Multi-visit plans and authorizations delay payment. Factoring supports staffing, scheduling, and expansion.

Medical staffing agencies. Staffing agencies and medical staffing firms have to meet weekly payroll, while hospitals pay on longer terms. Factoring bridges that mismatch.

Community clinics and urgent care. Volume swings and varied payer mixes strain working capital. Factoring stabilizes cash for supplies and scheduling.

Regardless of whether you're a solo practice or a multi-site network, converting account receivable to near-term cash via factoring keeps operations steady while payers process claims.

Medical Factoring vs. Other Health Care Financing Options

When cash is tied up in claims, health care businesses usually compare a few financing options: factoring, lines of credit, or medical billing term loans. Factoring isn't a traditional loan. It converts medical accounts receivable into working capital. There's no new balance to carry, and repayment occurs when the insurers pay the claims.

The Federal Reserve's 2025 small-business credit survey found that many small firms sought funding for operating expenses amid uneven cash flows. This helps explain why speed matters so much.

Why factoring is different: You sell verified receivables to a finance company, get an advance, and then the factor is paid by insurers. Funds land in your business bank account fast, so you can cover payroll, supplies, and scheduling once claims are clear.

| Medical Financing Options Comparison | |||||

|---|---|---|---|---|---|

| Option | Speed of funding | Debt vs. no debt | Collateral needed | Typical cost | Ideal use case |

| Medical factoring | Fast (often 24–48 hours) | No debt (sale of receivables) | None beyond receivables | Fee based on invoices and days outstanding | Bridging claim delays for practices with steady payer volume |

| Medical billing loans | Medium to slow | Debt (fixed payments) | Often personal/business guarantees | Interest + fees | Larger one-time needs when you prefer fixed amortization |

| Line of credit | Medium | Debt (revolving) | Usually collateral + guarantees | Interest on drawn amount + fees | Flexible cushion for seasonal swings, not tied to claim timing |

| Equipment financing | Medium | Debt (secured by asset) | Equipment itself | Fixed rate, term-based | Acquiring imaging, lab, or therapy equipment |

| Merchant cash advance | Fast | Not debt but expensive obligation | Future receipts | Factor rate, high effective cost | Emergency gaps — last resort for most in the medical industry |

How it fits: Factoring is a form of accounts receivable financing tied to medical billing, so approval centers on claim quality and payer mix rather than your balance sheet. Loans and lines of credit add liabilities that require scheduled payments regardless of insurer timelines.

If you need speed, minimal collateral, and funds that move with claim cycles, then factoring can be the most practical of the available financing solutions, especially when most revenue comes through insurers rather than at the point of service.

Benefits of Medical Factoring for Health Care Businesses

Providers choose factoring because expenses move daily, while reimbursements don't. Turning receivables into immediate cash flow helps you staff appropriately, keep schedules full, and avoid tapping high-cost debt. It's flexible too, as the facility scales as claims volume grows, which can steady cash flow through busy and slow seasons.

Fast access to capital. Funding can arrive in 24 hours, which helps clinics cover near-term needs without waiting on insurers.

No new debt on the books. Factoring converts receivables into cash, so there's no amortizing loan to service during payer delays.

More predictable working capital. Converting A/R reduces cash flow problems caused by batching, edits, and appeals, so payroll and vendors stay on time.

Admin relief on billing follow-ups. With professional factoring services, claim verification, and remittance tracking shifted off your team, you free hours for patient scheduling and revenue-cycle tasks.

Cover day-to-day spending. Use proceeds for operational expenses like payroll, rent, utilities, medical supply restocks, and equipment leases or repairs.

Scales with volume. As claims increase, approved capacity grows, making it an ideal fit for multi-site groups and expanding service lines.

Aligned with payer cycles. Because it's receivable financing tied to claims, the structure matches how revenue actually arrives from insurers.

Works alongside other tools. You can keep a credit card or line of credit for incidentals while using accounts receivable factoring for core operations.

Health care-specific partners. Experienced health care factoring teams understand HIPAA, payer rules, and clean-claim standards, which support smoother funding and patient experience.

Tailored support. Established medical factoring services can customize advance rates and reserves to match your payer mix and growth plans.

What Are the Costs and Risks of Health Care Factoring?

Factoring should be simple to understand, with price, structure, and privacy needing to be clear before you sign. Here's how the pieces fit together, how the factoring fee is computed, and what to ask a factoring company so that funding helps cash flow without surprises.

Pricing basics. The factoring fee is usually a periodic charge applied to the invoice amount, accruing until the payer remits. It's deducted from the reserve before the remaining balance is released.

Advance structure. Advance rates reflect claim age, payer mix, and risk. You receive most of the invoice amount up front; then the factor releases the rest at remittance.

Recourse terms. In recourse factoring, you agree to replace or buy back unpaid claims after a set window. It's typically cheaper because you share risk.

Non-recourse protection. Non-recourse or non-recourse factoring shifts are defined as nonpayment risk to the factor (usually limited to payer insolvency or specified denials) in exchange for higher fees.

Transparency check. Ask for a full fee schedule to avoid hidden fees like lockbox, due diligence, monthly minimums, or wire charges. Make sure to get it in writing.

HIPAA and BAAs. Verify HIPAA compliance, business associate agreements (BAAs), data handling, and access controls. Any health care factoring company worth your time should explain workflows without touching PHI (Patient Health Information) unnecessarily.

Term details. Review agreement length, termination provisions, and notice requirements. Clarify how reserves, disputes, and offsets are handled at closeout.

Operational fit. Confirm how payments from payers are posted, what happens with partial denials, and how disputes affect the timing of your remaining balance.

Cash flow impact. Because remittances repay the facility automatically, you get liquidity now and settlement later, aligning funding with insurer timing. It becomes a direct boost to cash flow.

Clarify Capital invoice factoring can provide up to 100% of the invoice value. No personal credit requirement and funded within 24 hours, with low documentation and rates as low as 0.5% per month.

Common Myths and Misconceptions About Medical Factoring

Factoring still gets mistaken for hard-sell collections or last-resort financing. In reality, reputable partners focus on clean claims, payer timelines, and patient experience, and not pressure tactics. Here are a few myths to clear up:

It's not a debt trap. You're converting receivables into liquidity through medical receivables financing and not adding a new loan balance. Funds arrive, then insurers repay the factoring provider. That structure can ease cash flow issues without fixed payments.

It's not a collection agency. Quality medical factoring companies validate claims, track remittances, and reconcile explanation of benefits (EOBs). They don't cold-call patients or chase copays as their workflow sits upstream of collections.

Your patient relationships stay intact. Reputable health care factoring companies work behind the scenes with payer portals and clearinghouses, coordinating with your billing team and insurance companies, not in your waiting room.

HIPAA compliance comes as standard. Established providers of factoring services sign BAAs, limit PHI access, and document controls. The goal is simple: accelerate payment from payers while protecting privacy.

It's built for health care operations. Factoring aligns with claim cycles and supports staffing, supplies, and scheduling. For practices dependent on reimbursements, it's a practical tool rather than a last resort.

How To Choose the Right Medical Factoring Company

Picking the right partner matters. In the health care industry, speed, compliance, and clear terms can make or break your cash position. Use this checklist to evaluate any factoring company before you sign.

Extensive industry experience. Prefer health care factoring companies that know HIPAA, payer portals, and clean-claim standards.

Transparent terms. Insist on written fee schedules, reserve rules, notice periods, and termination language so there are no surprises down the road.

Speed and reliability. Validate underwriting turnaround, typical funding windows, and how quickly remittances post.

Advance structure. Confirm advance percentages, reserve handling, eligibility criteria, and how claim aging affects pricing.

Putting patients first. Require BAAs, least-necessary PHI access, and workflows that avoid patient contact.

Reporting and support. Look for daily remittance reports, EOB reconciliation, and a dedicated account manager.

Reputation and scale. Check references, years in business, and health care client mix to gauge stability.

Back-office fit. Make sure there is smooth data exchange with your clearinghouse, billing software, and bank account.

Flexibility as you grow. Ask whether capacity scales with new locations, service lines, or seasonal spikes.

Capital strength. Assess the underlying finance company for financial stability and audit readiness.

Service alignment. Make sure the offered medical factoring services match your claim volumes, payer mix, and goals for medical factoring.

Get Started With Clarify Capital

You care for patients, not aging A/R. If slow reimbursements keep you stuck, medical factoring can turn tomorrow's claims into immediate cash today without new debt. Clarify Capital works with health care providers and medical practices to unlock working capital from verified receivables so you can cover payroll, supplies, and growth with confidence.

Qualifying is straightforward. If you generate at least $10,000 in monthly revenue, have been in business for 6+ months, have a business bank account, and have three months of statements, you may be ready to fund. Review the minimum requirements, then connect with a team that knows reputable medical factoring companies and the realities of health care billing.

Want faster funding and fewer cash crunches? Streamline your revenue cycle, keep schedules full, and focus on care — apply today.

FAQs About Medical Factoring

These quick answers walk through how medical factoring supports health care providers, how it connects to insurance reimbursements, what a factoring fee covers, and where medical claims fit in.

What Is Medical Factoring?

Medical factoring converts approved receivables from payers into near-term cash. A provider sells eligible A/R tied to medical claims and receives an advance. Then, the factor gets paid when insurers remit. It's not new debt, which helps practices stabilize operations while waiting on reimbursement. See related medical practice financing.

How Does Medical Factoring Work?

Medical factoring works by starting out with the submission of recent claims and aging. The factor verifies eligibility with payers, advances a percentage, and then receives remittances from insurers. After the payment clears, it releases the reserve minus fees. Settlement follows the claim, not a fixed schedule, which aligns funding with reimbursement timing.

What Is a Typical Medical Factoring Rate?

Costs vary by payer mix, claim aging, and risk. You pay a factoring fee on the invoice amount until the insurer pays, at which point the reserve is released. Clarify offers rates as low as 0.5% per month for qualified files. Always request a full fee schedule, including any minimums or wire charges.

How Does Factoring Apply to Insurance Reimbursements?

Factoring advances cash against claims owed by insurance companies. The factor verifies clean claims, eligibility, and status, then funds. When insurance reimbursements arrive, the factor applies payment, releases the reserve, and closes the item. This shifts timing risk off your practice while keeping patient billing and follow-ups with your team.

What Types of Health Care Providers Use Medical Factoring?

Many health care providers benefit from medical factoring, including private practices, home health, behavioral health, DME, labs, imaging, rehab, and medical staffing. If revenue depends on payers and A/R cycles, factoring can steady working capital during delays or denials. It's often used to cover payroll, supplies, and scheduling, while claims are clear.

How Is Medical Factoring Different From a Loan or Line of Credit?

Loans and a line of credit add debt with required payments, even when reimbursements lag. Factoring settles from insurer remittances, not your operating cash. It's tied to claim quality, payer reliability, and volumes. For plan-based financing comparisons, take a look at what makes up a medical practice loan.

How Fast Can I Get Funding Through Medical Factoring?

Speed depends on underwriting, claim quality, and payer mix. After setup, many files fund quickly and often within 24 hours for verified claims. Because settlement follows insurer payment, your advance can bridge operational gaps without adding fixed debt service while reimbursements on medical claims work their way through.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts