Qualifying Criteria for Private Money Lenders

Compared to banks and SBA lenders, private money lenders have more flexible underwriting guidelines, but there are still minimum requirements and eligibility requirements that most borrowers need to meet. Lenders look at overall creditworthiness, not just a single credit score or metric.

Here's what private lenders typically look for:

Credit Score: 500–650+

Many private lenders will work with businesses with bad credit, especially if your business has strong revenue or valuable collateral. Some may do a soft credit pull during the application process, but higher scores still unlock better terms and more loan options.

Monthly Revenue: $10,000 or More

Strong, consistent revenue signals your ability to repay. Most lenders require at least $10K in monthly business income or annual revenue that supports the requested loan amount to qualify for a loan or line of credit.

Time in Business: At Least 6 Months

While some lenders fund true startups, many want to see over six months of operational history and bank statements to verify business activity and cash flow trends.

Collateral: Optional, Depends on the Type of Loan

Unsecured loans are common, especially for short-term funding and MCAs. But for larger loan amounts, private lenders may require business or personal assets (equipment, real estate, receivables) as collateral for certain funding options.

Borrower Profile and Documentation

Expect to provide basic financials, like profit and loss statements, recent bank statements from your business bank account or business checking account, and your credit history. A clear use of funds, repayment plan, and business model helps build lender confidence and supports smoother underwriting.

How To Get a Private Business Loan in 4 Steps

Before applying with a private money lender, get your documents and pitch ready. Private lenders move quickly, but they still expect clarity, transparency, and proof that you can repay.

You can get a private business loan without going through a bank. Follow these four steps through Clarify Capital:

Apply online in minutes through Clarify.

Clarify matches you with private business lenders from its network of more than 75 non-bank providers.

Compare loan options and choose the offer that fits your cash flow and working capital needs.

Get funded in as little as one to two business days, depending on the lender and loan type.

Here's a checklist to help you prepare:

Build a short business plan that highlights what your business does and how it will grow.

Pull your financial statements. Include your most recent P&L statement, bank records, and balance sheet, where available.

Prepare collateral documentation if needed, such as property appraisals or equipment lists.

Outline a repayment strategy that explains how you will repay the loan from cash flow or future revenue.

Clarify your use of funds and exit strategy, so lenders see where the money is going and how you will close the loan.

Private vs. Bank/SBA Loans: Pros and Cons

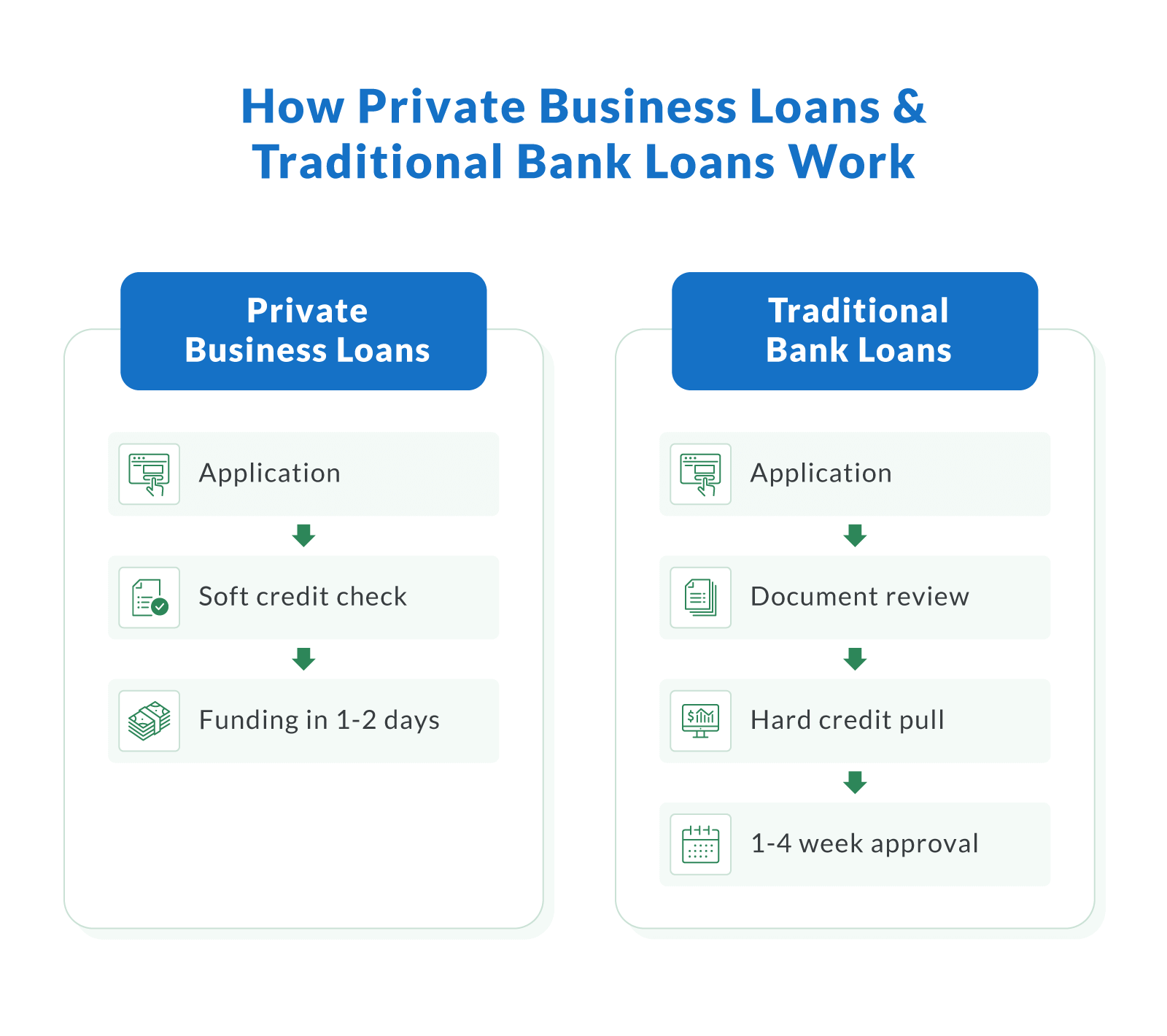

Not sure if you should go with a private lender or a traditional institution? Here's how they stack up across key decision points for small business owners, comparing alternative business funding options.

| Private vs. Bank/SBA Loans |

|---|

| Private business loans | Bank/SBA loans |

|---|

| Approval speed | Fast: get funds in 24–72 hours | Slower: 1–6+ weeks |

|---|

| Documentation | Flexible: minimal paperwork | Strict: full financial package required |

|---|

| Eligibility | Ideal for newer businesses or bad credit | Requires strong credit, revenue, and history |

|---|

| Interest rates | Higher interest rates (8%–40% typical) | Lower, especially with SBA guarantees (6%–12%) |

|---|

| Loan terms | Shorter terms (3–24 months) | Longer repayment options (up to 10 years) |

|---|

| Oversight and security | Less regulation, more lender flexibility | Heavily regulated, more borrower protection |

|---|

Private non-bank business loans are ideal when you need fast funding, have less than perfect credit, or don't want to deal with lengthy underwriting. Bank and SBA loans can be a better fit when you qualify for lower interest rates and larger long-term loan amounts.

Many small business owners use private loans to fill gaps when they don't meet SBA eligibility or can't wait for a full bank review. Bank, credit union, and SBA loans offer better rates and longer terms, but take more time and documentation to secure.

Legal Considerations With Private Money

Private business loans move fast, but that doesn't mean you should skip due diligence. Because private lenders aren't subject to the same regulations as banks, it's critical to review the terms carefully before accepting funding.

Some business owners worry that private business lenders are loan sharks or unregulated providers. Clarify Capital only works with established alternative finance companies and vetted providers. Many are licensed lenders, some are equal housing lenders or member FDIC institutions, and others include nonprofit lenders and community development organizations that focus on small business financing.

Here's what to watch for when looking into private business loans:

Have a legal advisor review the agreement. Don't sign any funding contract without understanding the repayment terms and structure, fees, and any personal guarantees.

Check your state's usury laws. Some states cap the maximum interest rate a lender can legally charge on small business loans.

Understand the full APR. Private lenders may present interest as a factor rate or flat fee, but you'll want to calculate the true annualized cost to compare options fairly.

Clarify all fees. Origination fees, prepayment penalties, or daily repayment schedules can impact your cash flow more than expected, and these details should be clear before you accept funding.

When working with a private money lender, a fast deal is only a good deal if the terms are transparent and sustainable for your business. Avoid predatory personal loans and work through vetted providers so your financing supports, rather than harms, your long-term creditworthiness.

Get Fast, Flexible Private Business Funding Today

Get fast access to private business loans through Clarify Capital. Small business owners can tap into private business funding from a network of more than 75 private business lenders.

Apply online today in under two minutes with no fees, no obligation, and no impact on your credit score. Your dedicated advisor will match you with the best funding options based on your business needs so you can get funded in as little as one to two business days, with same-day funding available for some term loans and lines of credit.

FAQ About Private Money Lenders for Business

If you're exploring private business loans, here are some common questions business owners ask before applying.

What Interest Rates Do Private Lenders Charge for Business Loans?

Private lender interest rates typically range from 10% to 30%, depending on the loan type, term length, borrower qualifications, and collateral offered. Some use flat fees or factor rates instead of traditional APRs. While rates are usually higher than bank loans, approvals are faster, and documentation is lighter, and lenders may offer different financing options based on your business credit and personal credit profile.

Are Private Loans Safer Than SBA Loans?

Private loans aren't necessarily "safer," but they offer more flexibility and faster access to capital. SBA loans tend to have lower interest rates and longer terms, but they require more paperwork and time and may involve specific down payments or collateral requirements. Private loans are a great option for businesses that need quick funding or don't qualify for SBA terms or prefer not to rely on business credit cards for larger expenses.

Can New Businesses Use Private Money Lenders?

Yes. Many private lenders fund startups and early-stage businesses that don't meet traditional bank criteria. However, ideally, they have been in business for six months or more. While newer businesses may face higher rates or need to offer collateral, private money can help bridge funding gaps quickly, so small business owners aren't limited to using a personal credit card or debit card to cover early costs.

How Do Private Business Loans Compare to Merchant Cash Advances?

Private loans often have longer terms, lower rates, and fixed repayment schedules compared to merchant cash advances (MCAs). MCAs take a daily or weekly percentage of your sales, which can strain cash flow because payments are pulled automatically from card transactions. For businesses with steady revenue, private loans can be a more manageable option.