Qualifying for small business loan requirements can feel overwhelming, particularly when each lender seems to have its own set of rules. Many small business owners hit bumps with their credit score, annual revenue, or lack of collateral, making the process confusing and frustrating.

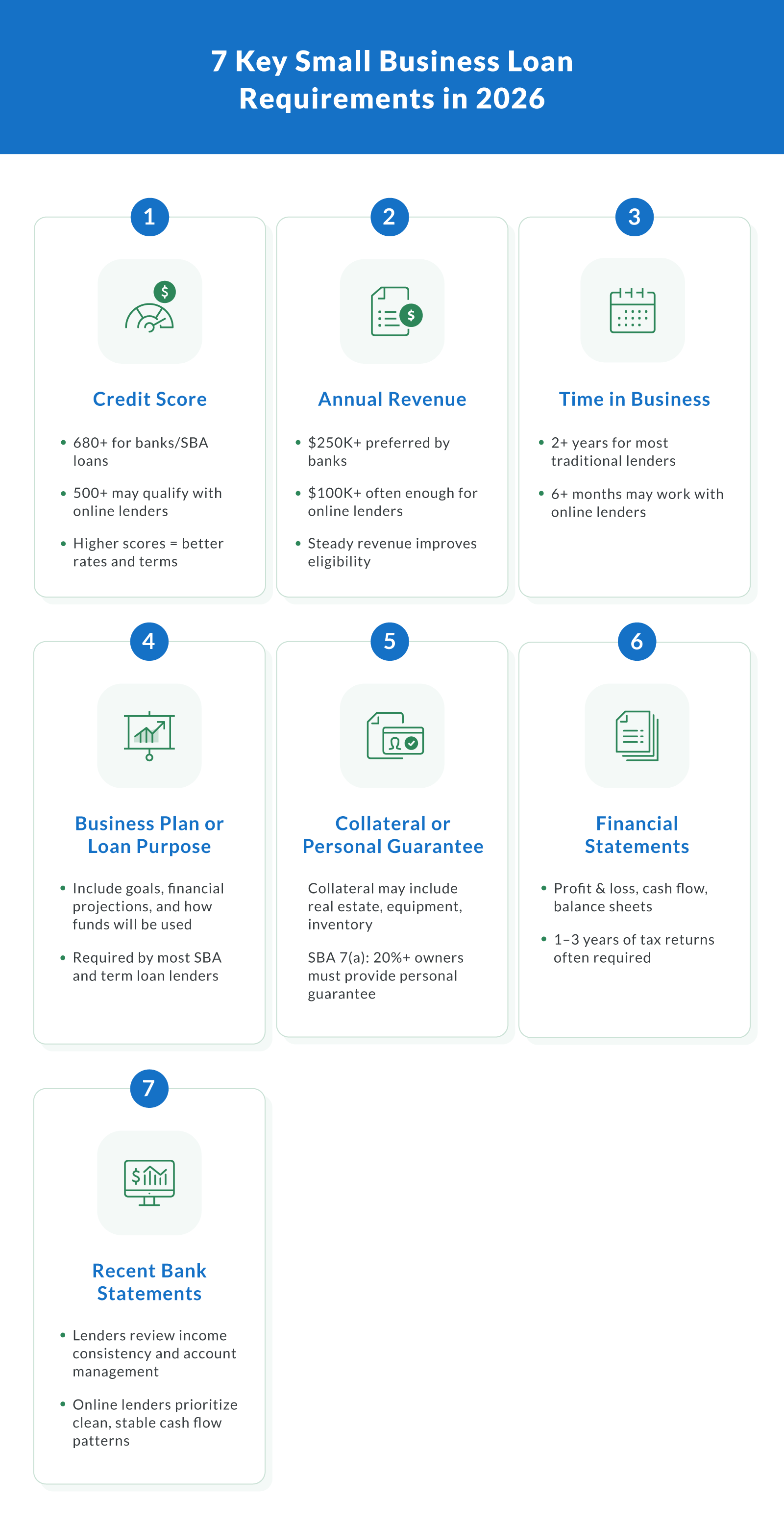

The good news is that most lenders look at the same core areas to decide if you're a good fit. At the heart of any small business loan decision is your ability to repay and how well the loan aligns with your business needs. This guide breaks down the key criteria into a simple checklist that you can prepare for: credit score, annual revenue, time in business, loan purpose or plan, collateral or personal guarantee, financial statements, and recent bank statements. Together, these show lenders your capacity to manage debt and your cash flow health.

While traditional banks and SBA programs often have stricter standards, many online lenders offer more flexible financing options, especially for businesses still building their financial foundation. Clarify Capital partners with a wide network to help you find the right match, even if one area isn't perfect.

By the end of this guide, you'll know exactly what lenders look for and how to prepare a stronger application that fits your loan terms and goals.

Credit Score Requirements

Lenders rely on your credit score to quickly assess your creditworthiness and risk level. Whether you're applying through a bank, an SBA lender, or an online provider, your credit profile plays a major role in determining your loan terms and approval odds.

Here's what small business owners need to know about credit score requirements when applying for financing:

Minimum score expectations. Traditional banks often require a score of at least 680, while SBA loans backed by the gov also expect a strong credit history. Online lenders may approve loans with credit scores as low as 500.

How score affects terms. Your credit score impacts interest rates, loan amounts, and term length. Higher scores result in more favorable offers, while lower scores may lead to higher costs.

What affects your score. Payment history, credit utilization, length of credit history, recent inquiries, and credit mix are key factors reviewed during underwriting.

Tips to improve your score. Pay your bills on time, lower your outstanding balances, and avoid taking on new debt before applying. Small improvements can lead to better financing options.

Annual Revenue Requirements

Your annual revenue is one of the most important factors lenders use to determine if your business can handle loan repayment. It reflects financial stability and directly affects the loan amount and terms you might receive.

Here's what small business owners should know about revenue expectations when applying for financing:

Minimum revenue thresholds. Traditional banks often require a minimum annual deposit of $250,000. Online lenders may approve businesses with $100,000 in yearly revenue.

Revenue affects loan terms. Strong, consistent revenue leads to better loan amounts, lower interest rates, and more favorable repayment structures.

Supports cash flow and working capital. Stable income helps ensure you can cover operating costs and maintain enough working capital to stay on track with payments.

Consistency matters. Even if your revenue is modest, steady growth over time can boost your financing profile.

Time in Business Requirements

Lenders use your business's operating history to gauge stability and risk. More time in business usually means more reliable financial data and a stronger case for eligibility.

Here's what business owners should know about time-based requirements:

Minimum time thresholds. Banks and SBA lenders typically require at least two years in business. This helps them assess long-term viability.

Flexible options for newer businesses. Online lenders may approve startups with just 6 months of operations, especially if cash flow is strong.

Startups can still qualify. Even as a new business, showing growth and a clear plan can meet the eligibility standards of alternative lenders.

Business Plan or Loan Purpose

Lenders need to see that you have a clear, strategic reason for seeking funding. A well-prepared business plan or defined loan purpose helps them understand your goals and how repayment will be managed.

Here's what to include to meet lender expectations:

Detailed business plan. Most loan programs require financial projections, revenue strategy, and competitive analysis to evaluate your funding request.

Loan purpose alignment. Explain how the funds will meet specific business needs, such as expansion, working capital, or equipment upgrades.

SBA-specific documentation. The Small Business Administration may require additional details, especially for larger or more specialized loans.

Collateral or Personal Guarantee

Lenders often require reassurance that they can recover funds if a loan goes unpaid, so they look for collateral or a personal guarantee before approving larger financing requests.

Here's what small business owners should know about how these requirements work:

Types of collateral accepted. Common options include commercial real estate, equipment, vehicles, and inventory that lenders can claim if you default. Accounts receivable or other business assets may also qualify, depending on the loan terms.

Personal guarantees and SBA 7(a) loans. For SBA 7(a) loans, anyone owning 20% or more of the business must sign as a guarantor, meaning they are personally responsible for the debt if the business is unable to repay it.

Secured vs. unsecured loans. Secured loans backed by collateral often offer lower interest and longer repayment periods, including fixed‑rate options. Unsecured loans don't require assets but may carry higher costs due to increased risk.

Refinance considerations. If you already have collateral tied to existing debt, refinancing can help restructure your exposure or improve your terms with a new lender.

Understanding how collateral and guarantees affect your application can help you choose the financing path that best fits your business goals.

Financial Statements and Tax Returns

Lenders use financial documents to evaluate your business's ability to manage monthly payments and repay new or existing business debts. Keeping these records organized and accurate is essential when applying for financing, especially from a financial institution or when refinancing.

Here are the key documents lenders typically request:

Profit and loss statements. Show whether your business is generating income or operating at a loss.

Balance sheets. Highlight your assets, liabilities, and equity to give a full financial snapshot.

Cash flow statements. Help lenders assess whether you can cover loan payments without disrupting operations.

Tax returns (one to three years). Used to verify income and spot trends in your business's financial history.

Strong documentation not only improves your application's credibility but also supports your eligibility for better loan terms.

Bank Statements

Lenders use your recent business bank statements to verify income, evaluate cash flow, and assess how you manage your financial activity. These records play a crucial role in both traditional and alternative business financing applications.

Here's what lenders typically look for in your bank statements:

Revenue consistency. Lenders want to see regular income deposits that support repayment.

Cash flow patterns. Stable balances and responsible spending habits help demonstrate financial health.

Account management. Avoiding overdrafts and maintaining healthy balances can improve your approval odds.

Many online lenders prioritize bank statements for faster approval, especially for financing options like business lines of credit or working capital loans. Clean records can lead to better terms and show that you're ready to manage new funding responsibly.

SBA Loan Requirements (Additional Consideration)

Because SBA loans are partially guaranteed by the Small Business Administration, lenders take on less risk. That backing makes financing more accessible for many small business owners, with competitive interest and longer repayment terms. At the same time, the SBA loan requirements are stricter, and the process involves more documentation than other financing options.

Here are the key qualifications lenders look for with SBA funding:

Strong credit profile. A solid credit history improves your odds of approval and better terms.

Collateral and personal guarantees. Certain loan types require collateral, and owners may need to personally guarantee the loan.

Detailed financial documents. Profit/loss statements, tax returns, and cash flow records help lenders assess your repayment ability.

Clearly defined use of funds. SBA lenders want to see how the money will support your business needs.

Business eligibility criteria. Your company must be for‑profit, based in the U.S., and meet the SBA's size standards.

Working with an SBA preferred lender can make the process smoother, as these financial institutions are authorized to make final decisions on behalf of the SBA. You may also work with a development company like a Certified Development Company (CDC) when applying for SBA 504 loans for long‑term fixed assets.

SBA loans remain a strong loan program for businesses that meet the criteria and need affordable, long‑term funding.

Bank vs. Online Lender Requirements

When applying for small business loans, it helps to know how lenders differ between traditional banks and online lenders. These differences can affect your approval odds, interest rates, and how long the underwriting process takes.

Here's how requirements typically compare:

Traditional banks and financial institutions. They usually require higher eligibility standards, like strong credit scores (often 600 or higher), at least $250K in annual revenue, and two or more years in business. Their underwriting is thorough and often involves extensive documentation and in‑person meetings.

Online lenders. These lenders offer more flexible criteria and faster decisions. Many accept credit scores as low as 500, approve businesses with six or more months of operating history, and require fewer documents, making them a good fit when you need rapid funding.

Interest rates and speed. Banks often provide lower interest rates but take longer to approve, especially for larger or more complex loans. Online lenders may charge higher rates in exchange for speed and convenience, especially for short-term or unsecured type of loan options.

Matching your business needs to the right lender can make a big difference. Whether you prioritize low rates or fast access to capital, understanding these differences helps you choose the best financing fit for your goals.

Take the Next Step To Qualify

Getting approved for small business loans starts with understanding what lenders look for. The seven core requirements — credit score, annual revenue, time in business, business plan or loan purpose, collateral or personal guarantee, financial statements, and bank statements — form the foundation of most applications.

By reviewing these areas ahead of time, you can strengthen your position and improve your chances of approval. Assess your credit, organize your finances, and clearly define your business needs. This preparation helps you avoid delays and choose the right financing options for your situation.

And if you aren't perfect in every category, that's okay. Clarify Capital works with a large network of lending partners, many of whom offer more flexible criteria than traditional banks. Even if you're building credit or just starting out, there may still be funding options available to help your business grow.

Get a no‑obligation prequalification in two minutes to see what you may qualify for without a hard credit pull. Whether you're exploring long‑term growth or short‑term cash flow support, Clarify Capital is here to help.

FAQ About Small Business Loan Requirements

If you are preparing to apply for funding, you probably have questions about how lenders review applications. These answers cover common concerns small business owners have when evaluating their loan options.

How Much Can You Qualify For?

Lenders use your financial profile to estimate the loan amount you may qualify for. They look at your annual revenue, working capital, business debts, and credit profile to make sure you can handle monthly payments over the life of the loan.

Typical qualification patterns include:

Revenue‑based estimates. Many businesses qualify for a loan of between 10% and 30% of their annual revenue.

Stronger financials. Higher revenue and stable cash flow improve your chances for larger loan amounts.

Debt management. Reducing existing business debts and bolstering working capital often increases your borrowing capacity.

Improving your credit and financials before applying can help you qualify for higher loan amounts with better terms.

What Determines Your Interest Rate?

Your interest rate depends on factors that affect lender risk. These include personal and business credit history, revenue consistency, industry, and whether the loan is backed by collateral.

Key rate influences:

Credit and financial history. A strong credit profile typically results in lower rates.

Rate structure choice. A fixed rate remains constant throughout the term, while variable rates change with market conditions.

Refinancing opportunity. As your business financials strengthen, refinancing may help you obtain a lower rate from another financial institution.

Higher rates often reflect higher risk, but improving your financial profile can lead to better pricing.

Is It Hard to Get a Small Business Loan?

Approval depends on your profile and where you apply. Traditional banks and FDIC‑backed lenders often have stricter standards, including high credit requirements, steady revenue, and longer time in business.

General patterns by lender type:

Banks and FDIC lenders. Often require strong revenue, high credit scores, and thorough documentation.

SBA loans. Provide favorable terms, but involve more paperwork and eligibility steps.

Online lenders. Tend to have more flexible eligibility criteria and faster decisions.

Working with lenders that match your profile increases your chances of approval.

Can a Start-Up LLC Get a Loan?

Startups often struggle because they lack an established credit history and consistent revenue. Many lenders prefer at least six to 12 months of operation and reliable cash flow before approving term loans.

For newer businesses:

Short‑term financing. Some products are designed to meet early‑stage needs.

Down payments or personal capital. Using personal funds can help secure other financing.

Alternative paths. Crowdfunding and similar resources may provide initial capital.

Clarify Capital does not currently fund brand‑new startups, but planning and preparation can help you qualify for future financing.

What Disqualifies You From Getting a Business Loan?

Several issues can lead to a denial, and understanding them helps you strengthen future applications. Common disqualifiers include:

Low credit score. Poor credit often leads to rejection because lenders view you as a higher risk.

High business debts. If too much of your revenue goes toward existing payments, lenders may be unwilling to add new obligations.

Incomplete documentation. Missing or inconsistent records often trigger red flags during the underwriting process.

Other issues can arise during in‑person review at some banks, but addressing core financial gaps first often improves your chances.

How Can I Get an SBA Loan for a Startup With No History of Profit?

SBA loan requirements typically involve demonstrating stable revenue or profitability, which makes it challenging for early-stage startups. However, some paths can improve your chances.

Options to consider:

SBA microloans. These have lower limits and slightly more flexible requirements.

Strong business plan. Showing exactly how funds support growth helps lenders evaluate your case.

Alternative support. Personal capital or early‑stage funding programs can bridge the gap until you qualify for a traditional SBA loan.

A thoughtful plan and preparation improve your chances of meeting SBA criteria.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts