Dealing with business debt is a normal part of running a company, but how you manage that debt has a real impact on profit and long-term stability. At some point, many owners begin to look at how to refinance business loan obligations because something feels off. Perhaps the interest rate is too high, monthly payments keep squeezing cash flow, or the original lender no longer feels like the right fit.

In many cases, the first business loan came together fast. You might have accepted a higher interest rate because you were a new borrower or needed funding quickly. As your numbers improve and the business becomes more stable, refinancing becomes a way to replace the old agreement with one that offers a lower interest rate, better repayment terms, and less pressure on your cash flow.

Refinancing simply means replacing the existing loan with a new loan from either the same lender or a different lender that matches your current needs. In the sections that follow, we'll walk through how refinancing works, when it may make sense for a small business loan, and how to compare offers.

What Does It Mean To Refinance a Business Loan?

Refinancing a business loan means replacing your current loan with a new loan that better fits your situation. The new lender pays off the existing loan in full, so you're left with one new agreement. From that point on, your loan payments, loan term, and repayment terms follow the new deal, not the old one.

Most owners refinance a business loan because they want a lower rate, a payment schedule that doesn't choke cash flow, or a structure that makes their business financing easier to follow. Sometimes the goal is to refinance debt into a single payment instead of making multiple payments on three or four different loans every month. In other cases, the goal is to free up working capital for hiring or inventory.

You can refinance many types of funding. Some businesses may transition an SBA 7(a) loan into another option within the SBA loans family, or into a conventional term loan with a different lender. Others replace a high-cost merchant cash advance with a working capital loan that has clearer repayment terms and a set loan amount. Equipment loans and short-term loans can also be refinanced, especially if the original payments feel steep.

Picture a contractor who rushed into an expensive short-term loan during a busy season. By refinancing into a longer loan term with a lower rate, the contractor can lower their monthly payment and keep more money in their budget for materials and staff rather than watching it all go toward interest.

Benefits of Refinancing Your Business Loan

Refinancing gives you a way to reshape business debt so it fits your current plans instead of the moment you first signed the papers. The benefits of refinancing depend on your numbers, but most borrowers look for a mix of savings, better cash flow, and simpler management compared to the original loan and repayment setup.

Lower interest rates. A lower interest rate reduces the total amount of interest you pay over the life of the loan, which matters a lot for bigger balances or a longer loan term.

Lower monthly payments. A better rate or adjusted loan term can lead to lower monthly payments, which frees up cash flow for everyday expenses instead of sending so much to debt.

Fixed-rate stability. Switching from a variable rate to a fixed rate keeps loan payments predictable, even if market rates increase in the future.

Debt consolidation. Refinancing through business debt consolidation loans can roll several loans and even a business credit card balance into one lump sum with a single payment date.

Access to new funds. Some business owners increase the loan amount during a refi to tap extra working capital for hiring, inventory, or marketing.

For example, a company might replace an original loan with a high rate and short term with a new term loan that has a lower interest rate and a slightly longer schedule. The monthly payments drop, cash flow improves, and the total amount paid in interest over time can also decrease, depending on the structure of the new financing options.

How To Refinance a Business Loan: Step-by-Step Guide

Refinancing feels less confusing when you walk through it step by step rather than guessing your way through the numbers. A simple process helps you compare financing options, determine whether you're actually saving money, and avoid surprises later.

Clarify Capital can also help by gathering offers from different lenders and talking through what each option means for your business financing.

Review your current loan details. Start by gathering all documents related to your current loan. Consider the interest rate, remaining loan term, payoff total amount, and any prepayment penalties or balloon payment at the end. That information gives you a clear baseline, so you know what a better deal looks like.

Check your credit and financial health. Take an honest look at your business credit, personal credit, current revenue, and cash flow. Stronger creditworthiness and cleaner financials usually improve your eligibility for a lower rate and more favorable terms during underwriting.

Compare lender offers and loan options. Shop around and explore different financing options, such as a small business term loan, a business line of credit, or a working capital loan. Clarify's marketplace can show you several offers for the same loan amount, each with its own repayment period, fees, and rate structure. Lay them out side by side and focus on competitive rates and total costs, not just the headline number.

Calculate potential savings and costs. Compare the life of the loan cost for your existing agreement with each new option. Factor in origination fees, any prepayment penalties on the old loan, and closing costs on the new one. A basic loan calculator or spreadsheet works well for mapping out loan payments across the full repayment period.

Complete the loan application and close. When you're comfortable with one offer, move ahead with the loan application. Be ready to provide financial statements, recent bank statements, and any collateral details required for certain types of business financing, such as commercial real estate or real estate loans.

After final approval, the new business loan pays off the old one, and you begin making payments under the refinanced agreement.

When Does Refinancing Make Sense?

Refinancing usually makes sense when the numbers support it, not just your gut feeling. You want a clear benefit on paper and a stronger business credit score or overall creditworthiness than when you first took on the debt. It also helps to think about the current rate environment, the shape of your existing debt, and where you want the company to be in a year or two.

So, it may be worth a closer look if:

Rates have improved. Market rates dropped after you signed the original agreement, so replacing high interest rates with a new offer over a similar loan term could lower what you pay overall.

Your credit profile is stronger. Your business credit score and personal credit have improved, which can help you qualify for better repayment period options and more flexible loan payments.

Cash flow feels tight. Current payments keep pulling too much cash flow out of the business, and stretching the schedule slightly could ease that pressure.

You carry multiple loans. You have several portions of existing debt and would rather consolidate them into a single lump sum with one clear plan.

To find your break-even point, compare the interest you would pay over the new loan term with what you would pay if you stay put. Then add fees or prepayment costs and see how many months of lower payments it takes before you're truly ahead.

Types of Business Loans You Can Refinance

Most types of business financing can be refinanced in some way, although some are much easier to replace than others. It helps to know where your loan sits before you start comparing loan options or talking with a new lender about refinancing.

Term loans. A common target for refi across many types of business, including short-term and longer-term loans, is often swapped for a new term loan with a better interest rate and clearer schedule.

SBA loans. An SBA lender or conventional bank may help refinance SBA loan balances, especially SBA 7(a) loans backed by the Small Business Administration.

Equipment loans. These equipment loans can sometimes transition into a structure with lower monthly payments or a longer term while the equipment still holds value.

Business lines of credit. Owners may refinance a costly business line of credit into a fixed-term line-of-credit loan if the balance rarely gets back to zero.

Merchant cash advances. A lump-sum refi can replace expensive advances with a structured term loan and more precise repayment terms, sometimes linked to real estate loans or commercial real estate in more complex deals.

How Refinancing Affects Cash Flow and Growth

Refinancing can change how money flows through your business month to month. If you can shift to a lower interest rate or extend the repayment terms a bit, the loan payments often decrease. A greater portion of the total amount you bring in remains in the business as working capital rather than going straight to the lender.

Those extra dollars can go toward real business needs. Some owners put the savings into hiring, a small equipment upgrade, fresh inventory, or a new marketing channel they have wanted to test. With the right financing options, refinanced working capital loans or a new business loan can also support stronger business credit over time.

Common Mistakes To Avoid When Refinancing

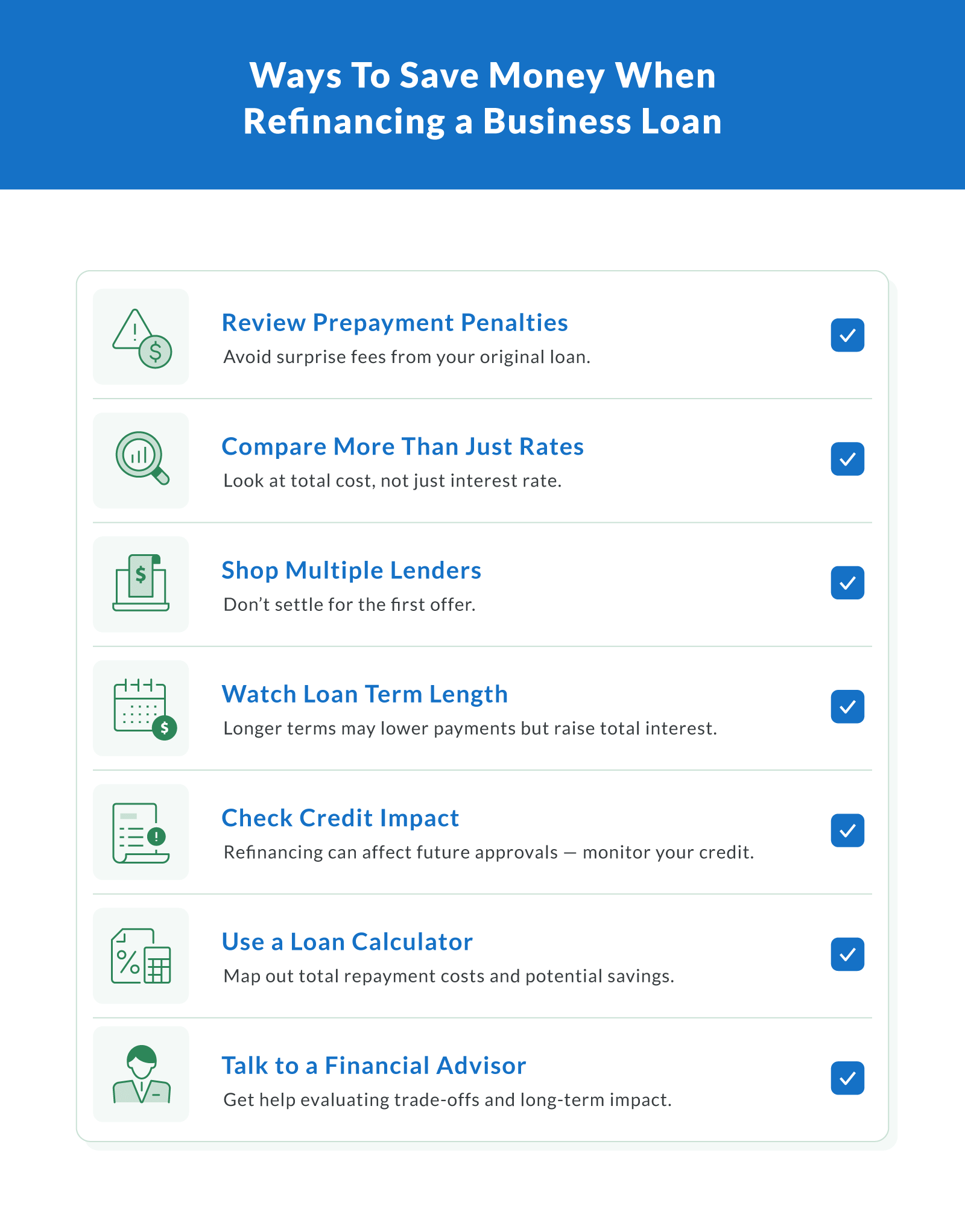

Refinancing can help clean up your balance sheet, but a few common mistakes can quietly eat into your savings. It helps to slow down and watch for these trouble spots before you sign anything.

Ignoring prepayment penalties. Some owners skip the fine print on their existing loan and miss prepayment penalties that cut into the benefit.

Focusing only on the rate. A lower interest rate might look great, but fees, loan term length, and disclosures about total cost matter just as much.

Skipping comparison shopping. Accepting the first offer means you may miss better business financing options from other lenders.

Extending the term too far. Stretching the repayment period can lower the monthly bill, but it will increase the total amount of interest over time.

Overlooking credit impact. Refinancing can affect personal credit and future approvals, so it's helpful to review the full picture.

Before you proceed, consider talking with a trusted financial advisor or accountant who can help you navigate the tradeoffs.

Save More by Partnering With Clarify Capital

If you think you might be overpaying on your business loan, it usually makes sense to check. Clarify Capital works like a marketplace for business owners, comparing multiple lender offers, competitive rates, and refinancing options in one place. Our team can help you review the numbers, talk through favorable terms, and support the application process from start to finish.

See how much you could save when you refinance business loan obligations. Get a free, no-obligation quote and apply today with Clarify Capital to explore a lower rate and healthier cash flow.

FAQ About Refinancing a Business Loan

Refinancing raises a lot of practical questions, especially if you have never changed a business loan before. It helps to clarify a few basics around timing, credit impact, and how the refinancing process usually works. These FAQs give a quick starting point before you decide to refinance business loan obligations.

How Long Does It Take To Refinance a Business Loan?

Most refinances take about two to four weeks from application to funding, depending on lender approval, underwriting, and loan size. Marketplaces like Clarify Capital can often shorten the funding time by organizing details upfront.

Can You Refinance a Business Loan With Bad Credit?

Some lenders will still consider refinancing with bad credit if revenue and cash flow look strong. Clarify Capital works with several partners and can explore refinancing options based on your business credit score and overall eligibility.

Does Refinancing a Business Loan Hurt Your Credit Score?

A new application usually triggers a credit inquiry that may cause a small, temporary dip in credit scores. Over time, on-time payments on the refinanced loan can support healthier business credit.

Can You Refinance Multiple Business Loans at Once?

Yes. Debt consolidation lets you refinance business loan balances from several accounts into one new agreement. That move can change repayment terms, loan amount, and the combined interest rate while giving you a single monthly payment.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts