Don't panic if your business loan denied message landed in your inbox; it happens more often than you think. For many small business owners, a loan application rejection can feel discouraging, but there are still solid paths to business financing ahead.

Lenders look at things like your credit score, cash flow, time in business, lenders' risk criteria, collateral, and existing debt. If one of those areas doesn't meet their standards, a bank might say no even if your business is otherwise sound and growing. The good news is that most of these issues can be addressed, and they're not the end of your funding journey.

Alternative lenders often have more flexible requirements and can help you get back on track faster. In this guide, we break down the five most common reasons a loan is rejected and provide practical steps to address them. You'll also learn how Clarify Capital helps small business owners secure funding after a denial elsewhere, with access to a broad network of partners and same‑day approval possibilities.

You're not alone in this, and a “no” today doesn't mean “no” forever.

Why Was Your Business Loan Denied?

When a loan application gets rejected, it usually comes down to how lenders assess risk. They look at your creditworthiness, cash flow, time in business, available collateral, and existing debt to decide if you can handle repayment. If one of these areas falls short, lenders may see you as too high‑risk and decline your request.

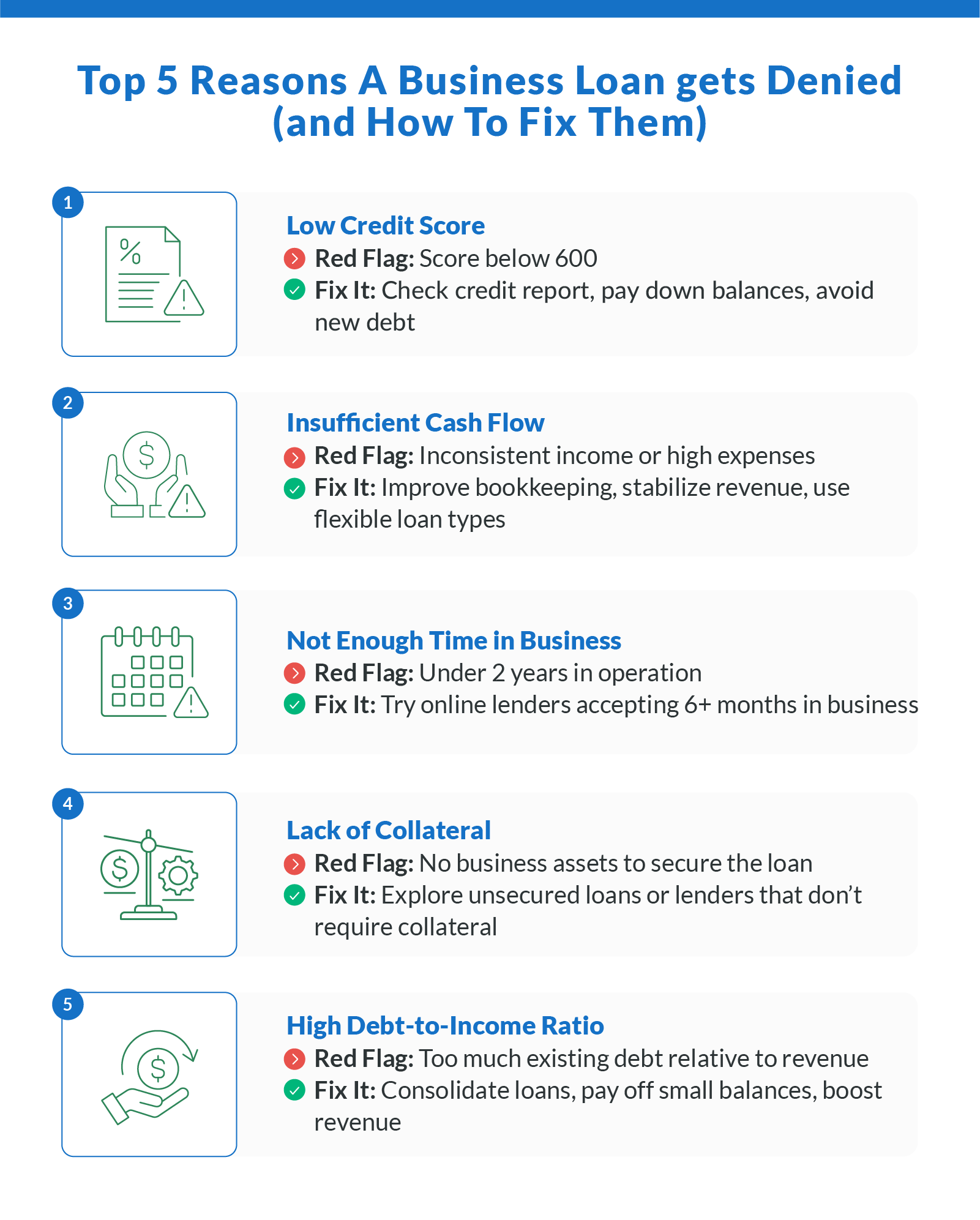

Below are the five most common reasons a business loan is denied, and, more importantly, how to fix them.

Poor or Low Credit Score

Your credit score, including both personal credit score and business credit score, is one of the first things lenders check. A poor credit score signals a higher risk of missed payments, so many traditional banks set strict thresholds.

Online lenders tend to be more flexible, but low scores can still be a hurdle for many borrowers. Clarify Capital works with scores as low as 550, helping more business owners stay in the running. Reviewing your credit report for errors and paying down balances can boost approval odds over time.

Insufficient Cash Flow

Cash flow is a major indicator of your ability to repay a loan. If your revenue is inconsistent, invoices are delayed, or more money goes out than comes in, lenders may flag your application due to insufficient cash flow.

This is one of the most common reasons for rejection, but it's also fixable. Improve bookkeeping, stabilize income streams, or choose a product that aligns with your cash flow patterns. A short-term business line of credit or another flexible option might better fit your situation.

Not Enough Time in Business

Many financial institutions require at least two years of operating history, which can make things hard for startups and early‑stage companies. Without an established track record, traditional lenders often won't approve the application.

If you're a new business, you're not out of options. Clarify Capital works with small business owners who've been operating for at least six months or more, giving newer companies a real shot at funding when banks say no.

Lack of Collateral

Some lenders require collateral, like real estate, equipment, or inventory, to secure a loan. If your business doesn't have enough collateral or you're not sure what counts as acceptable assets, that can lead to a denial.

Alternative financing options can help you avoid this hurdle. Many online lenders, including those in Clarify Capital's network, offer products that don't require collateral, relying instead on cash flow, credit score, or time in business.

High Debt-to-Income Ratio

Your debt-to-income ratio (DTI) measures how much of your monthly income goes toward existing debt. If this ratio is high, lenders may worry you won't manage new repayment terms, especially if you're also juggling a business credit card or other obligations.

To improve this ratio, consider consolidating credit card balances, renegotiating payment terms, or paying off smaller debts. Lowering your DTI improves your financial profile and increases your chances of future approval.

What To Do After Your Business Loan Is Denied

A loan denial can feel like a major setback, but it does not have to end your funding journey. Many small business owners reapply successfully after making focused improvements. Understanding why your application fell short and knowing your next steps can help you find financing options that work better for your situation.

Review the Reason for Denial

Start by identifying why your loan was declined. Under the Equal Credit Opportunity Act (ECOA), lenders must give you an adverse action notice explaining the reason for the denial.

Review this notice carefully. It will highlight red flags such as a low credit report score, inconsistent revenue, or missing documents that may have affected your application. Once you know the specific issue, you can fix it or seek out providers with different approval criteria.

Improve Your Credit Before Reapplying

If your credit is the problem, there are steps you can take before you reapply. Check your personal credit and business credit reports for errors. Lower your utilization rate, pay down balances, and avoid new credit inquiries.

Even modest improvements in your credit score can boost your approval chances, especially with lenders who work with entrepreneurs rebuilding their credit history.

Strengthen Your Business Financials

Lenders want to see a healthy business. If inconsistent revenue or unclear documentation led to your denial, update your business plan and improve your bookkeeping. Showing stable cash flow and a clear repayment strategy can make a big difference.

A detailed business loan application that clearly outlines your business needs and financial picture gives lenders confidence in your ability to repay.

Consider Alternative Lenders

If traditional banks are not an option, alternative lenders may help. They often use more flexible criteria and can tailor financing options to your situation, including short-term loans or invoice factoring.

Clarify Capital partners with over 75 online lenders to match business owners with the right funding solution. Whether you need faster access to capital or do not meet bank standards, Clarify can help you find a lender that fits your needs.

Funding Options If You Were Denied by a Bank

Being turned down by a traditional bank doesn't mean you're out of options. Many small business owners find better fits through alternative financing, with products designed for faster access, fewer restrictions, and more flexible repayment terms. Below are some of the most accessible funding options if your bank says no:

Business line of credit. This flexible line of credit lets you borrow only what you need, repay it, and borrow again. It's ideal for managing seasonal costs or unpredictable cash flow.

Short‑term loans. These offer fast approvals and lump-sum funding with repayment periods ranging from three to 18 months. They're a solid choice when you need quick working capital without a long commitment.

Invoice factoring. If slow‑paying customers are hurting your cash flow, invoice factoring lets you sell outstanding invoices to access funds right away without taking on new debt.

SBA loans. Backed by the Small Business Administration, these loans offer low interest and longer terms. They do have stricter eligibility and longer processing times, but they can be great long‑term business financing when you qualify.

Crowdfunding and nonprofit lenders. For startups and early‑stage businesses, crowdfunding or mission‑driven nonprofit lenders can provide capital without traditional credit hurdles.

These funding options provide alternatives to traditional lenders, allowing you to keep your business moving forward.

How Soon Should You Reapply for a Business Loan?

Timing your next loan effort matters just as much as fixing what caused the denial. Submitting another loan application too soon, before you've addressed key issues, can hurt your chances. During the application process, lenders can see previous denials, and frequent reapplications without improvements may signal low creditworthiness.

Addressing the factors that led to denial strengthens your financial profile and boosts your odds when you reapply.

Recommended Timeline To Reapply

In most cases, waiting 30 to 90 days before you reapply gives you time to make meaningful progress. The exact timing depends on why your application was denied:

Low credit score. Give yourself several months to improve your credit by paying down debt or correcting errors on your credit report.

Insufficient documentation. If the issue was related to missing financials or forms, reapplying may be possible almost immediately.

Inconsistent cash flow. Stabilizing your income and expenses may take a few weeks or months before you're ready to apply again.

Steps To Take Before Reapplying

Before you reapply, take time to strengthen your application with these key actions:

Review and correct your credit history. Address outstanding issues or errors on both personal and business credit reports.

Update your business plan. Make sure it clearly outlines your funding goals, expected returns, and repayment strategy.

Improve your cash flow. Streamline operations, cut unnecessary expenses, and build up your reserves to show financial readiness.

A Better Path Forward: Find Second-Chance Business Funding

Just because a bank said no does not mean you're out of options. Many small business owners who are initially denied go on to secure capital through alternative lenders. These providers use flexible underwriting that looks beyond a single credit score or financial snapshot, giving deserving businesses a real chance to move forward.

Clarify Capital specializes in helping small business owners who've been denied elsewhere. With a network of over 75 funding partners and a wide range of business financing products, Clarify can match you to funding options tailored to your situation, even if your credit isn't perfect or your company is still growing.

If you've faced a denial, don't give up. You may be just one application away from the right fit. To explore your options and get personalized support, apply today for a free consultation with Clarify Capital.

FAQ About Business Loan Denials

If your business loan application was denied, you are not alone, and you probably have questions. Below are answers to the most common concerns small business owners have after receiving a loan denial.

Can a Business Owner Get a Loan With a Poor Credit Score?

Yes, but it depends on the lender. Traditional banks often turn down borrowers with a poor credit score or a bad credit history because they have stricter standards and expect longer financial track records.

However, alternative lenders offer more accessible financing options. These providers evaluate a broader range of factors and often work with borrowers who might not qualify at a bank. Improving your credit score by paying down debt and correcting any errors on your credit report can also lead to lower interest rates and better terms down the line.

How Can I Get an SBA Loan for a Startup With No History of Profit?

SBA loans through the Small Business Administration are meant to support small businesses, but they usually require financial history, a proven track record, and realistic cash flow projections. Startups with no profit history can struggle to qualify without other strengths in their application.

To improve your chances, focus on a solid business plan, offer collateral if you have it, and show creditworthiness through strong personal credit or relevant industry experience. You can also explore SBA microloans or other financing options that may be more suitable for newer businesses.

Do Lenders Have To Tell You Why You Are Turned Down for Business Credit?

Yes. Under the Equal Credit Opportunity Act, lenders are legally required to explain why your business credit application was denied. This comes in the form of an adverse action notice, which outlines the main factors that affected your credit report and led to the loan denial.

These disclosures help you identify common reasons for rejection and give you a clear starting point for improving your application for future financial institutions.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts